-

Credit unions announce board election results, strategic appointments, new hires and more.

June 12 -

Donegal Group and Donegal Mutual Insurance are selling the holding company for Union Community Bank in Lancaster County.

June 12 -

Longview, Texas-based credit union has tipped Randall Perason to succeed retiring CEO Betty DeWeese.

June 12 -

Chief Administrative Officer Jane Verret will succeed CEO Dawn Harris, who plans to retire at the end of this year.

June 12 -

Seacoast's deposits in the central Florida city will increase by 49% after it completes the $133 million acquisition.

June 11 -

The company will pay $114 million to gain 10 branches and $482 million in assets.

June 11 -

BB&T is buying Regions Financial's insurance business. That made the timing right for its retail broker to undergo a name change, the company said.

June 11 -

From supporting life-saving research to making a difference in their communities, here's how credit unions across the country are giving back.

June 11 -

Ross last year was elevated from EVP to president and chief operating officer, as league CEO Dave Adams shifted his focus to CU Solutions Group.

June 11 -

Millennials may be the largest demographic in America today, but one marketing expert says credit unions who ignore older potential borrowers do so at their own peril.

June 11 -

Fixing HSBC's troubled U.S. division will be one of the "most challenging" parts of the lender's new $17 billion strategy, Chief Executive Officer John Flint said.

June 11 -

Nutmeg State Financial Credit Union is the first CU in Connecticut to offer in-branch DMV services — a move that could drive new growth at the credit union.

June 11 -

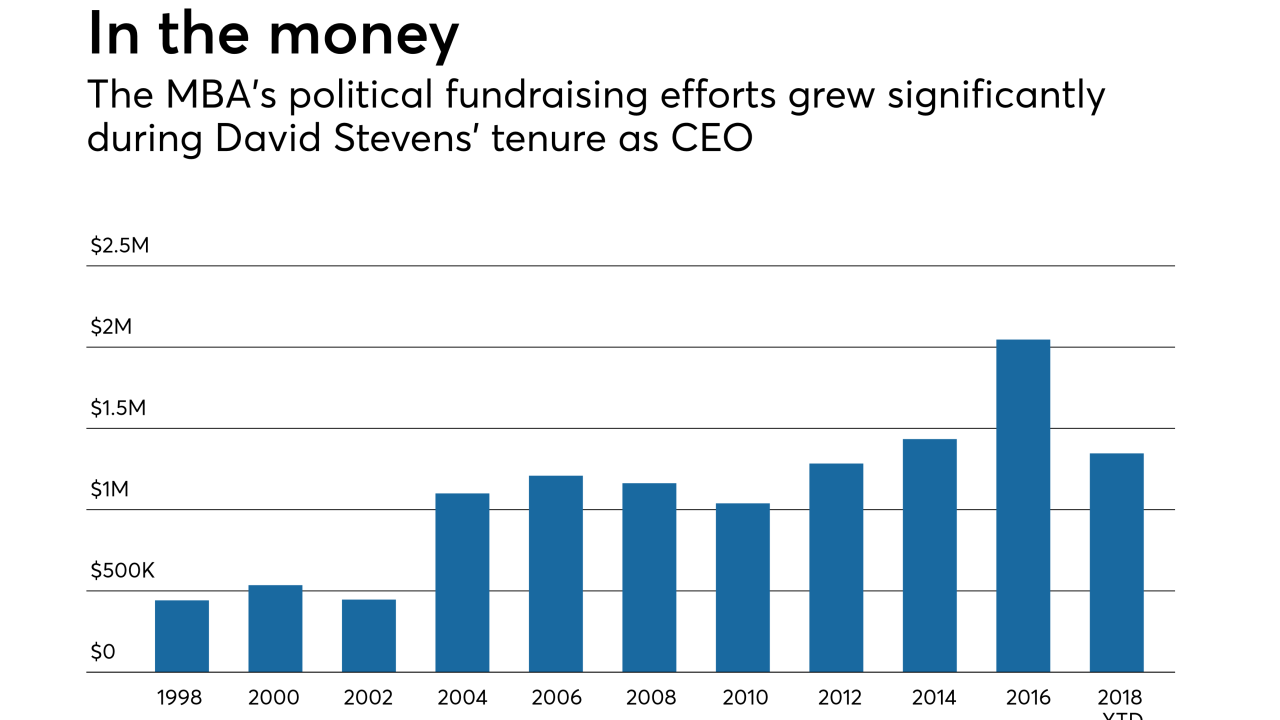

Robert Broeksmit has a tough act to follow succeeding David Stevens, the CEO revered for navigating the Mortgage Bankers Association through one of its most tumultuous eras on record. But in doing so, Broeksmit has a distinct advantage over many of his predecessors: inheriting an organization on the upswing.

June 8 -

The OCC finds that Wells Fargo was not alone in its sales abuse practices (though it's not naming names); Fifth Third's Tim Spence is our Digital Banker of the Year; the CFPB acting director wipes out the agency's Consumer Advisory Board; and more from this week's most-read stories.

June 8 -

Developing technology in-house and then licensing it is one way a small bank can build a reputation as an innovator.

June 8 -

Institutions that have been opening consumer accounts without consent need to prepare for the fallout, even if the OCC has said it won't name names.

June 8 MWWPR

MWWPR -

It's tough to explain the bizarre way the CFPB handled the decision to dismiss the members of three advisory councils earlier this week.

June 7IntraFi Network -

As these up-and-coming leaders continue to move up through the ranks, some could be heading for the corner office.

June 7 -

Ameris Bancorp said that Edwin Hortman will step down as president and CEO in July but will continue as chairman.

June 7 -

Live Oak is the latest bank to jump into this niche lending area. But some warn they are beginning to see cracks in credit quality.

June 7