-

The switch to Thomas Cangemi from longtime CEO Joseph Ficalora could foreshadow a push to curtail the company’s reliance on multifamily lending and the pursuit of a bank acquisition that lowers funding costs.

December 29 -

The company promoted two executives as part of an effort to revamp its leadership team and establish a bigger presence in the Carolinas.

December 28 -

On Sep. 30, 2020. Dollars in thousands.

December 28 -

On Sep. 30, 2020. Dollars in thousands.

December 28 -

Longtime chairman and CEO Joseph Ficalora will step aside Thursday as head of the regional bank and be succeeded by CFO Thomas Cangemi.

December 28 -

The legislation would let banks postpone the start date of the Current Expected Credit Losses accounting standard and delay categorizing pandemic-related loan modifications as troubled debt restructurings.

December 23 -

Demand for home purchases and car loans would need to increase substantially to make up for what's expected to be a sharp drop in refinancing revenue.

December 22 -

The proposal builds on guidance the agency gave to Fannie Mae and Freddie Mac earlier this year.

December 17 -

The percentage of seriously delinquent loans hit 5.8% in the third quarter, up from 1.5% a year earlier but down from 6.8% in the second quarter.

December 16 -

The community bank and fintech are offering the first live bank account and debit card that offer rewards in the form of bitcoin.

December 15 -

The consumer bureau's revamp of criteria for "qualified mortgages," a special regulatory class of loans free from liability, emphasizes pricing instead of a borrower's debt-to-income ratio.

December 10 -

Citigroup is following up on a September promise to help these minority depository institutions finance as much as $50 million in affordable multifamily rental housing.

December 10 -

Many have assumed the high court would rule that presidents can fire the Federal Housing Finance Agency director at will. But during oral arguments in a case challenging the agency’s structure, some justices suggested they could stop short of such a decision.

December 9 -

The Consumer Financial Protection Bureau has taken a hands-off approach to servicers during the pandemic. But with forbearance plans set to expire and President-elect Biden likely to appoint new CFPB leadership, companies lacking aggressive plans to help borrowers could face tougher enforcement.

December 8 -

Fudge, who has served in the House since 2008, represents most of the majority-Black areas of Cleveland as well as part of Akron.

December 8 -

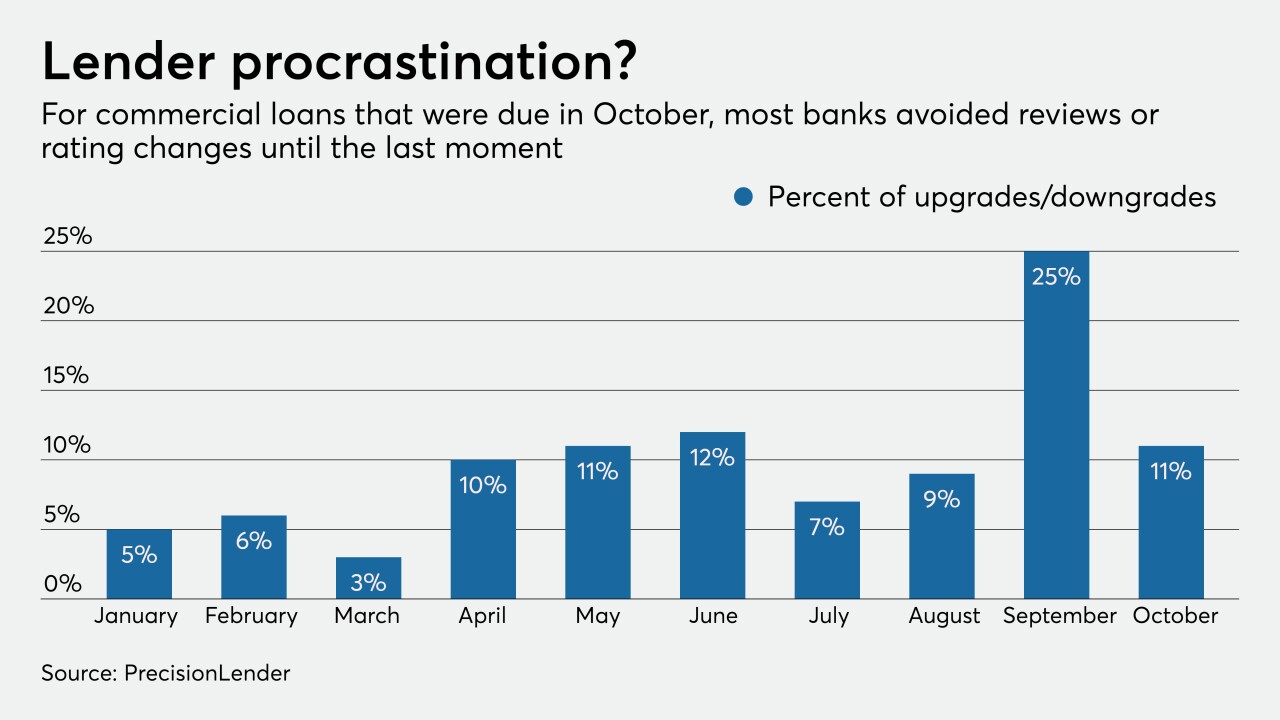

Some lenders are poring over commercial portfolios more frequently than normal — perhaps as often as once a month — to uncover problems hidden by payment deferrals and government stimulus before it's too late.

December 8 -

On the same day that Mr. Cooper announced a settlement with state and federal authorities over its servicing practices, the Dallas company, U.S. Bank and PNC reached separate agreements with DOJ regarding bankrupt borrowers.

December 7 -

On Sep. 30, 2020. Dollars in thousands.

December 7 -

On Sep. 30, 2020. Dollars in thousands.

December 7 -

On Sep. 30, 2020. Dollars in thousands.

December 7