-

Google Payment, a company owned by Alphabet Inc., obtained an e-money license in Lithuania, joining a growing number of fintech firms that have secured permission from the Baltic nation to offer financial services across the European Union.

December 21 -

While credit cards have been around since the 1950s and debit cards introduced years later, they both have become indispensable to the modern consumer. In fact, in certain retail sectors consumers can only use payment cards or mobile payments to make a purchase.

December 19 -

Neither Amazon nor Starbucks could be described as a traditional retailer. But they both use their shared headquarters city as a playground for developing digital and in-store innovations that all merchants and payment companies will have to respond to the years ahead.

December 18 -

PayPay, a mobile payments company backed by SoftBank Group Corp., Yahoo Japan Corp. and India’s largest digital-payments company Paytm, said it’s updating its app to strengthen security after multiple complaints from users of wrongful charges.

December 17 -

Beyond flashy and visible mobile-driven innovation and transaction options, many executives don’t see the need and opportunity that resides behind the scenes, according to Don Halliwell, director of marketing and communications at Zafin.

December 17 Zafin

Zafin -

If they don't have them in place already, financial services firms need to provide digital budgeting tools, mobile payment and banking services before young consumers flee to other providers, says Chris Koeneman, senior vice president of strategic solutions for MOBI.

December 17 MOBI

MOBI -

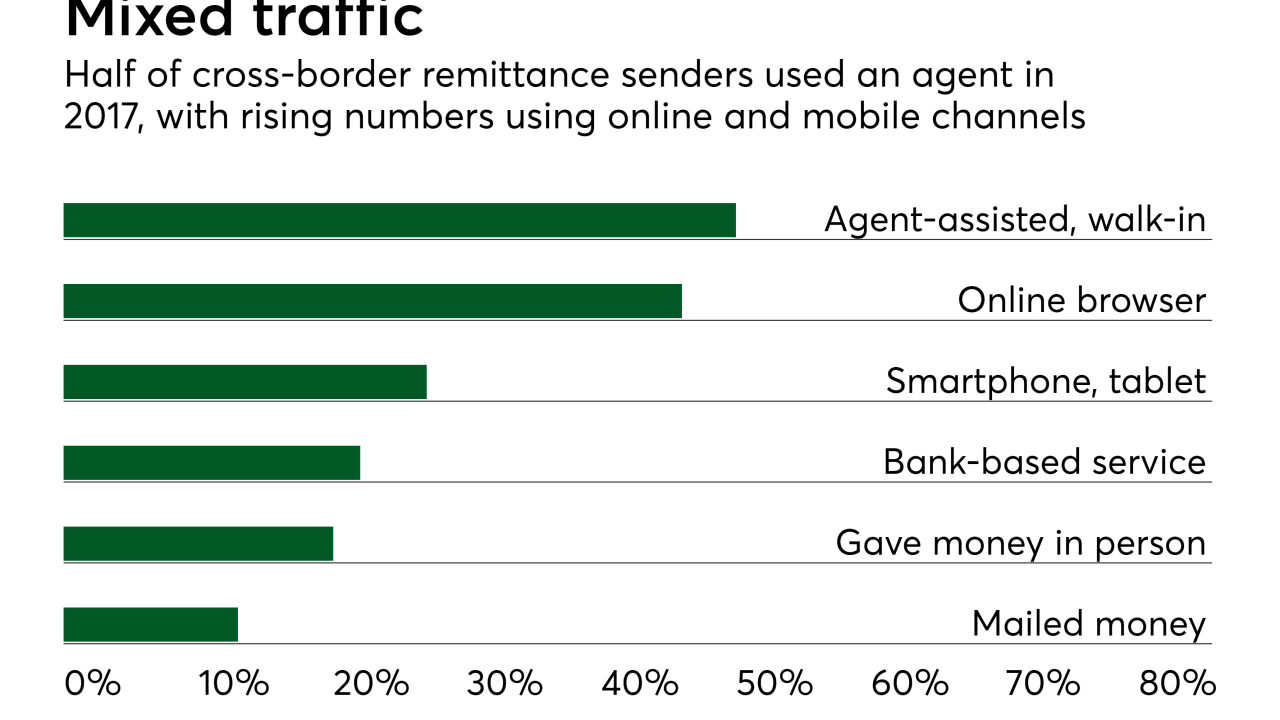

Cross-border payment startups like TransferWise and Xoom achieved rapid market growth by enabling consumers in emerging markets to receive funds via mobile wallets, cutting out intermediaries. Now legacy remittance giants Western Union and MoneyGram are improving their own resources to send funds directly to recipients' mobile wallets.

December 17 -

Mobile payments technology has fallen short of expectations in major markets, particularly the U.S., where less than 10 percent of consumers routinely use devices to pay in stores — despite more than four years of aggressive development from large technology companies and banks.

December 13 -

Mastercard and white label payment software company Cardstream are partnering to accelerate the deployment of Mastercard’s Secure Remote Commerce (SRC)-ready Masterpass wallet and its “Pay by Bank” solution.

December 12 -

Germany-based Wirecard is working with Google to enable users of Wirecard’s boon mobile app to pay at any French merchant that accepts Google Pay as it becomes available in France.

December 11 -

Vipps International, a Norway-based payments service operated by a coalition of more than 100 Norwegian banks, is the latest to collaborate with China’s Alipay mobile wallet in a partnership to capture more payments from Chinese tourists.

December 11 -

Mobile banking, e-commerce integration, loyalty and rewards schemes and even IoT payments all link to cards. That’s a lot to ask of a back-end system, writes Rune Sorensen, a product manager at Nets.

December 11 Nets

Nets -

Chase and UATP, the airline-owned payment network, are collaborating to make Chase Pay an option on airline websites and mobile apps.

December 7 -

It's commonly thought that retailers are loath to upgrade the point of sale as the holidays approach, since they don't want to introduce any variables that could lead to lost sales.

December 5 -

Even as Amazon has expanded its cashierless Amazon Go stores to new cities, it has been careful to limit the size of each store as a concession to the limits of its technology. That constraint may soon be a thing of the past.

December 3 -

An invisible payment becomes a lot more visible when it’s compromised, making Marriott’s data breach a threat to one of the most important innovations in retail, which should scare everyone from Uber to Amazon.

November 30 -

The concept of Smart Cities — which use mobile payments, global positioning and related technology to streamline parking, transit, building access and traffic — is deeply intertwined with the development of payments technology and regulation.

November 30 -

As the concept of smart cities — urban settings undergoing a digital transformation through "internet of things" technology and connected platforms — evolves, so too will the concept of making a payment.

November 30 -

Quicken and U.S. Bank are launching a co-branded contactless credit card that will integrate with Quicken's personal finance software and mobile app.

November 29 -

Kenya’s Family Bank Ltd. will collaborate with London fintech SimbaPay to launch a transfer service to China with WeChat.

November 28