-

With policymakers casting doubt on Facebook's cryptocurrency and some of the social media giant's partners pulling out, a Federal Reserve governor continued the drumbeat of criticism.

October 16 -

Making a domestic or cross-border B2B payment should be as easy as a consumer making a payment at a retailer's point of sale. There are plenty of obstacles toward this goal, but also plenty of paths to success.

October 16 -

Digital services are gaining momentum, and traditional plastic cards are adding innovation to keep up after years of lagging, says FIME's Stéphanie El Rhomri.

October 16

-

The Facebook Inc. executive responsible for the embattled Libra cryptocurrency said he doesn’t fault companies that pulled out of the project, adding that he’s optimistic more organizations will sign on despite intense opposition from politicians who seem to fear financial innovation.

October 16 -

Even the homeless are getting on board with contactless payments, through a new U.K. wide initiative between Swedish payments company iZettle and the Big Issue Foundation, which enables homeless people to become street vendors by selling its its Big Issue magazines.

October 16 -

Its quarterly results show lower rates and emerging credit risks can be overcome. Whether most banks have all the same levers to pull is another matter.

October 15 -

CEO Michael Corbat said he “wouldn’t rule out” building branches to keep the momentum going.

October 15 -

American Express is adding a new dimension to its year-old partnership with PayPal by giving credit card customers more options for splitting a restaurant check and paying with loyalty points.

October 15 -

Wirecard AG fell the most since February in Frankfurt after a news report said it found repeated questionable accounting practices at the German payments firm.

October 15 -

Better-than-expected trading results also helped to boost net income.

October 15 -

Consumer banking is expected to offset the banks’ underperforming Wall Street units; the defections of Visa, Mastercard and Stripe threaten the cyrpto project’s viability before it starts.

October 15 -

South Africa’s payments industry wants to displace cash by enhancing its B2B-focused digital payment system to add instant low-value mobile P2P transactions.

October 15 -

Banks shouldn't let the legal and regulatory hurdles deter them, attorney Felix Shipkevich says.

October 15 -

The facial recognition development trail is dotted with starts and stops in its search for consumer adoption, from Mastercard's "selfie pay" to Apple's 3-D facial scan tests and the Federal Trade Commission's approval of biometric authorization.

October 15 -

Payroll advance provider Branch has partnered with Mastercard and Evolve Bank & Trust to offer a debit card that allows hourly workers to instantly access a portion of their earned wages ahead of their periodic paycheck.

October 11 -

Italian banking group Intesa Sanpaolo has made a €7 million ($7.8 million) investment in MatiPay, an Italian cash acceptance network that leverages wireless vending machines.

October 11 -

Rapid-fire acquisitions, partnerships and investments in the likes of Uber, Lyft and Grab are transforming these ride-sharing providers. And much of this activity is built on their ability to handle payments seamlessly as part of the experience.

October 11 -

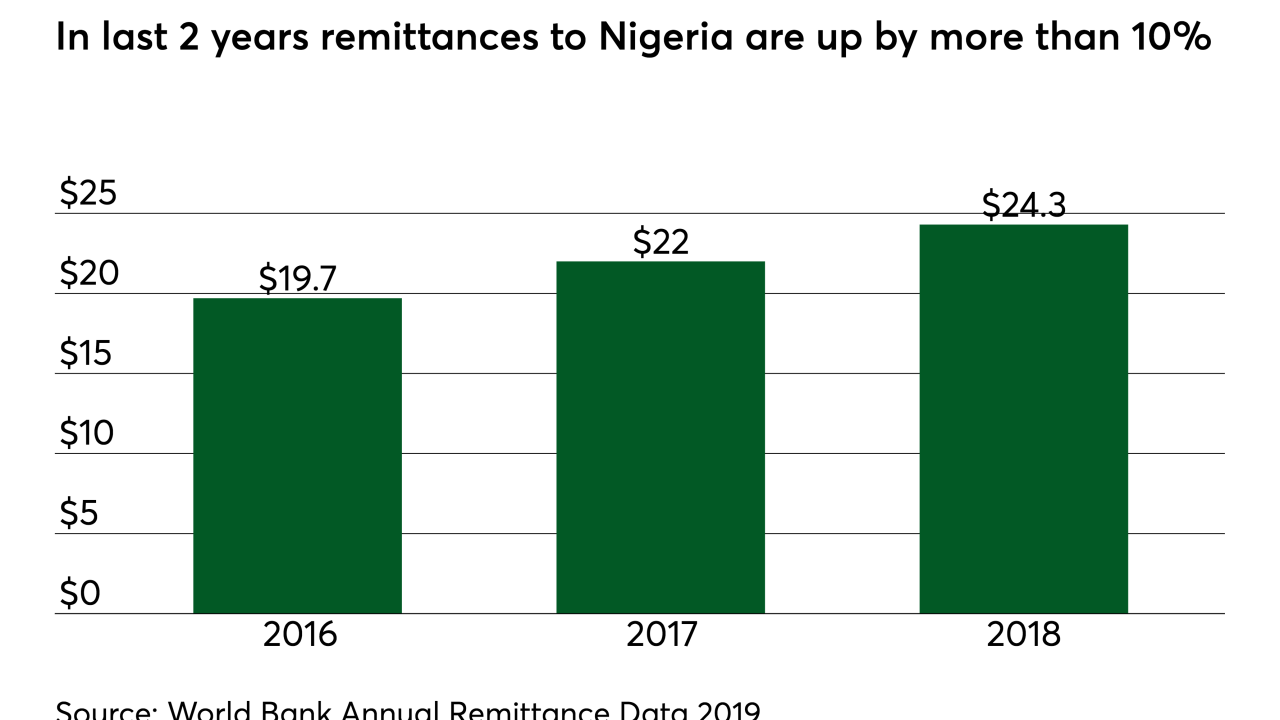

Incumbents and challenger fintechs dominate the remittance market, leading Majority to forge a very narrow use case for its initial corridor.

October 11 -

Majority, which will launch nationwide later this quarter, will use networks of immigrants to sell a mobile phone-based account that features unlimited remittances and international calling services.

October 10 -

In a move to tap into an underserved market opportunity — but with the potential for political backlash — Sallie Mae launched three different cash-back reward credit cards aimed at college students and young adults.

October 10