-

Mastercard is helping earned wage access provider Clair overhaul its technology platform and service offering.

February 9 -

Fraudsters have increasingly targeted financial services, online dating sites and social media since the end of the holiday season.

February 9 -

There's already an appetite for digital and consumers should quickly embrace Apple's range of services, says CellPoint Digital's Howard Blankenship.

February 9 CellPoint Digital

CellPoint Digital -

Newer partners like the Isreali fintech First are building connections to help stores enroll.

February 9 -

On Sep. 30, 2020. Dollars in thousands.

February 8 -

Citigroup will refund an additional $4.2 million to some credit card customers who were overcharged years ago.

February 8 -

Fintechs and challenger banks are small, nimble and tech-centric. However, incumbents have strong reputations, customer trust and loyalty built over many decades, says Twilio's Bijon Mehta.

February 8 Twilio

Twilio -

The arrangement, which focuses on merchant services, comes about six months after Global Payments secured a similar partnership with Amazon Web Services on the issuer side of its business.

February 8 -

Merchants are making a miscalculation on data management, says FreedomPay's Chris Kronenthal.

February 8 FreedomPay

FreedomPay -

A showdown between megabanks such as JPMorgan Chase and the likes of Apple and PayPal could be the prelude to a broader fight.

February 7 -

The inquiry into Venmo's debt collection practices is a taste of what PayPal can expect as it expands to other categories that increasingly face regulatory pressure.

February 5 -

The inquiry into Venmo's debt collection practices is a taste of what PayPal can expect as it expands to other categories that increasingly face regulatory pressure.

February 5 -

COVID-19 has taken a great deal away from us in the past 12 months, but from a digital payments perspective, it has also opened the doors for new innovation and activity, says Cognizant Softvision's Karla Ch'ien.

February 5 Cognizant Softvision

Cognizant Softvision -

Visa and partners fast-tracked the big game's digital overhaul as the pandemic caused a sharp spike in demand for contactless payments.

February 5 -

People are reluctant to use physical point of sale terminals, putting biometrics in the middle of the contactless payment wave, says Fingerprints' Christian Fredrikson.

February 5 Fingerprints

Fingerprints -

Visa and partners fast-tracked the big game's digital overhaul as the pandemic caused a sharp spike in demand for contactless payments.

February 5 -

The ability to manage both domestic and international invoices through the same AP automation and workflow creates enormous operational advantages for finance teams and the line of business, says MineralTree's Nicolette Medina.

February 4MineralTree -

Venues are piloting payment technology as a way to promote less contact and shorter lines.

February 4 -

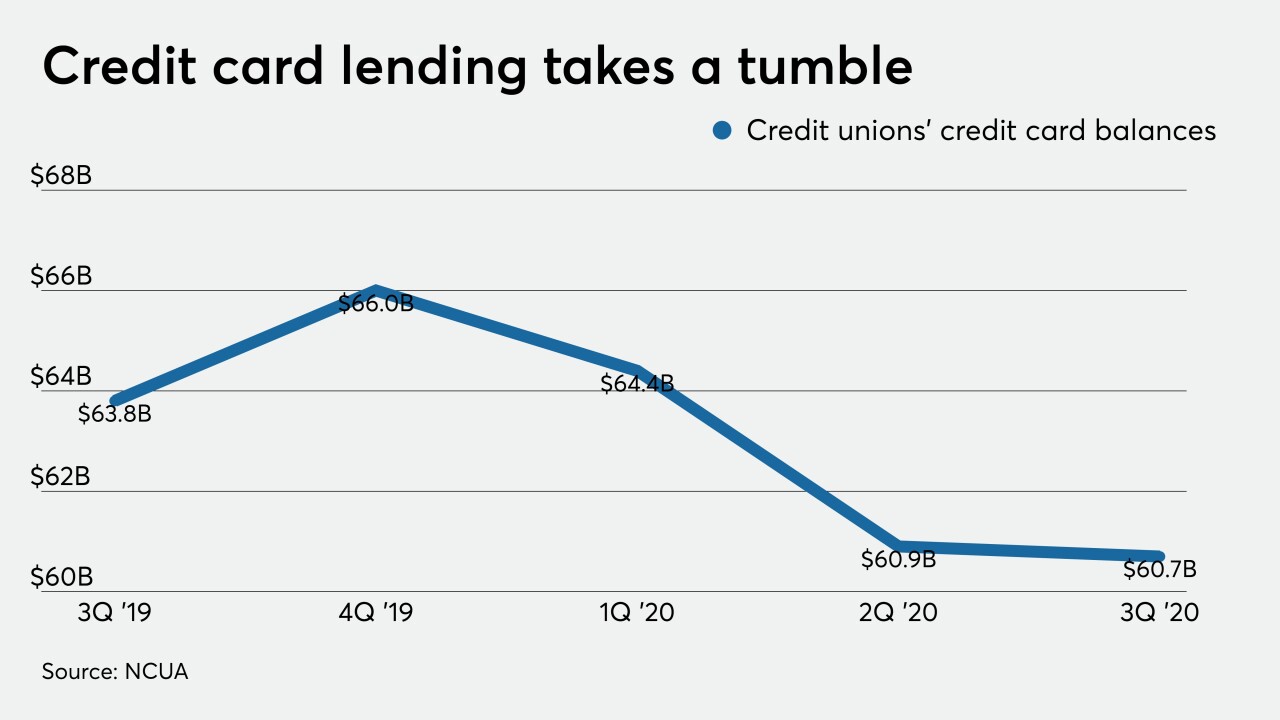

Credit unions are hoping for a return to normal credit card spending patterns sometime during the second half, but the pandemic has created a domino effect of complicating factors.

February 4 -

JoomPay has launched a new P2P service for money transfers across Europe, operating as a socially focused spinoff of the Joom e-commerce marketplace.

February 4