-

For years mobile wallets have been a solution in search of a problem – until now. COVID-19 has reframed the retail point-of-sale (POS) and with it, how consumers want to pay, giving wallets a new relevance for safer in-store payments.

August 12 -

The acquisition of Florida-based Service Finance Co. would expand the North Carolina bank’s presence in the point-of-sale lending business.

August 10 -

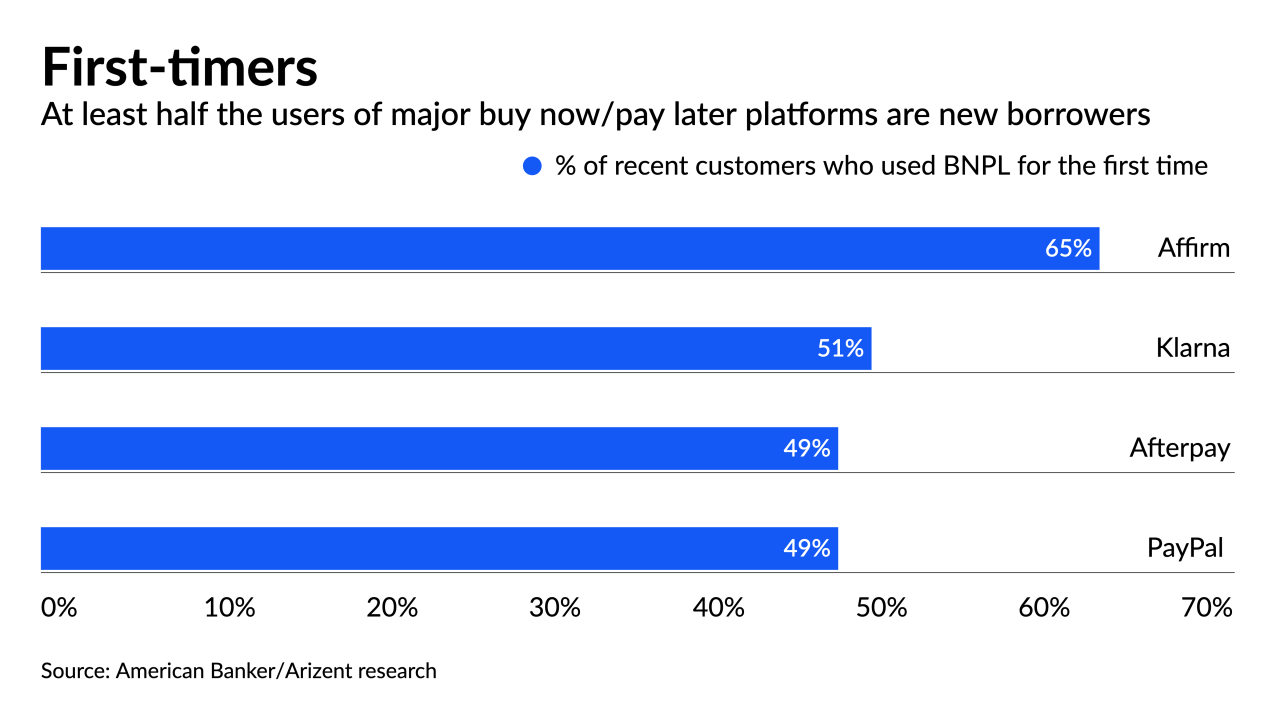

As tech giants rush into point-of-sale lending, the smaller companies that built the market are counting on acquisitions and partnerships with specialized vendors to defend their turf and pull in new borrowers.

August 9 -

The $29 billion purchase of the Australian installment lender would bring larger retail relationships, as well as a fast-growing product that has appeal to both consumers and merchants.

August 2 -

The $29 billion deal would enable Square to better compete with PayPal and Apple, and provide an opportunity to cross-sell other services to the Australian lender's global audience.

August 2 -

Persistent coronavirus fears have accelerated consumer interest in checkout-free retail options like Amazon Go, just as new technologies like 5G make such concepts more practical to implement.

July 28 -

The tech giant is entering a heavily competitive market led by large companies like PayPal and hot startups like Affirm and Afterpay.

July 16 -

The fintech, which arranges point-of-sale loans in partnership with merchants, was fined $2.5 million by the Consumer Financial Protection Bureau and ordered to refund up to $9 million to consumers who received loans they never applied for.

July 12 -

Shoppers surveyed in the U.S., U.K. and Australia cited concerns about debt and fees, along with a general lack of knowledge about how installment loans work, as reasons for their skepticism.

July 7 -

Building on renewed consumer interest in digital payments, companies such as linked2pay and Pax are making it easier for retailers to add options like ACH and to import shopper data into back-office systems.

July 2 -

Low card penetration and sparse borrower information in the region make it hard to determine an applicant's identity and ability to pay. Buy now/pay later lenders instead focus on factors such purchase activity, social media presence and even the speed at which users type their personal information.

June 25 -

Under federal health plans, categories like dental still have steep out-of-pocket costs, creating opportunities for companies like Sunbit and Ally Lending to provide options at the point of care.

June 23 -

A growing number of companies like Klarna, Sezzle and Circle let consumers split large purchases into smaller transactions paid over time. But they say they need to offer more than one product to set themselves apart and build customer loyalty.

June 18 -

The deal for the Salt Lake City-based home improvement lender, which Home Depot tried to acquire more than a decade ago, is part of a larger effort by Regions Financial to diversify its home lending business.

June 8 -

The Australian bank's stakes in technology firms Little Birdie and Amber add price shopping for point of sale credit and bill pay.

May 27 -

The private-label card issuer says that, as merchants reopen, now is the time to realize the benefits of its 2020 acquisition of the buy now/pay later company Bread.

May 26 -

As stores that went online-only start to reopen their physical locations, JPMorgan Chase is looking to bolster its position among European merchants by adding software from ACI Worldwide that's designed to support payments across multiple channels.

May 25 -

The fintech, which is reportedly building a checking and savings account into its app, is using its banking charter to speed the development of new services as it races its rivals to deliver an all-in-one app.

May 25 -

Pine Labs has raised $285 million in its latest funding round, including participation from Singapore’s sovereign fund Temasek, to continue its geographic and product expansion.

May 17 -

Restaurants have a broad menu of tech services to choose from. The challenge now is to make these products work together.

May 5