-

Finance ministers call for tight regulation of cybercurrencies; Williams says the Fed must “act quickly to lower rates at the first sign of economic distress.”

July 19 -

The consumer bureau said banks are "uniquely positioned" to know if an elderly customer is being targeted by fraudsters.

July 17 -

Democrats called on the social media company to halt its Libra project, while Republicans said Congress should keep the door open to innovation.

July 17 -

A new project backed by the government of Luxembourg could ultimately be influential in the U.S., where banks have been slow to develop a shared platform for digital identities.

July 16 -

David Marcus, who oversees Facebook’s digital wallet, plans to tell Congress that the company will roll out Libra only after it has "received appropriate approvals.”

July 15 -

A Spanish effort to prosecute a gang that used Bitcoin automated cash machines suspected of being a front for illegal-drug payments has exposed a hole in European anti-money-laundering controls, law enforcement authorities in the country said.

July 11 -

The Justice Department is investigating the bank for possible money laundering violations; the Fed chair says Facebook’s plan raises “serious concerns.”

July 11 -

Executive searches are hard enough, but a shortage of qualified candidates with strong resumes will make filling those jobs that much more challenging.

July 5 -

Researchers found that stolen payment data has been used to finance terrorism, human trafficking and other organized crime. Their conclusion that card fraud needs to be taken more seriously by banks and card networks drew pushback from the financial industry.

June 25 -

Dallas Fed chief says lower interest rates may require stricter rules to ward off riskier lending; after financial crisis, debt backed by HELOCs disappeared.

June 25 -

Nearly half the nation's state regulators have agreed to a new multistate licensing business for money servicers, including fintechs.

June 24 -

Sterling Bancorp must enhance its BSA policies and hire an outside firm to review its account activity.

June 24 -

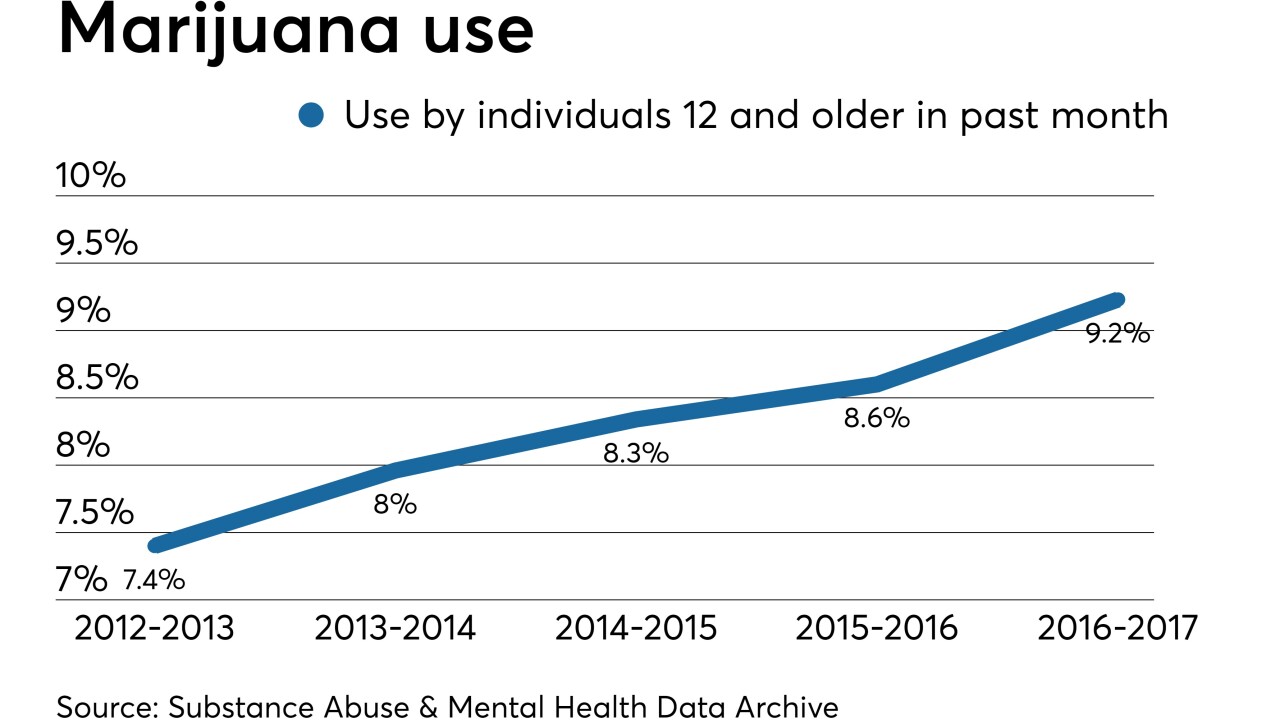

Credit union executives discussed serving the legal marijuana and hemp businesses during NAFCU's annual conference in New Orleans, including vastly different motivations for serving the industry.

June 20 -

While a bill to require firms to identify their owners has gained bipartisan support, some small companies argue it is burdensome and would subject them to harsh penalties.

June 20 -

Deutsche Bank is being investigated by U.S. federal authorities for potential lapses in money laundering compliance, The New York Times reported, citing unidentified people with knowledge of the inquiry.

June 20 -

Banks shouldn’t have trouble this year, but the rules may change next year; U.S. authorities are probing possible AML compliance violations at the German bank.

June 20 -

The company will create a regulated subsidiary offering a digital wallet; San Francisco Fed wants CRA credit for loans that help prepare for climate change.

June 18 -

The National Credit Union Administration's controversial risk-based capital proposal could see further delays or changes as thousands of industry professionals head to CU conferences across the country.

June 17 -

Hard sell ahead for BB&T-SunTrust as ‘Truist’ lands with a thud; Citizens looks to poach BB&T-SunTrust talent; what the Senate AML bill means for banks; and more from this week’s most-read stories.

June 14 -

Visa, Mastercard and PayPal are each putting up $10 million to back the cryptocurrency; company “gearing up” to reboot its flagging small business lending unit.

June 14