-

The purchases of Truck Insurance Specialists and Hometown Insurance are expected to help the company expand its dealings in transportation and agriculture.

May 4 -

The company will start to offer insurance planning and risk management services as part of its purchase of Strategic Wealth Group in Valdosta, Ga.

May 4 -

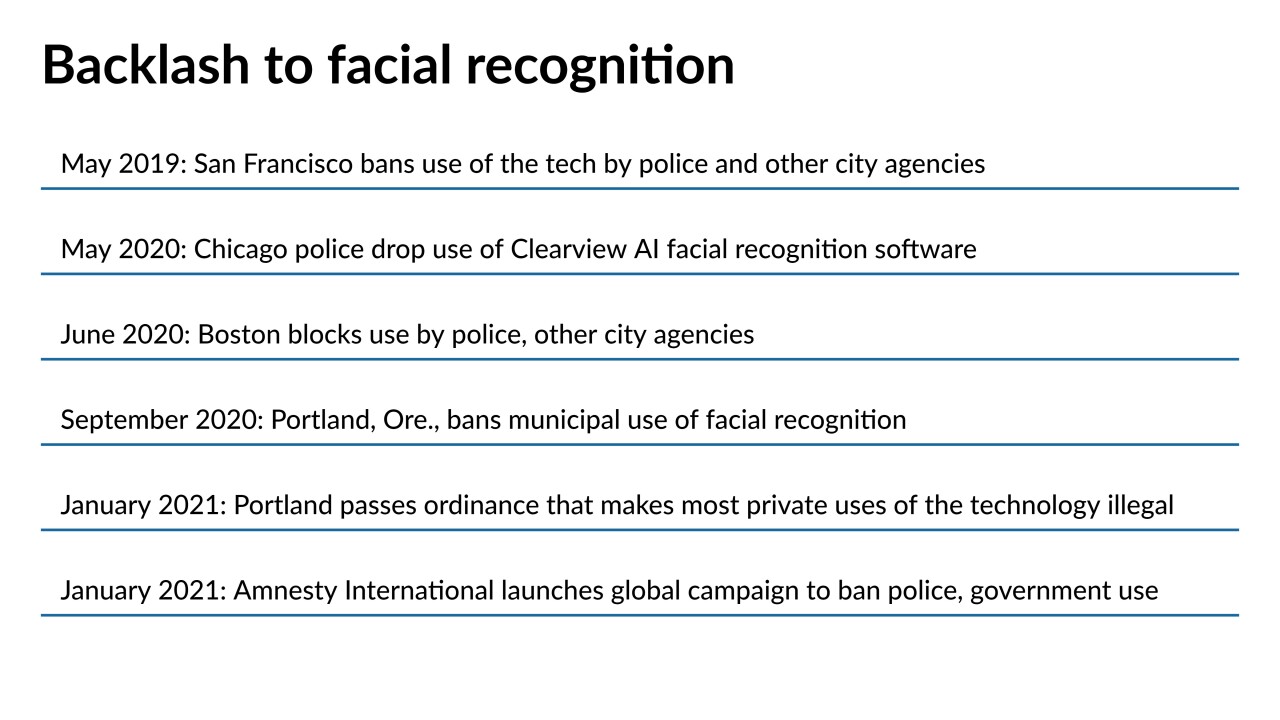

Citing the risk of bias and misidentification, cities and civil liberties groups are calling more loudly for a ban on the use of face scans.

May 3 -

Larissa Thurston, who will also become the Massachusetts credit union's president, will succeed James Garvey, who is retiring.

April 29 -

Mike Butler will also become president of the de novo, which focuses on technology companies and venture capital firms.

April 29 -

The company’s retail banking and auto-lending businesses in the U.S. generated a larger share of overall profits in the first quarter, and Executive Chairman Ana Botín and other executives unveiled expansion plans for both units.

April 28 -

The Arkansas bank is turning to asset-based lending and loans to venture capital and other investment groups to help fill a void created by a shortage of new, big-ticket commercial real estate deals.

April 28 -

Mike Daniels has been president and CEO of Nicolet's bank since 2015.

April 28 -

The Dallas company will pay nearly $54 million for a 49% stake in a lender that operates in 10 states.

April 28 -

The $56 million acquisition will extend Southern California Bancorp's footprint north of Los Angeles.

April 28 -

The Massachusetts community bank, which rebranded last summer, landed on affiliate marketing as one cost-effective way of attracting choice customers to its business checking and crypto banking capabilities.

April 27 -

Profits slumped last year and many investors are now voicing their displeasure with the compensation awarded to senior leaders. A nonbinding “say on pay” vote taken Tuesday passed narrowly, but Chairman Charles Noski indicated that the board will take the results into account when designing future pay packages.

April 27 -

Citigroup said a full review conducted after the lender mistakenly sent $900 million to a group of investment firms concluded the bank didn’t need to claw back any pay from executives.

April 27 -

The Missouri company announced the deal just five months after buying Seacoast Commerce in San Diego.

April 26 -

The merger would create a company with nearly 400 branches, 87 loan production offices and $87 billion of assets.

April 26 -

The proposed acquisition is the second deal in as two days to involve an Atlanta-based seller.

April 23 -

The Illinois companies agreed to merge in a transaction that is expected to close later this year.

April 23 -

Regulators recently eased field-of-membership rules to promote growth of federal credit unions. A handful of institutions are taking advantage of the changes to recruit more members, but some may find the process too cumbersome.

April 22 -

The company promoted Bob Fehlman to become its president and hired Jay Brogdon from Stephens Inc. to succeed Fehlman as chief financial officer.

April 22 -

The Georgia company agreed to pay $84 million for a bank with nine branches and $715 million of assets.

April 22