-

Some institutions have taken steps to ensure their websites meet accessibility standards, but experts say many credit unions could still be doing more.

March 2 -

-

Observers speculate that Intuit simply wants to enhance revenue and protect its tax software business, but the CEOs of each company say the deal would also give consumers more control of their overall finances.

February 24 -

Intuit has agreed to buy Credit Karma for $7.1 billion. The move is seen as a way for Intuit to get access to more consumer behavior data, generate new sources of income and potentially protect a key business.

February 24 -

Consumer advocates and policymakers are railing against use of the technology by government, universities and others. Banks using it for authentication need to tread cautiously, experts say.

February 18 -

"To wake up one day and assume everyone in America is going to be above average at math and above average rational is crazy," says Ethan Bloch, whose app is designed to help people achieve financial health.

-

It was Varo's second try with the Federal Deposit Insurance Corp., but it has now moved within a few steps of obtaining what has eluded fintech firms of late: a green light from banking regulators.

February 10 -

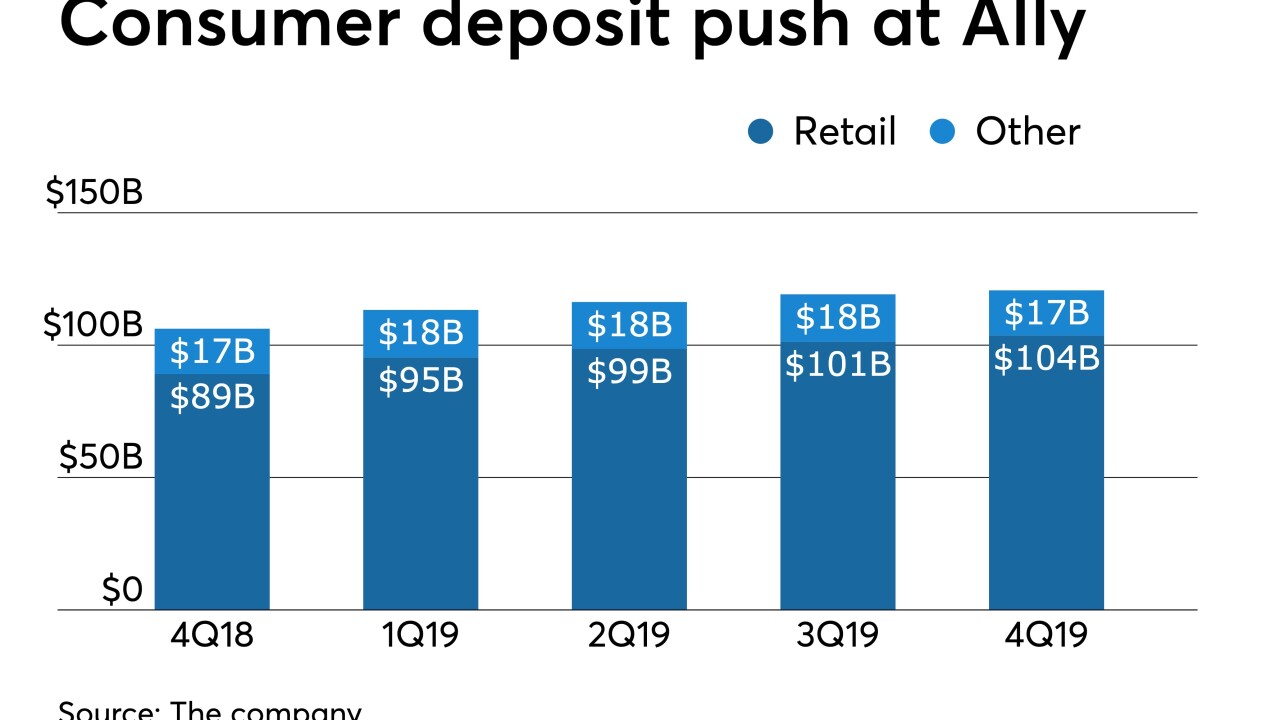

The digital-only bank found customers are anxious about their inability to set aside money, so it decided to offer automated savings tools, consumer chief Diane Morais says. It is one of the larger companies to do so.

February 7 -

A new app will allow small-business clients to quickly apply for credit while expanded offerings for homeowners associations will help CIT build up its base of low-cost deposits.

January 31 -

The startup has added more sophisticated invoicing features, sleeker onboarding and a more detailed dashboard.

January 28