-

With mobile payments and banking apps on the rise, biometric authentication is now increasingly common in consumer finance, says Fingerprints' Michel Roig.

February 26 Fingerprints

Fingerprints -

About 70% of Bank of America's customers are now “digitally active” and 17 million people use Erica, its virtual assistant. David Tyrie, who was recently promoted to head of digital, would like to get that rate up to 100%.

February 1 -

MoneyLion, a mobile banking, lending and investment platform, is in talks to go public through a merger with Fusion Acquisition, a blank-check company, according to people with knowledge of the matter.

February 1 -

The decision to shutter the digital bank comes just weeks after BBVA USA announced it was selling itself to PNC Financial Services Group for $11.6 billion.

January 7 -

GO2bank marks the latest effort by the prepaid card issuer and banking-as-a-service provider to deliver more traditional banking products directly to consumers. Its mobile-first account offers cash back, overdraft protection and a secured credit card to customers.

January 6 -

The company's new relationship with Billshark highlights its quest for partners that can deliver financial management products to complement its banking services.

November 19 -

The complaint charges the fintech startup with misleading customers about the interest they'd receive on deposits and the level of access to their money. It seeks an unspecified amount of consumer relief in addition to other remedies.

November 18 -

The two companies have worked together to provide a banking app that community banks can implement and deploy in 30 days.

November 18 -

A recent survey by the American Bankers Association found that mobile apps surpassed online banking as the go-to platform for consumers earlier this year, and its popularity has continued to rise since the onset of the pandemic.

November 18 -

Infinity FCU sought out a merger partner after realizing that even at $338 million in assets it was too small to provide the technologies members wanted. It could be a harbinger of more deals among larger players.

November 6 -

Some customer fraud and a lack of cooperation from partners Huntington Bank and Dwolla prevented Beam Financial from returning funds to savers, says Aaron Du, the fintech's CEO. He says he’s trying to make things right, but Huntington and Dwolla are taking the dispute to court.

November 4 -

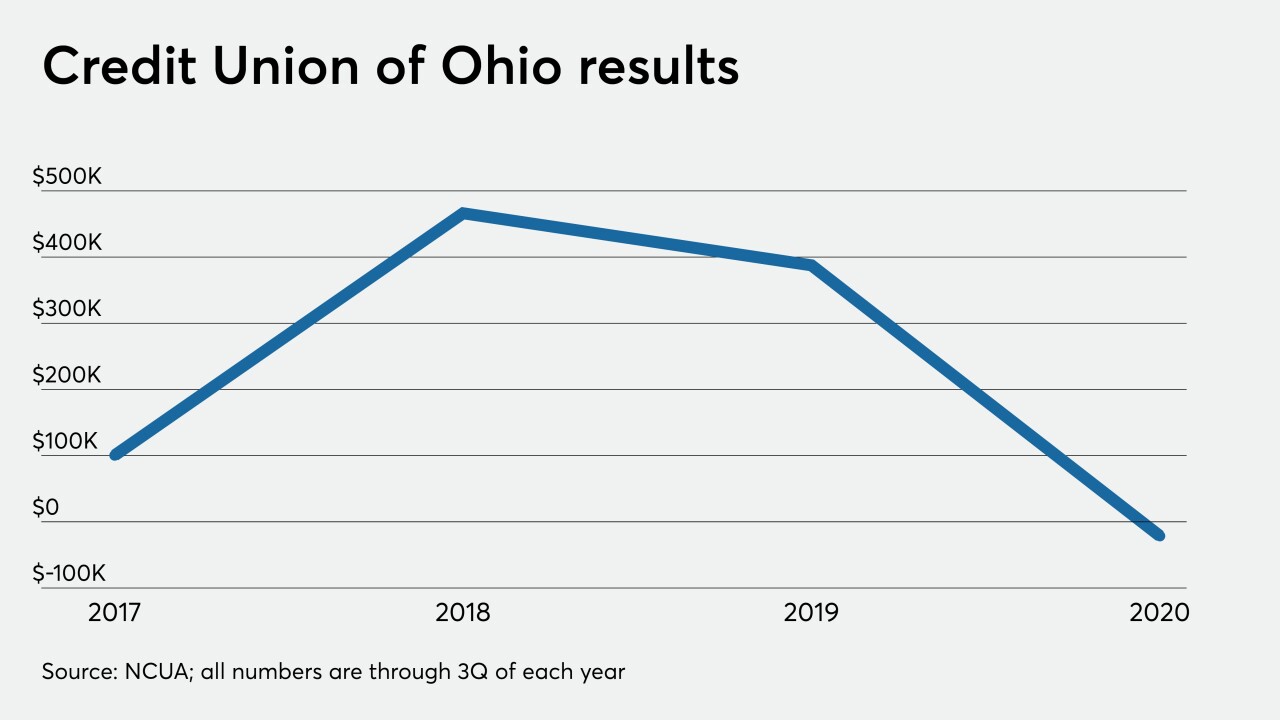

Members of First Choice Community Credit Union will have access to mobile banking and other products once the institution becomes part of Credit Union of Ohio.

October 26 -

Foreign banks for years have been using technology that folds several communication and information-sharing capabilities into one platform. Now Citigroup and others here are showing interest because of the growing importance of digital in the pandemic.

October 23 -

The media company Urban One has launched a new account that includes a prepaid debit card and encourages customers to buy from Black-owned business and lets them donate their cash back to charity.

October 22 -

The media company Urban One has launched a new account that includes a prepaid debit card and encourages customers to buy from Black-owned business and lets them donate their cash back to charity.

October 22 -

The events of 2020 have only served to accelerate a number of potentially disruptive trends among consumers when it comes to banking and financial services — What does the emerging future of consumer and retail banking now look like?

October 16 -

Mobile and online banking technologies that the Toronto bank previously rolled out, including a virtual assistant developed by Kasisto and money management tools made by Moven, have become much more popular since the arrival of COVID-19.

October 13 -

Chase First Banking is embedded in the bank's mobile app and has parental controls. It is an example of how banks are trying to attract Generation Z.

October 13 -

The lawsuit follows two successful USAA suits against Wells Fargo that claimed infringement of patents.

October 2 -

Harit Talwar, who is moving from CEO of the digital banking unit to chairman of consumer banking, says Marcus wants to add checking and investment products, embed its offerings in additional high-profile platforms, and grow far beyond its current 5 million customers.

September 30