-

The hacks keep coming — most recently to Facebook and the federal government’s health insurance sites — and consumer trust in online security systems disintegrates along with them, according to a number of recent surveys.

October 24 -

As VR and AR mature, new possibilities open up for customer interaction in a virtual space.

October 19 -

Worldnet is adding Google Pay to its cloud-hosted platform to address the pressure on payment service providers and independent sales organizations to securely embrace multiple payment channels and computing devices.

October 17 -

Marks & Spencer is the first major U.K. retailer to launch a mobile scanning and payment app in its stores. Several U.K. supermarket chains have launched pilots of cashierless and checkout-free mobile shopping, but have yet to roll out services.

October 17 -

Capgemini's 2018 World Payments Report is out, and it has some alarming predictions. Are its findings a threat to traditional payment systems, or just the first sign of a transformation that will affect all economies?

October 16 -

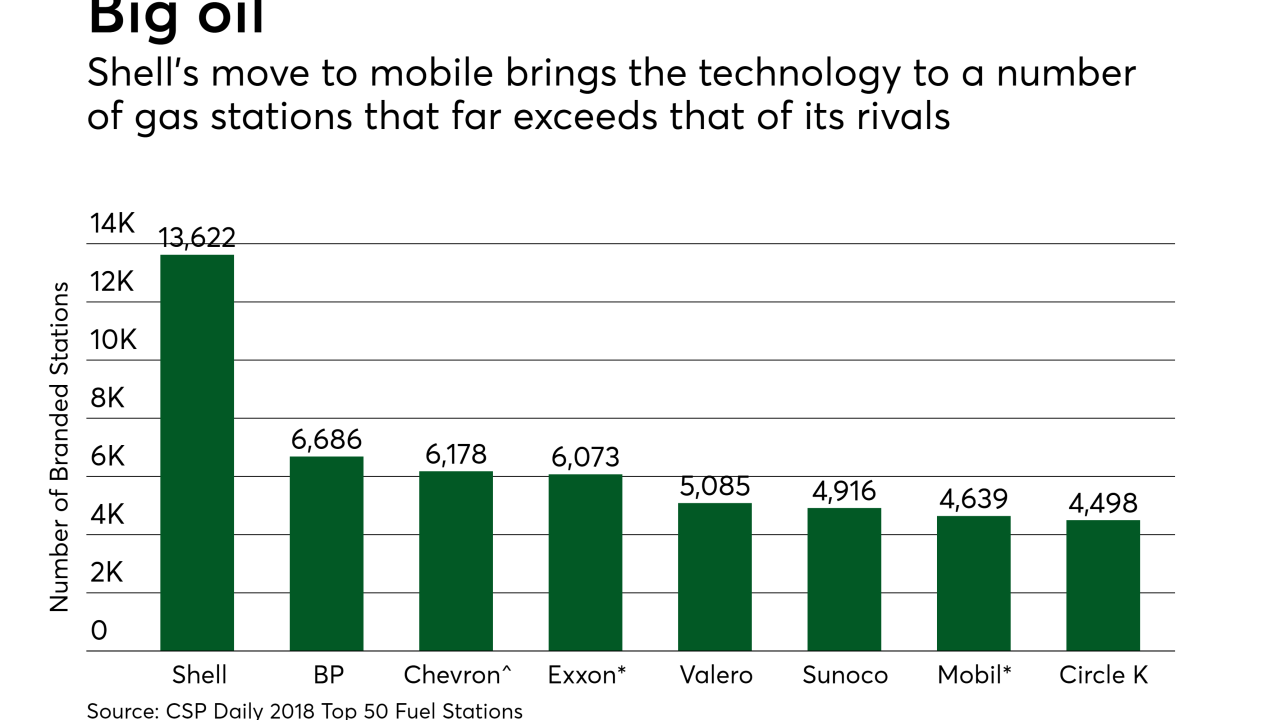

Shell has launched a new mobile app called Pay & Save, designed as a frictionless complement to the EMV-chip cards it must accept at its pumps by late 2020.

October 16 -

Cross-border e-commerce is seeing explosive growth, driving a race among payment providers and acquirers to equip online sellers with the technology to accept any kind of payment in virtually any region. Credit and debit cards are the dominant payment type North American merchants accept, but are much less common elsewhere.

October 12 -

Visa showcased payment technologies it’s developing for future Olympic games, including in-home “couch commerce” leveraging augmented reality.

October 12 -

The payment landscape is still very fragmented with local solutions holding their own against global giants and new technologies such as AI and blockchain keeping the payments market very enterprising, writes Eva Murphy Ryan, trade development executive for financial services and technology at Enterprise Ireland New York.

October 11 Enterprise Ireland New York

Enterprise Ireland New York -

At Tropical Smoothie, a new IT project will deploy new cloud-hosted point of sale terminals, handheld devices and kitchen display systems over the next few weeks across its 700-location footprint.

October 10 -

Comparing the U.K. payments landscape to that of the U.S. is sometimes like comparing apples to oranges according to Ankit Kumar, manager of digital payments and mobile financial services at Gemalto.

October 5 Gemalto

Gemalto -

PayPal launched a new merchant app called PayPal for Business, aimed at driving usage and adoption of its invoicing and payments services among freelance workers and small businesses in India.

October 4 -

Banks and merchants are rapidly deploying chatbots for answering basic account questions, shopping and accessing the internet of things. But new data suggests consumers don’t fully trust chatbots yet with payment account details and personal information. Here’s a look at what consumers think of chatbots and why it matters.

October 3 -

Payments will melt into the wider commerce experience and create new incremental value for consumers, according to Brendan Miller, a principal analyst at Forrester.

October 2 Forrester Research

Forrester Research -

For merchants to reap the full benefits of the modern mobile payments ecosystem, their payments strategy can go beyond accepting a contactless tap-and-go card and encourage use of smartphone payments at the point of sale, writes Jason Oxman, CEO of the Electronic Transactions Association.

October 2 Electronic Transaction Association (ETA)

Electronic Transaction Association (ETA) -

As with many mobile apps and services, I think we underestimated the fragmentation issue. That includes consumers preferring different operating ecosystems, and also different versions of Android or iPhone hardware, according to Ankit Kumar, manager of digital payments and mobile financial services at Gemalto.

October 1 Gemalto

Gemalto -

Australians' love for contactless payments is driving the Australia and New Zealand Banking Group to incorporate mobile withdrawal technology to its ATM network.

September 28 -

Contactless payments are a big success story in most countries around the world—including developing markets—but not in the U.S.

September 27 -

Even among the experts in the payments industry, people still use cash. Banks can't ignore this, according to Paul Amisano, senior vice president for enterprise digital and payments strategy at BB&T.

September 26 -

The Merchant Customer Exchange may not have succeeded, but there is still value to the concept that drove the retailer-driven wallet, according to Brian Crist, chief payments counsel at Uber.

September 26