-

A proposal from the credit union regulator was criticized for being needlessly complex and not requiring enough transparency.

June 18 -

NSWC Federal Credit Union is rolling out a new name in the hopes of boosting membership and dispelling misconceptions about who can join.

June 17 -

A new study shows 60% of adult children whose mother or father are credit union members do not belong to the same institution as their parents.

June 16 -

As governments explore whether to compensate African Americans for centuries of racism, financial institutions need to do their part to redress victims of persistent redlining.

June 16 Polyient Labs

Polyient Labs -

Some of the industry’s biggest institutions intend to keep a significant portion of their staff working from home indefinitely. That’s raising new questions about organizational cultures and how to appropriately utilize credit union facilities.

June 16 -

Executives argue the rollouts will largely focus on new markets and work in tandem with digital banking efforts.

June 15 -

Chuck Shaffer will take the helm in December, becoming the first leader outside of the Hudson family since the bank's formation in 1926.

June 15 -

The Michigan institution's asset base increased substantially in 2019 thanks to a merger but has continued to grow in 2020.

June 15 -

-

Three corporate credit unions serving more than 70% of the industry have banded together for a new effort following Catalyst Corporate's purchase of Aptys Solutions in late May.

June 15 -

Lawmakers shouldn't let themselves be misled by a slower pace in personal bankruptcy filings so far this year.

June 15North South Government Strategies -

Some institutions may want to consider self-insurance to lower expenses as the coronavirus cuts into earnings.

June 15 CU Benefits Alliance

CU Benefits Alliance -

Nobody knows what the next six to 12 months are going to look like. That means AP needs to focus on conserving cash while keeping operations moving, says Nvoicepay's Josh Cyphers and Derek Halpern.

June 15Nvoicepay -

PNC open to deal that would boost assets to $700 billion; banks take hard line against accountants seeking fees for PPP referrals; rush to online banking during coronavirus has hackers salivating, bureau says; and more from this week's most-read stories.

June 12 -

Credit unions are once again opposing language in draft legislation of the 2021 National Defense Authorization Act that would allow banks to rent space on military bases for free.

June 12 -

Members at Malheur Federal Credit Union will vote later this year on whether to join Medford, Ore.-based Rogue.

June 12 -

The Oregon company tapped Tory Nixon to serve as president of its bank.

June 11 -

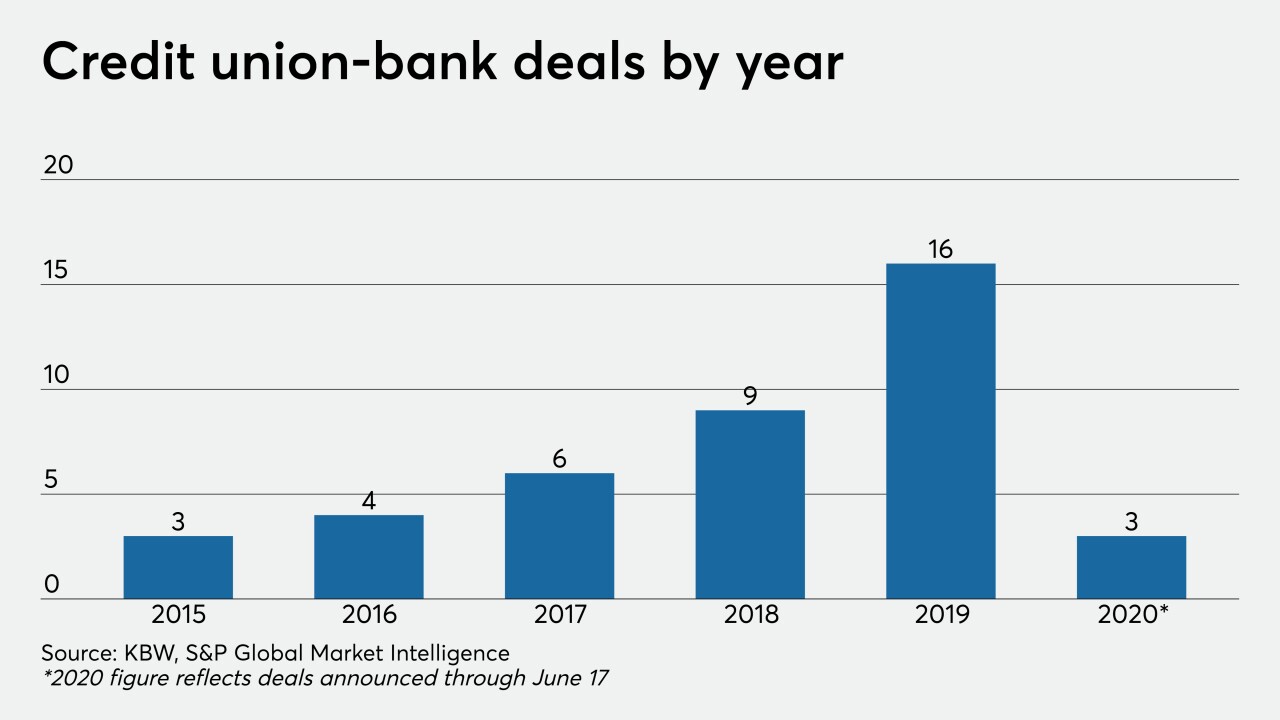

The credit union will pay an undisclosed amount for Community State Bank of Southwestern Indiana.

June 11 -

The Odon, Ind.-based credit union would gain six branches by acquiring Community State Bank of Southwestern Indiana.

June 11 -

The company is partnering with Sensibill, a fintech whose technology turns photos of receipts into text and helps people track and manage their expenses.

June 11