-

Ally Financial has launched a mobile app that uses geolocation to caution smartphone-carrying customers when they are arriving at stores where they overspend.

April 18 -

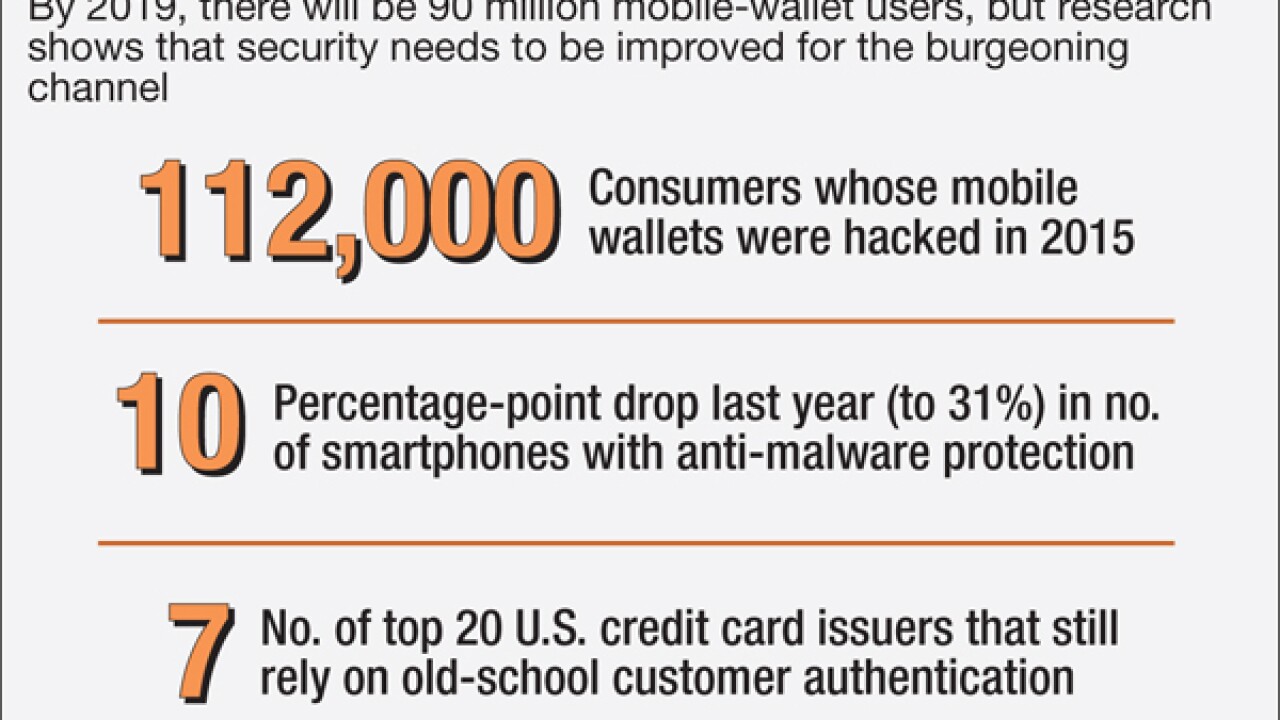

As mobile wallets become more popular they'll also become more popular targets for fraud. Banks ought to improve enrollment guidelines and other security tools in plotting their mobile-wallet strategy.

April 18 -

The Memphis, Tenn., company's forecast for the remainder of the year calls for cost saves from a branch-reduction effort that's gaining momentum as online and mobile banking grow and monthly visits to branches plummet.

April 15 -

It sounds like a bad idea to seat customers in front of a screen to open accounts or get other higher-level services from remote banking officers, but BluCurrent Credit Union in Springfield, Mo., turned to video banking to cure its branch traffic woes and its members seem to like it.

April 15 -

To get more Americans into the financial system, the industry must find ways to help more people get access to the Internet.

April 14

-

Banks are starting to use Facebook Messenger as a way to connect with customers. For now, such interactions will be limited and largely based on artificial intelligence. Down the road, the move could place Facebook deeper into the lives of its customers and could give it an entrée into financial services.

April 13 -

Retail banks must reinvent the way they charge consumers for their services at a time when institutions are struggling for profitability.

April 13 Sontiq

Sontiq -

Bank of America customers could soon interact with the bank via Facebook's Messenger app, the banking company said Tuesday.

April 13 -

Before banks are truly integrated into the digital landscape, they must break down data silos and implement steps to make data more accurate and actionable.

April 12 CCG Catalyst

CCG Catalyst -

Banks are slowly warming up to the idea of open APIs, essentially tools that allow banks to easily connect with others, but BBVA's Shamir Karkal says that they will likely also push banks to modernize their core systems.

April 11 -

It's easy to get lost in the technological complexity of "application programming interfaces," but banks need to stay focused on improving business and customer outcomes, which is the ultimate goal.

April 11

-

Federal rules for technology-based firms providing the fast-moving sector certainty and consistency would be a benefit, even if rules are suboptimal.

April 8 Mercatus Center at George Mason University

Mercatus Center at George Mason University -

Even as JPMorgan Chase tries to beat fintech firms at their own game it's still looking to these upstarts for inspiration, its CEO says.

April 7 -

As the pressure builds for mortgage lenders to offer digital specifically mobile tools, innovators in the space are encouraging the industry to keep the customer as the focus in designing new offerings.

April 6 -

Most consumers haven't developed a "muscle memory" for using mobile wallets, says Julie Pukas, head of U.S. bankcard and merchant services at TD Bank. It will simply take more time and, more importantly, widespread merchant acceptance before consumers feel comfortable paying with their phones.

April 6 -

U.S. Bank's steep price for instant payments risks limiting the feature's appeal. Rather than overcharging, banks need to think longer-term about how to drive payments volume.

April 5

-

Recent devaluations of startups and other signs of trouble do not mean the end of fintech upheaval but rather the start of acquisitions and other repositioning to advance stability.

April 4

-

Add U.S. Bank to the list of companies allowing its customers to access its mobile app through their thumbprint.

April 1 -

Bank of America appears to be retaining more deposits from recent branch sales, using technological advancements to keep customers despite the lack of a physical location.

March 31 -

Regulators are right to target overdraft and other fees as obstacles to banks offering affordable checking account options, but thats just the beginning in developing transactional products that work for consumers.

March 31