-

Another look at how credit unions across the country are making a difference during "the most wonderful time of the year."

December 28 -

The branch closures will reduce overhead by an estimated $1.9 million a year.

December 28 -

The $126 million-asset credit union selected the new core platform in order to increase automation and cut down on "busy work" for employees.

December 27 -

Here's a look at some of the industry’s latest hires and promotions, along with credit union employees who were recognized for their work.

December 27 -

Through a unique partnership, Nutmeg State Financial Credit Union offers DMV services at two of its locations. So far the results have showcased the power of technology.

December 27 -

The pressure is on CEO Christopher Myers, one of our community bankers to watch, to make the most of CVB Financial's biggest acquisition to date.

December 26 -

The Jacksonville, Fla.-based credit union purchased the facility from Atlantic Coast Bank for $2.2 million.

December 26 -

Credit unions are having a positive impact by doing everything from shredding thousands of pounds of paper to building their 492nd home for a family.

December 26 -

Cadence has upped the exchange ratio by 10%, a move made necessary by the 40% decline in its stock price since the deal was announced in May.

December 26 -

Entering 2019, lenders must think carefully about how they expand their auto loan portfolio. Failure to do so could result in bad loans and bad reviews online.

December 26 EFG Companies

EFG Companies -

Greater Commercial Lending has targeted making loans in some unique sectors, including mining and renewable energy, after launching in January.

December 26 -

There are steps financial firms can take to protect their customers in the event a major wireless network is compromised, including reconsidering the use of SMS messaging for account authentication.

December 24 -

The Massachusetts-based institution has paid out over $10 million to its members since 1996.

December 24 -

Edward Paternostro will step down Jan. 2, and the institution's current COO, John Deieso, will take the helm.

December 24 -

Utilizing AI and automation will help stop hackers and reduce repetitive jobs, allowing institutions to save money and reinvest more into products for members.

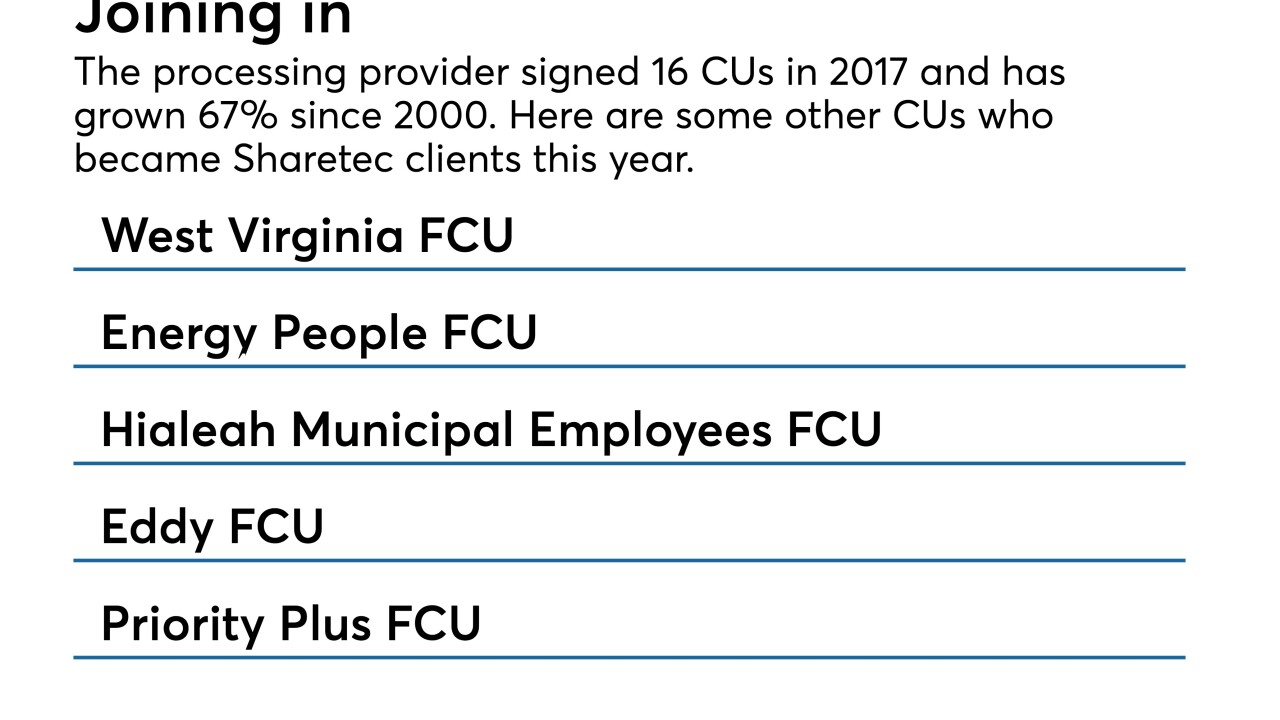

December 24 EPL, Inc.

EPL, Inc. -

With the holiday season in full swing, a number of credit unions are making their communities a bit brighter.

December 24 -

A 2017 holiday shopping growth strategy worked so well for the $4.1 billion-asset institution that management decided to hit the mall again this year.

December 24 -

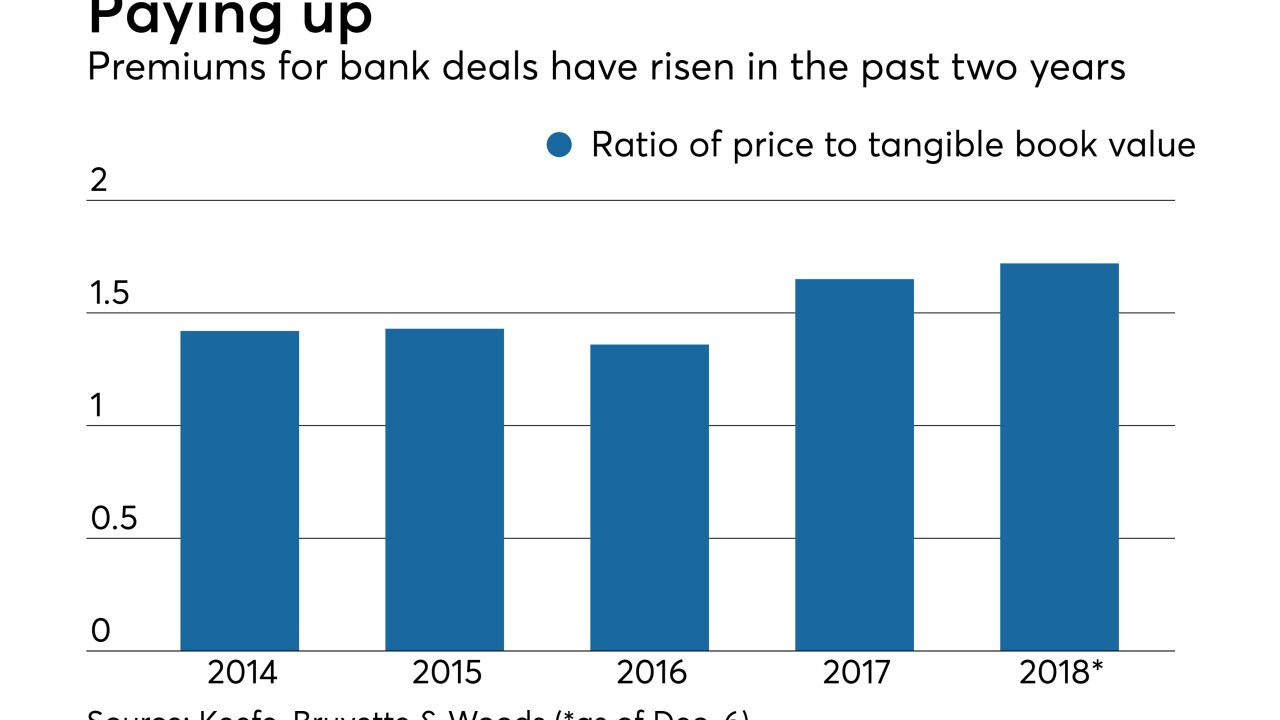

A big splash by Fifth Third, a bid by WSFS to reinvent itself and some bold long-distance expansions highlighted a year where deal activity held steady but premiums rose.

December 23 -

The combination of CCF Holding, Heritage Bancorp. and Providence Bank will create a $1 billion-asset institution. Veteran bank investor Kenneth Lehman will be its chairman.

December 21 -

Christopher O’Malley is set to lead the California-based institution as Ron Berry retires.

December 21