-

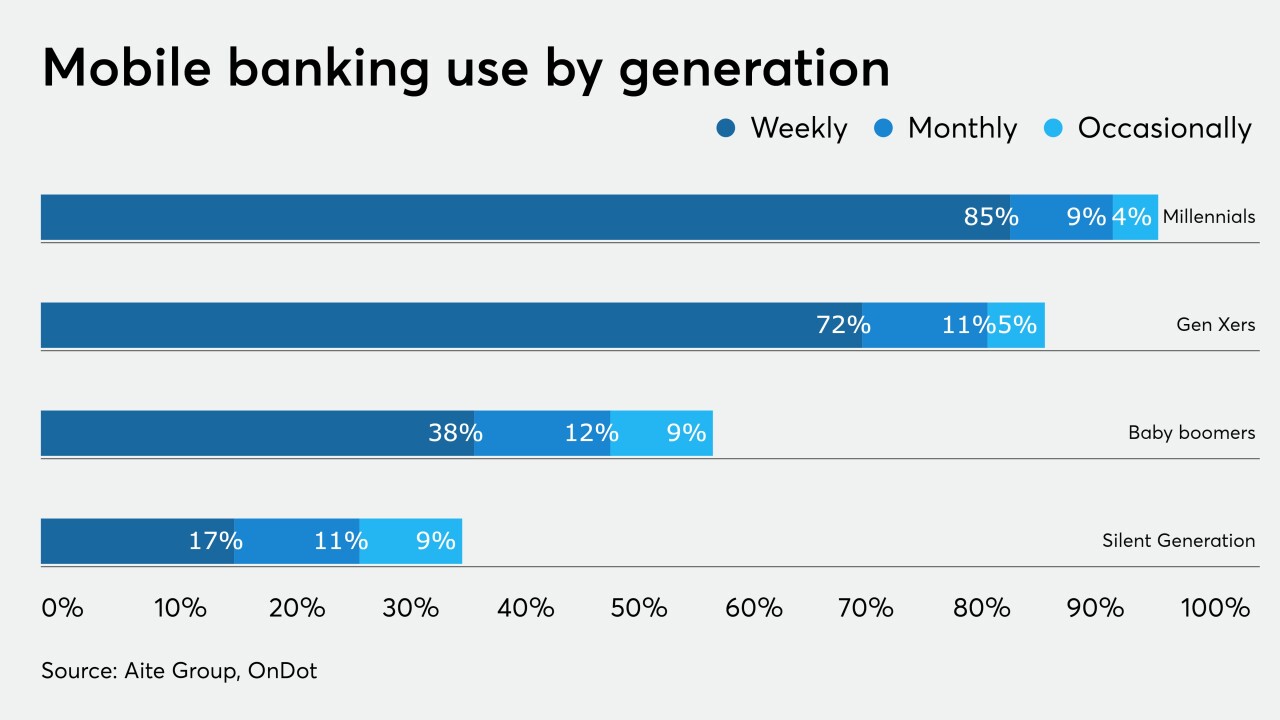

A recent survey by the American Bankers Association found that mobile apps surpassed online banking as the go-to platform for consumers earlier this year, and its popularity has continued to rise since the onset of the pandemic.

November 18 -

Infinity FCU sought out a merger partner after realizing that even at $338 million in assets it was too small to provide the technologies members wanted. It could be a harbinger of more deals among larger players.

November 6 -

Some customer fraud and a lack of cooperation from partners Huntington Bank and Dwolla prevented Beam Financial from returning funds to savers, says Aaron Du, the fintech's CEO. He says he’s trying to make things right, but Huntington and Dwolla are taking the dispute to court.

November 4 -

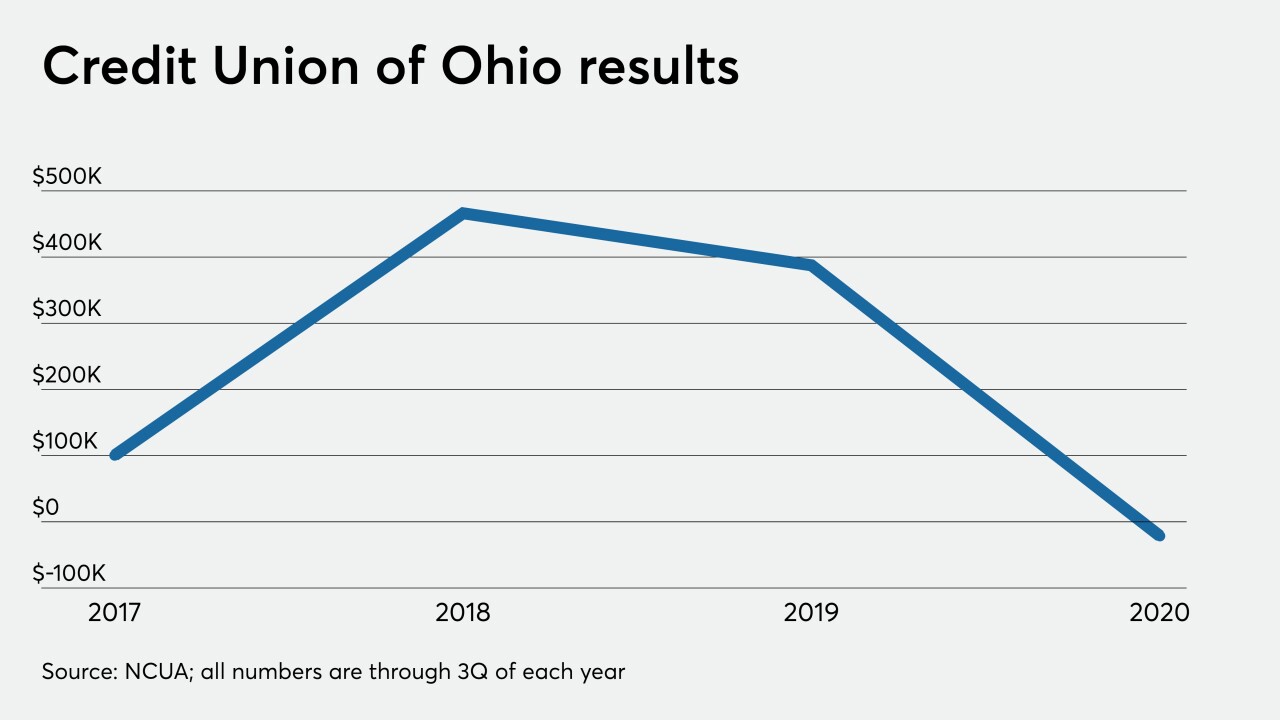

Members of First Choice Community Credit Union will have access to mobile banking and other products once the institution becomes part of Credit Union of Ohio.

October 26 -

Foreign banks for years have been using technology that folds several communication and information-sharing capabilities into one platform. Now Citigroup and others here are showing interest because of the growing importance of digital in the pandemic.

October 23 -

The media company Urban One has launched a new account that includes a prepaid debit card and encourages customers to buy from Black-owned business and lets them donate their cash back to charity.

October 22 -

The media company Urban One has launched a new account that includes a prepaid debit card and encourages customers to buy from Black-owned business and lets them donate their cash back to charity.

October 22 -

The events of 2020 have only served to accelerate a number of potentially disruptive trends among consumers when it comes to banking and financial services — What does the emerging future of consumer and retail banking now look like?

October 16 -

Mobile and online banking technologies that the Toronto bank previously rolled out, including a virtual assistant developed by Kasisto and money management tools made by Moven, have become much more popular since the arrival of COVID-19.

October 13 -

Chase First Banking is embedded in the bank's mobile app and has parental controls. It is an example of how banks are trying to attract Generation Z.

October 13 -

The lawsuit follows two successful USAA suits against Wells Fargo that claimed infringement of patents.

October 2 -

Harit Talwar, who is moving from CEO of the digital banking unit to chairman of consumer banking, says Marcus wants to add checking and investment products, embed its offerings in additional high-profile platforms, and grow far beyond its current 5 million customers.

September 30 -

The competition has leading-edge technology, but consumers may be looking for more than just bells and whistles when choosing where to do their banking.

September 18 Agora Services

Agora Services -

A survey conducted by Harris Poll and commissioned by Plaid found that 60% of U.S. adults are using more apps to manage money since the onset of the pandemic.

September 15 -

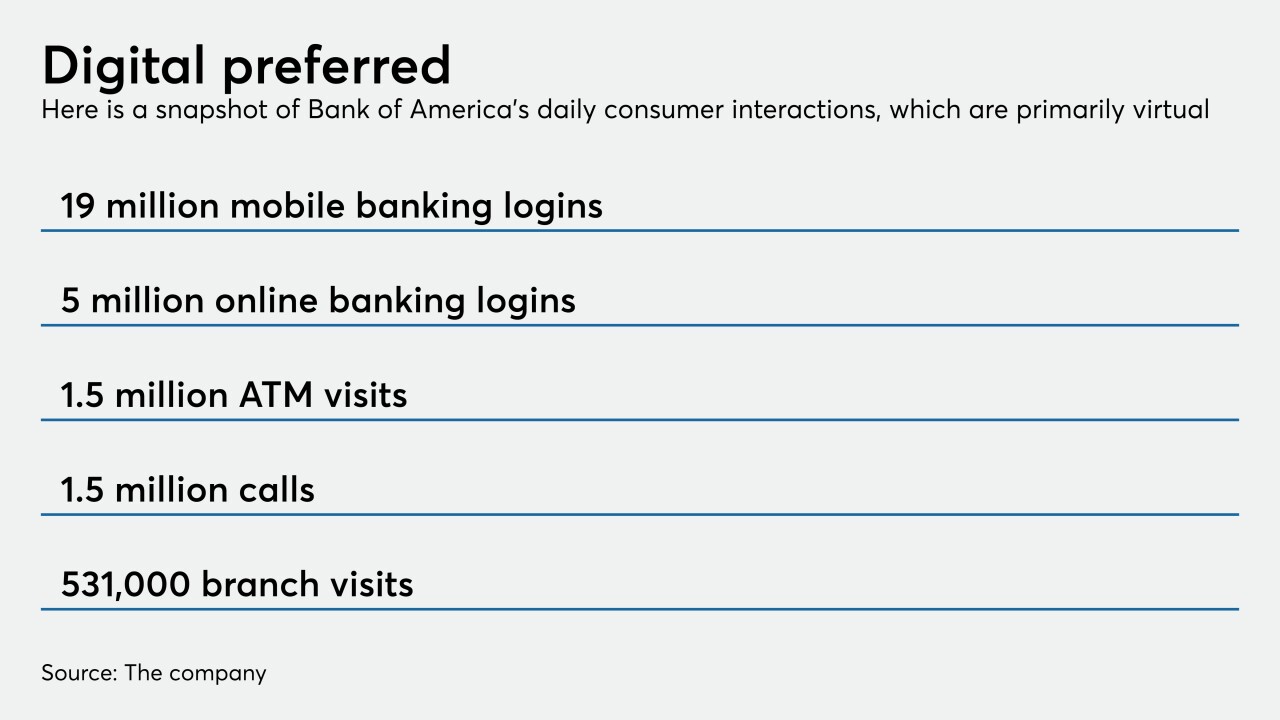

BofA, which has applied for or been granted thousands of patents, has been working recently on technologies that analyze spending patterns to give budgeting advice and use augmented reality to provide estate-planning services.

September 14 -

The fintech and the Minnesota bank it acquired last week, renamed Mid-Central National Bank, intend to pioneer a new method of storing and moving money for consumers.

September 8 -

Institutions considering new technologies must ask themselves what they're looking for not just from a product but from a partner.

September 4 PenFed

PenFed -

Texas Trust Credit Union boosted loan volumes with a marketing tool inspired by “Game of Thrones,” but gamification strategies can be risky in light of data privacy concerns.

September 4 -

The bank is making continuous improvements, including integrating Merrill Lynch accounts into its banking app and adding a security feature to Zelle.

August 31 -

T-Mobile Money is now being offered to the 150 million customers of the combined wireless carriers, which merged this spring.

August 24