-

U.S. consumers have been more punctual than ever before in paying back debts as the economy rebounds from the pandemic.

October 14 -

The $317 million deal will provide the London company with a large base of American clients and help it compete with technology firms like Square, PayPal and Stripe.

October 14 -

Chase Payment Solutions combines Chase Merchant Services with WePay, a fintech the bank bought in 2017, to provide more tailored offerings — such as card acceptance without a merchant account — to entrepreneurs.

October 14 -

The lender is building on a 20-year-old partnership with Fiserv to provide options such as revolving credit, with plans to add buy now/pay later.

October 14 -

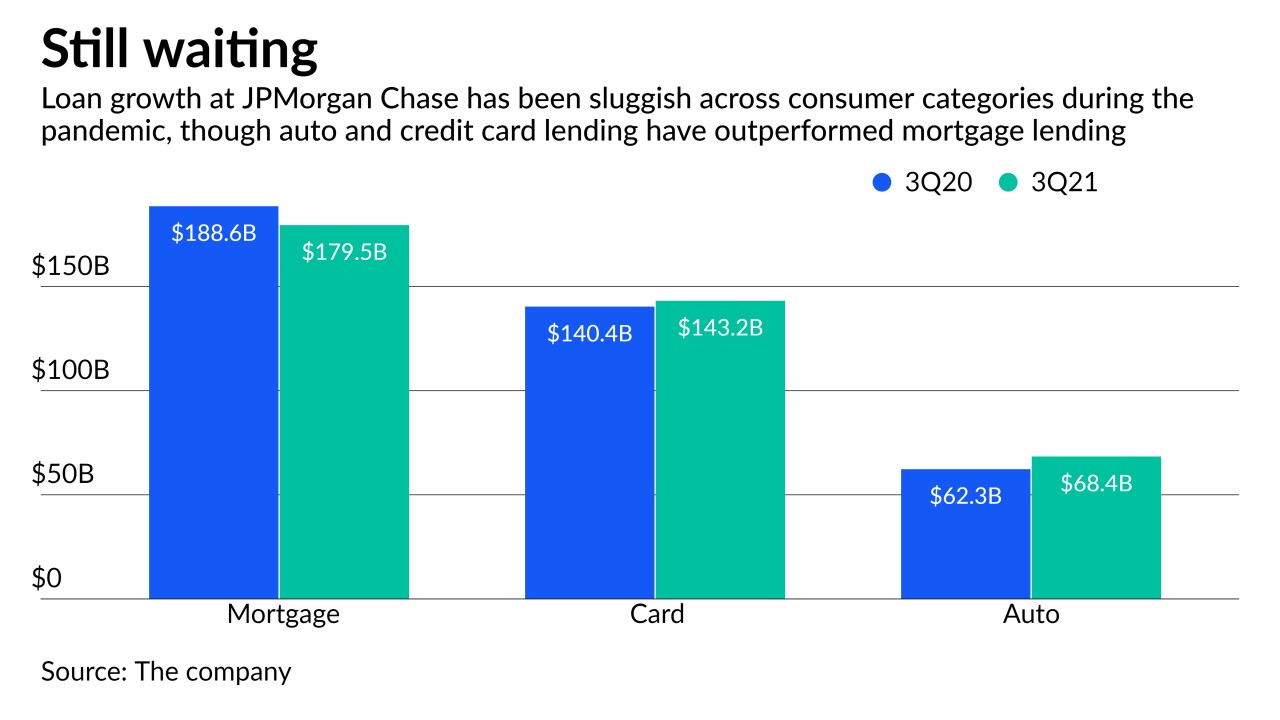

Spending on cards continued to increase during the third quarter, while loan balances rose slightly and payment rates began to return to more normal levels. A top company executive expressed confidence that loan growth will pick up but said, “It’s going to take time.”

October 13 -

Banks working with Swift, The Clearing House and EBA Clearing have completed a successful pilot transaction from the U.S. to Europe and are ready to bring the system to other international corridors.

October 13 -

The payments firm dropped support for Bitcoin payments in 2018, but company executives say the increasing popularity of digital currency makes it a good time to reenter the market.

October 13 -

By partnering with the London-based fintech, Andrews Federal Credit Union will enable members to send transfers to 80 countries.

October 13 -

The bank-supported blockchain organization plans to use the acquired assets to speed testing for digital currencies.

October 12 -

Nonfungible tokens, which provide proof of ownership in the digital world, are booming. Payment companies are betting they will require payment rails to fund high-value purchases and attract new customers for loyalty marketing.

October 12 -

Bank of America is giving businesses new ways to transfer money to their customers with the rollout of a system called Recipient Select.

October 12 -

Many of the application programming interfaces that help banks and fintechs share data predate the law that established open banking on the Continent.

October 7 -

The feature, which was years in the making, allows Amex cardholders to link their accounts to PayPal without leaving the issuer's app.

October 7 -

Card issuers are lobbying Visa behind the scenes to reduce Apple's share of revenue from recurring transactions made on its devices. But the iPhone maker has a track record of warding off threats to its income.

October 7 -

The partnership with Stellar Development Foundation will integrate MoneyGram’s network with the Stellar blockchain to facilitate payments using Circle Internet Financial’s USD Coin.

October 6 -

As head of global liquidity and cash management, Reyes oversees an operation that has 9,000 employees serving 40,000 large corporate and midmarket companies and 1.5 million business banking clients.

October 6 -

Clark heads global transaction banking at MUFG Americas Holdings and is Bay Area president of MUFG Union Bank.

October 6 -

Executives from banks, credit unions, card issuers and investment firms at American Banker's Card Forum discussed ways the public's embrace of digital transactions and credit alternatives like buy now/pay later is shaping everything from products to business strategies.

October 5 -

Venture capital firms are pouring money into startups whose data-crunching technology — including machine-learning systems that predict funds availability — speed payments and inform credit decisions in e-commerce.

October 4 -

By limiting the credit offered to new borrowers during the pandemic, banks created an opening for installment lenders like Affirm, Afterpay and Klarna.

October 1