-

Citizens Bank and Barclays US are among the lenders expanding in this market — with or without fintechs on board.

April 30 -

Citizens Bank and Barclays US are among the lenders expanding in this market — with or without fintechs on board.

April 30 -

Incumbents have access to tons of information on consumers, but developing the means to analyze and act on it requires a strategic change, says Icon Solutions' Simon Wilson.

April 30 Icon Solutions

Icon Solutions -

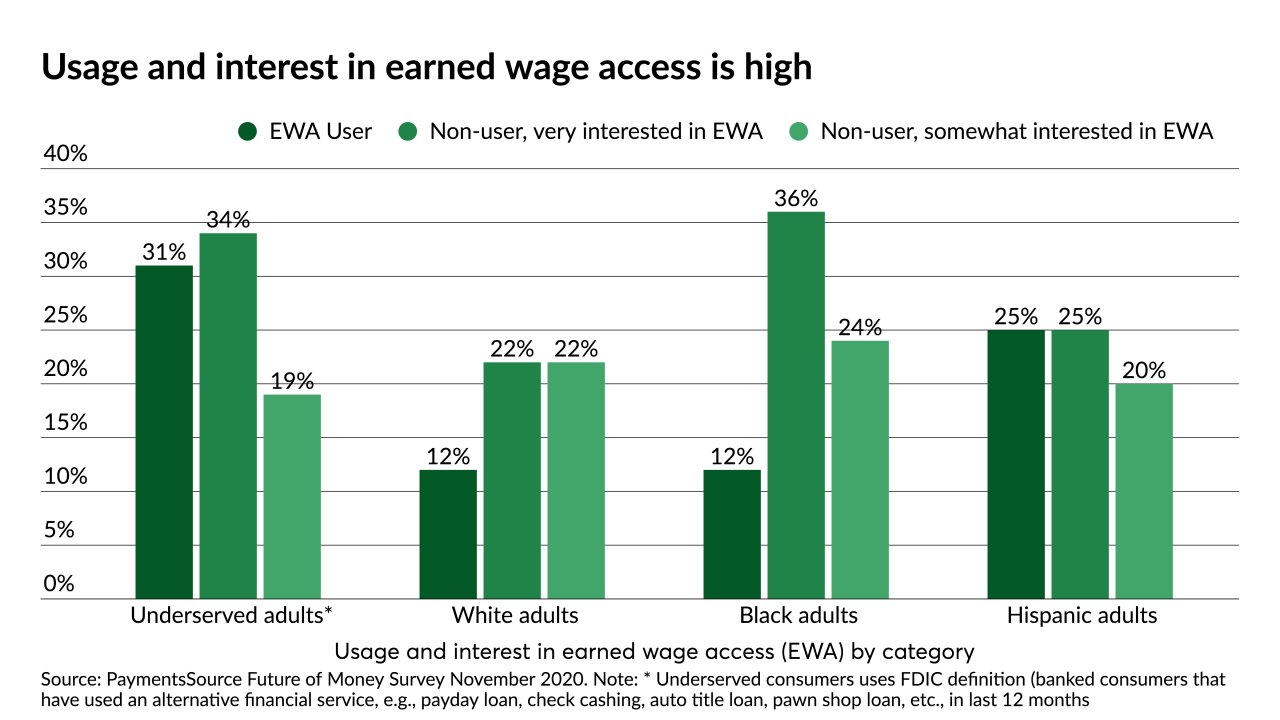

Fiserv is joining the increasingly crowded market for earned wage access in partnership with Instant Financial.

April 29 -

It’s time organizations use the same type of data security approach to meet Nacha compliance as they do to secure PANs in accordance with PCI DSS, says comforte AG's Trevor Morgan.

April 29 comforte AG

comforte AG -

With greater connectivity and more information being shared about customers and transactions, there will be more potential to generate valuable business intelligence, says Citizens' Matt Richardson.

April 28 Citizens

Citizens -

While a merchant may choose to run a program incorrectly, it is our responsibility as professionals to fully understand what the rules are and communicate the impact if they are not followed, says Clearent's Phil Ricci.

April 28 Clearant

Clearant -

The tech vendor allows merchants using the Clover point-of-sale platform to accept PayPal and Venmo payments, a move that serves the company's continuing focus on full omnichannel experiences for its merchants.

April 27 -

Barclays US, which offers a range of cobranded credit cards targeting middle-income consumers, is adding a buy now/pay later option for its merchant partners.

April 27 -

Kate Fitzgerald, senior editor at PaymentsSource, talks to Eric Schuppenhauer, Head of Consumer Lending and National Banking at Citizens Bank, about lending at the point of sale.

April 27 -

Four out of five gig workers want faster payments, and most have less than $500 in savings, according to a study by Branch and Marqeta.

April 27 -

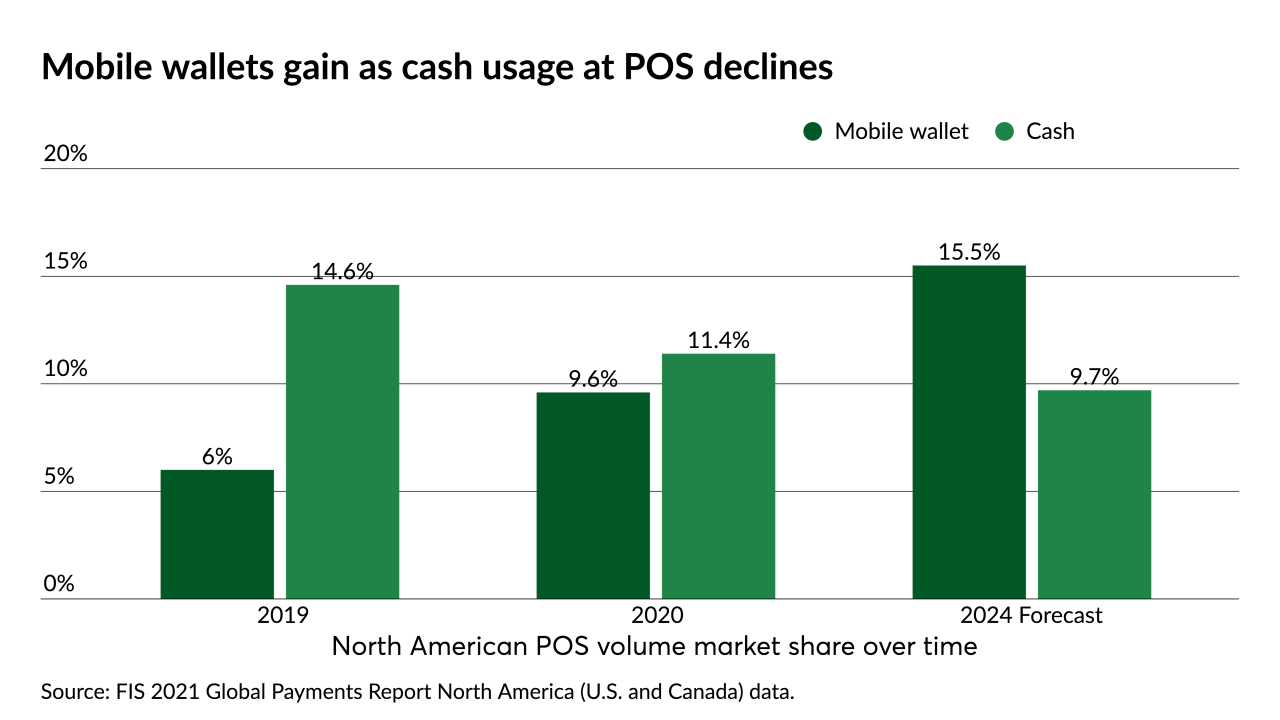

Mobile wallets have seen strong adoption as an in-store payment method in China, but have lagged in appeal in the U.S. until recently. Coronavirus fears have caused many Americans to rethink the mobile wallet’s value proposition.

April 26 -

Fraud detection and prevention technology must align with clear return policies and strong customer service ensuring that confused but loyal and well-intentioned customers can continue to purchase from merchants, says Ravelin's Mairtin O'Riada.

April 26

-

The card brand has built a sizable business after receiving approval to operate in China eight months ago.

April 23 -

Issuers should use the next year to build their own card program, tailored for their market's specific needs, says Zeta's Bhavin Turakhia.

April 23 Zeta

Zeta -

Long after the pandemic is finally behind us, the many security and financial benefits owners, management companies and fans alike receive from having the technology in place will remain too invaluable to ignore, says Corsight's Rob Watts.

April 23Corsight -

Affirm's deal to buy Returnly emphasizes the need to simplify the process when a point-of-sale lender stands between the consumer and merchant.

April 23 -

Amazon.com is poised to bring its automated checkout technology to full-size supermarkets, a significant milestone in the race to revolutionize how people buy their groceries.

April 22 -

On its path to diversify beyond check printing, Deluxe has agreed to purchase Texas-based merchant services firm First American Payment Systems for $960 million.

April 22 -

Accounts payable is one of the most paper-intensive business functions, with lots of room for more environmentally sound processing, Daniel Ball of Medius says.

April 22 Medius

Medius