-

Three years ago, payments technology provider Dwolla submitted a 164-page proposal to the Federal Reserve's Faster Payments Task Force. This week, the Fed unveiled a plan for its own faster payments system, but Dwolla had already moved on to other projects.

August 7 -

As technology advances, new terms are existing with older vocabulary, causing potential confusion that challenges user experience, says NvoicePay's Alyssa Callahan.

August 7 Nvoicepay

Nvoicepay -

Klarna raised another $460 million in fresh equity funding, pushing the Swedish company’s valuation to about $5.5 billion.

August 6 -

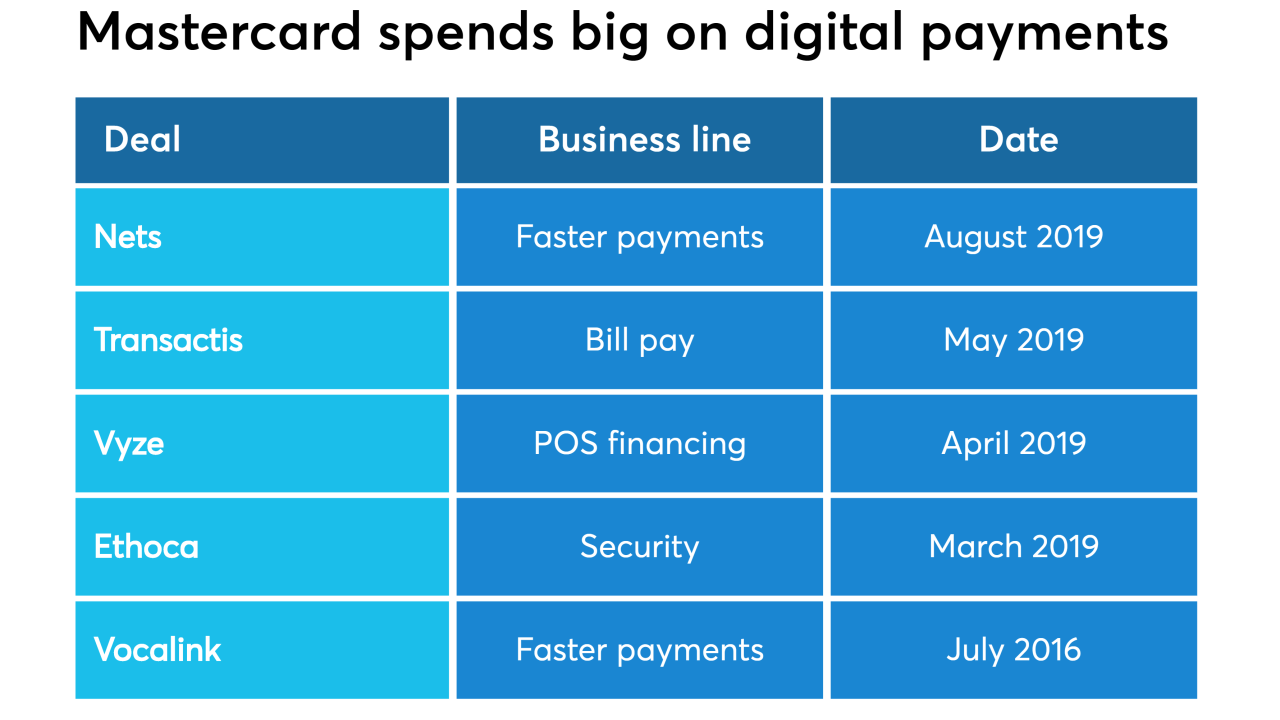

Mastercard has spent more than $4 billion on investments so far in 2019 to thread a needle between several must-haves in the digital payments market.

August 6 -

Managing compliance and breach risk make it harder to offer a good customer experience, but the cost of friction may be even higher, argues Bob Janacek, CEO of DataMotion.

August 6 DataMotion

DataMotion -

Mastercard Inc. agreed to buy a payments platform owned by Denmark-based Nets for 2.85 billion euros ($3.19 billion), using its biggest-ever acquisition to help extend a push into faster payments.

August 6 -

The payments system, called FedNow, would go head-to-head against one built by big banks; the senator from Oregon wants Amazon to address vulnerabilities in its cloud data storage.

August 6 -

Addressing payment security and achieving interoperability with a rival, private-sector network are just some of the challenges the central bank faces in building a government-backed real-time payment system.

August 5 -

As part of its justification for developing its own government-backed system, the central bank said that leaving only a single fast network run by big banks constitutes a potential risk to the economy.

August 5 -

Community banks shouldn’t wait for the Fed to create a new real-time payments rail when consumers are already flocking to other options.

August 5Cape Cod Five Cents Savings Bank