-

AI-focused venture fund Radical Ventures is the lead investor in a $31.5 million Series B round in Sensibill, which boosts it overall financing to $46.5 million. National Bank of Canada is also part of the investment round.

July 5 -

Fraud targeting accounts payable departments had been on the rise to begin with, but a new sense of urgency has taken hold in the wake of a recent incident that cost Facebook and Google $100 million.

July 5 -

The technology behind bitcoin has spread far and wide, boosting bank and payment innovation. The competitive impact on the traditional payment industry will be felt for years to come, according to Demetrios Zamboglou, COO of BABB.

July 5 BABB

BABB -

Swish is expanding to physical stores to extend usage among the millions of Swedes who use the app for account-to-account transfers.

July 3 -

It’s too early to measure the market effect of New York City's contactless transit payment acceptance pilot launched barely a month ago, but many merchants in the immediate area may not be ready if demand spikes.

July 3 -

Seamless transactions are the key to engaging and holding onto consumers, says Tim Tynan, CEO of Bank of America Merchant Services.

July 3 Bank of America Merchant Services

Bank of America Merchant Services -

Payoneer, which developed a platform to facilitate cross-border payments, hired FT Partners to explore options for expansion, including a private funding round, according to a person familiar with the matter.

July 2 -

Cloud computing has boosted P2P and makes it easier for developers to build new businesses and payment technology, says Demetrios Zamboglou, BABB's chief operating officer.

July 2 BABB

BABB -

FamilyMart and 7-Eleven Japan are using mobile payment technology to compete with each other and attempt to manage the country's labor shortage.

July 2 -

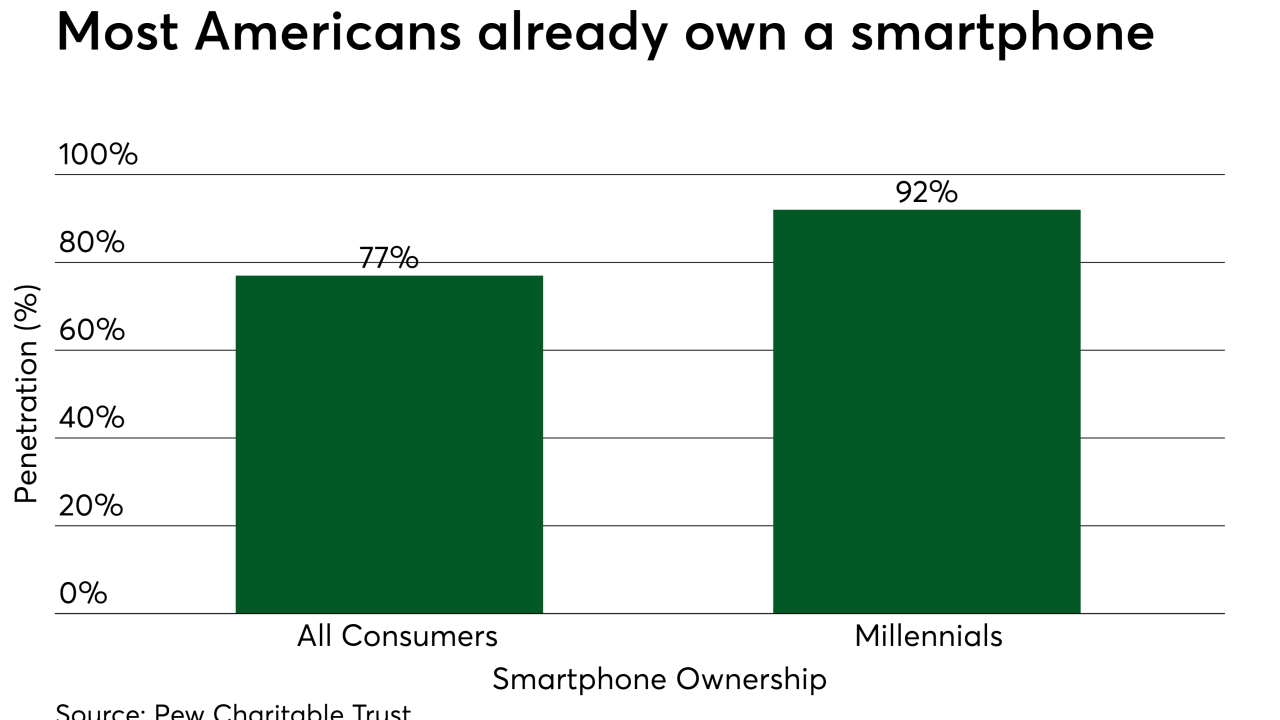

Fiserv is supporting mobile bill presentment in to meet a growing demand for receiving and paying bills through smartphones, which are now nearly ubiquitous in the U.S.

July 1 -

For many banks, especially midtier institutions, payments isn’t a core business — and their batch processing-based legacy systems weren’t designed to deliver real-time payments.

July 1 -

The bank is considering eliminating as many as 20,000 jobs; BIS doesn’t want central banks to fall behind private cybercurrency efforts.

July 1 -

By turning compatibility into a nonissue, APIs help enable open banking, which has the potential to offer core banking services such as payment initiation or account balances through APIs, writes JPMorgan Chase's Stephen Markwell.

July 1 JPMorgan Chase

JPMorgan Chase -

Most large banks have declared their strategies for adopting contactless cards, but the rank and file of FIS’ midsize and smaller issuers are still weighing their options about when to flip the switch.

July 1 -

From regulatory reform to natural disasters and more, here's a look at Credit Union Journal's special report on what to expect for the second half of the year.

June 28 -

Wirecard’s platform for delivering corporate disbursements is expanding to the Philippines.

June 28 -

Naval Group, an international technology company specializing in naval defense systems, is among the first to complete a cross-border payment through Swift's global payments innovation early adopter program.

June 28 -

CEO David Solomon said that Goldman is “absolutely’’ looking at digital currencies and conducting “extensive research’’ on tokenization.

June 28 -

A court decision brings much needed clarity to the complex world of money transmitter licensing by holding that the transmission of information alone is not engaging in the business of money transmission under Pennsylvania law, writes Anita Boomstein, a partner with Manatt, Phelps & Phillips, LLP.

June 28 Manatt, Phelps & Phillips, LLP

Manatt, Phelps & Phillips, LLP -

The millions of people displaced by war, famine and other hardships face distinct challenges and dangers when accessing and using money, and these pain points are being addressed by a blockchain-powered payment app that is part of Western Union's accelerator program.

June 28