-

The Senate Republicans' coronavirus relief package, known as the HEALS Act, would continue to make the loan program available to businesses, but any final bill would need to be negotiated with House Democrats.

July 28 -

The Senate Republicans' coronavirus relief package, known as the HEALS Act, would continue to make the loan program available to businesses, but any final bill would need to be negotiated with House Democrats.

July 27 -

A new Small Business Administration notice explains what steps lenders must take to seek approval of their forgiveness decisions under the Paycheck Protection Program. But lenders say lawmakers and regulators must do more to cut red tape.

July 24 -

The online lender has already branched out into facilitating payments and analyzing cash flow for small-business customers. Its new checking account is meant to round out those services.

July 22 -

Many bankers want to focus more on the forgiveness process, assessing the status of deferrals and pursuing traditional lending opportunities.

July 21 -

The Georgia company warned that outstanding loans could fall and deferrals will likely rise as its home state and Florida grapple with the pandemic.

July 21 -

Loans to retailers and hotels are at the highest risk of default, the Salt Lake City company said in its second-quarter earnings presentation.

July 21 -

Government stimulus efforts, including the Paycheck Protection Program, have fueled a deposit surge. The challenge for banks is figuring out how to put that new money to use.

July 17 -

Treasury Secretary Steven Mnuchin did not define "small," but advocates have been urging Congress to convert all Paycheck Protection Program loans of less than $150,000 into grants.

July 17 -

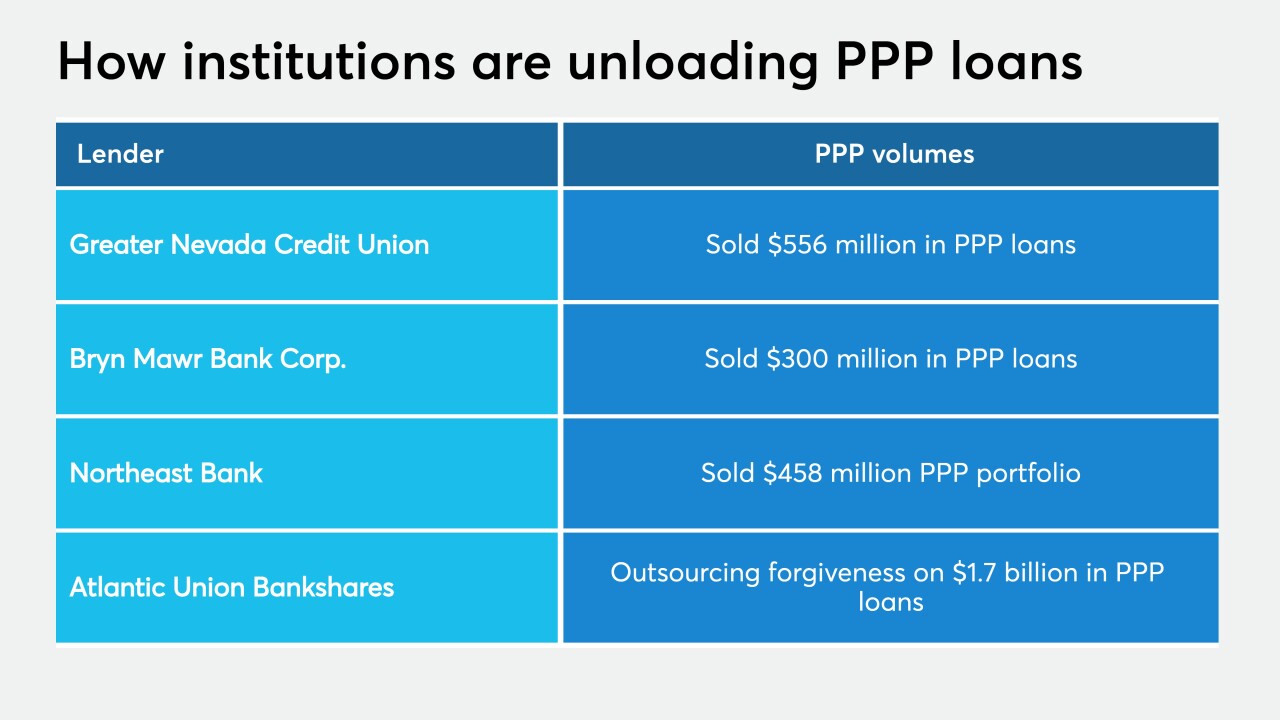

Greater Nevada Credit Union, like a number of community banks, agreed to sell its Paycheck Protection Program loans to avoid having to navigate the complicated forgiveness process.

July 15