-

Venmo has more than 40 million active users, PayPal has revealed for the first time. This finally gives the market a sense of how popular Venmo is, and sheds a little light on how it compares to the bank-run Zelle service.

April 24 -

Facebook has informed users of its P2P Messenger money transfer option in the U.K. and France that the service will no longer be available as of June 15.

April 16 -

Singapore-based OCBC Bank and Rapyd have formed a partnership that will leverage Singapore’s local P2P service plus Rapyd’s Checkout solution to power instant payments for local e-commerce purchases.

April 15 -

Following its own economic downturn that required bailouts by Saudi Arabia, Kuwait and the United Arab Emirates, Bahrain’s governors hit on an economic recovery plan that includes turning the tiny nation into a global payments hub.

April 11 -

In 2016, a big-bank consortium said that it would charge the same prices to all institutions, regardless of their size. But now the group has added a large caveat to that pledge.

April 10 -

The largest U.S. banks got a head start in launching Zelle through their mobile apps about 18 months ago, working closely with Zelle’s owner Early Warning Services LLC. It’s taking longer for smaller institutions to get up and running, due to some technical complexity.

April 10 -

A Cleveland startup’s play in the crowded and noisy P2P market is to nudge the transaction as close to digital version of paper money as possible — without Venmo’s social tools or Zelle’s email model.

April 9 -

Payment processor and financial messaging integrator Volante Technologies is partnering with the Banco Base financial group to provide end-to-end payments software for domestic and international payments.

April 8 -

As the consumer payments technology market is becoming saturated, B2B payments have captured the attention of the investment community, writes Karla Friede, CEO of Nvoicepay.

April 4 Nvoicepay

Nvoicepay -

The gig economy presents many challenges in its reliance on a freelance workforce. Among those is the task of managing corporate spending for workers that don't use a corporate card or expense platform.

April 2 -

Visa and Remitly have formed a partnership enabling U.S. consumers to send cross-border remittances in real time via Visa Direct, the card network’s debit push-payments service.

March 28 -

As PayPal seeks to turn Venmo into a profit engine, the service has also taken steps to collect consumer debts, moves that are sure to spark controversy as some of the targeted users claim they have been fraud victims.

March 25 -

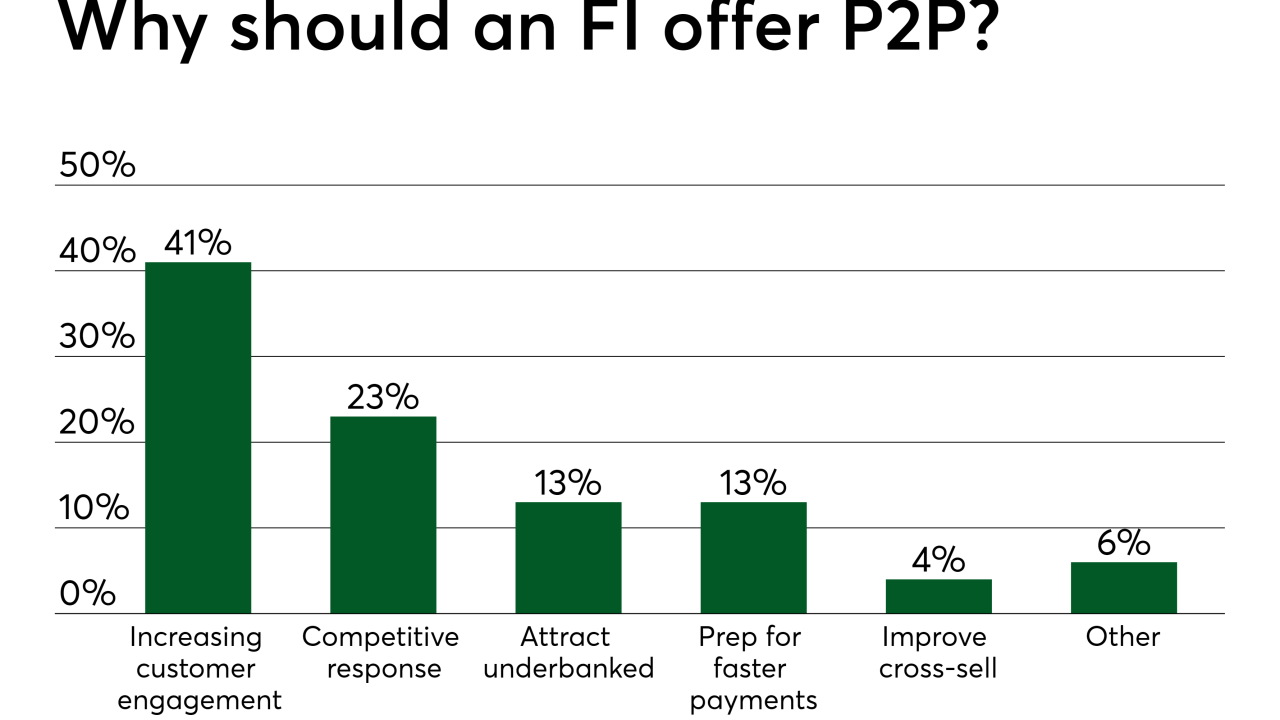

The market for P2P payments is finally taking off after years of false starts, but there are still many unanswered questions. The biggest one: How do banks get value out of offering this service free of charge?

March 22 -

Person-to-person payments have become table stakes for institutions looking to attract and retain younger customers. The service may also be one of the keys to keeping big-tech insurgents like Amazon at bay.

March 22 -

The market for P2P payments is finally taking off after years of false starts, but there are still many unanswered questions. The biggest one: How do banks get value out of offering this service free of charge?

March 22 -

Person-to-person payments have become table stakes for institutions looking to attract and retain younger customers. The service may also be one of the keys to keeping big-tech insurgents like Amazon at bay.

March 21 -

There is a growing proliferation of social P2P technologies within the U.K. banking sector, but the market for such payments is vastly different from that in the U.S., where social payment apps have found a welcoming audience.

March 21 -

The new U.S. Faster Payments Council states a clear mission — to promote faster payments in the U.S. But this new entity could butt heads with the Federal Reserve if it thinks the Fed isn't moving fast enough.

March 14 -

Jack Henry & Associates has overcome an obstacle that delayed banks and credit union integration with Zelle, with a hub to streamline the onboarding process. But the new system’s first bank doesn’t go live until May, and the hub won’t hit full stride until next year.

March 14 -

Vipps, which launched in Norway in 2015 as a P2P app accessible to all local bank customers, is integrating invoice and bill-payment capabilities through a collaboration with Nets Group, a Nordic payment service provider.

March 12