-

Alex Carriles, who runs mobile, online and digital accounts at BBVA Compass, describes how updates like account aggregation and expense analysis have helped increase use of its app.

April 30 -

Many banks rely on the location data they get from carriers through data aggregators to spot fraudulent transactions. With telecom companies shutting that source down, banks are worried it could significantly hurt their capacity to detect fraud.

April 29 -

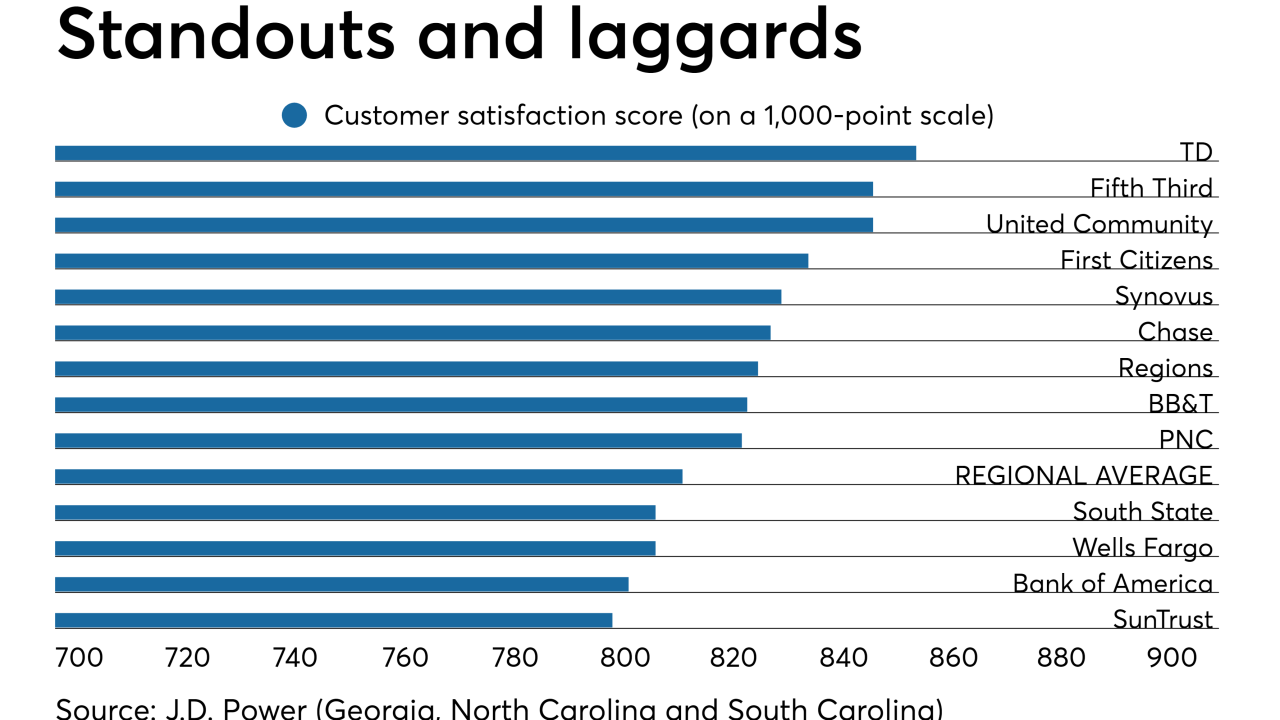

Larger institutions in particular have made banking so convenient that customers see little reason to move their accounts, according to a new report from J.D. Power.

April 25 -

David Tyrie, the bank’s new head of digital banking, discusses plans to offer customers constant course corrections and its new Life Plan product, and the latest on the virtual assistant Erica.

April 24 -

Leaders in bank innovation have ideas for improving financial services with high-speed, highly responsive 5G networks — ideas they say could be implemented relatively quickly.

April 22 -

The move is an extension of a pilot project begun in the fall. T-Mobile says it sought to give customers a better deal on digital banking and stand out from its rivals.

April 18 -

With branch traffic on the decline, some CUs have taken steps to tweak their facilities in order to help brick and mortar stay relevant in a digital world.

April 17 -

Karen Andres at the Center for Financial Services Innovation talks about the financial problems of people over 50 and how banks can help.

April 16 -

KeyBank is deploying new technology designed to improve the online and mobile banking experience and to guide branch employees' conversations with customers. The move comes on top of steps to modernize its IT infrastructure.

April 15 -

Derek White, an alumnus of BBVA and Barclays, will oversee digital innovation across all lines of business at the bank.

April 15 -

About 100 financial institutions are owned by or work with Native Americans, yet traditional banking services remain out of reach for many in this demographic.

April 15 -

The venture, which will do business as CU APPS, will offer mobile apps for other credit unions.

April 10 -

Customers are starting to reveal more to private bankers when they use GoTo, the bank's strategy chief Rilla Delorier says.

April 2 -

As N26 schedules its launch for midyear, it will face off against other startups and mobile-only spinoffs from incumbent financial institutions.

April 1 -

Under the hood of U.S. Bank's new mobile app; BofA, Wells Fargo sour on blockchain; are Fannie and Freddie too big?; and more from this week's most-read stories.

March 29 -

The internet giant's planned gaming service may create an omnichannel model for banks to emulate.

March 28

-

With its expanded capacity and reliability, 5G will drive innovation in mobile, online and branch services for credit unions.

March 28 AT&T Business

AT&T Business -

As banks push customers to digital channels, they are losing opportunities to help and connect with consumers, according to Rilla Delorier, an executive vice president at the Oregon bank.

March 27 -

AI-driven customer insights, mortgages and small-business loans are among the features in the app, which the bank is rolling out Friday.

March 24 -

Alongside identity-document scanning and other ID verification, the two companies are offering real-time checks of lists of suspicious persons. The goal: keep money launderers out of the banking system.

March 22