-

Citigroup has been pulling back retail operations from broad swaths of the globe, but its commercial banking business is finding new regions for expansion.

February 22 -

Super Bowl ads' impact, another overdraft-fees ouster, and more in banking news this week.

February 18 -

Royal Bank of Canada shareholders will vote on whether the bank should tighten its standards for sustainable finance, action inspired by a 2021 pipeline financing deal that was criticized for greenwashing and general concern over lax standards for so-called sustainability-linked debt.

February 17 -

The Silicon Valley fintech expects to make $1.5 billion in auto loans this year after implementing key elements needed to achieve scale, said CEO David Girouard. The expansion comes as the automotive market continues to boom.

February 16 -

The chief executives at 11 large and regional banks have been on the job for 21 years or more. Here's a countdown of who they are and how they've endured.

February 15 -

As more investors look to make portfolio allocations based on their values, we explore what ESG ratings can do — and what they can't.

-

The fintech-turned-bank has bet big on pro football marketing. Sunday’s game at SoFi Stadium should give its customer acquisitions a boost, analysts say.

February 14 -

Deutsche Bank promoted Charlie Burrows to oversee the expansion of the bank’s wealth management unit across the southeastern U.S., as the German lender builds out its business of catering to the ultrarich.

February 8 -

Minnesota Bank & Trust dropped Mike Lindell as a customer after the committee investigating the Jan. 6, 2021, attack on the U.S. Capitol subpoenaed the Trump supporter's telephone records. But its rationale for doing so needed more explanation.

February 7 Steel City Re

Steel City Re -

Wages, marketing spending and technology investments are all on the rise. While higher interest rates should eventually help tame inflation, it's not clear how quickly banks will be able to limit their spending increases.

February 1 -

This elite group of young wirehouse and regional employee representatives collectively generate more than $200 million in annual revenue.

February 1 -

The bank is working with a tech company to personalize customer communications using proprietary data. It's an alternative to cookies, which are becoming less viable as data privacy laws become stricter.

January 28 -

-

The expenses jumped 33% last quarter, which was generally in line with trends elsewhere in the credit card industry. The battle for new customers is “intense,” CEO Richard Fairbank told analysts.

January 26 -

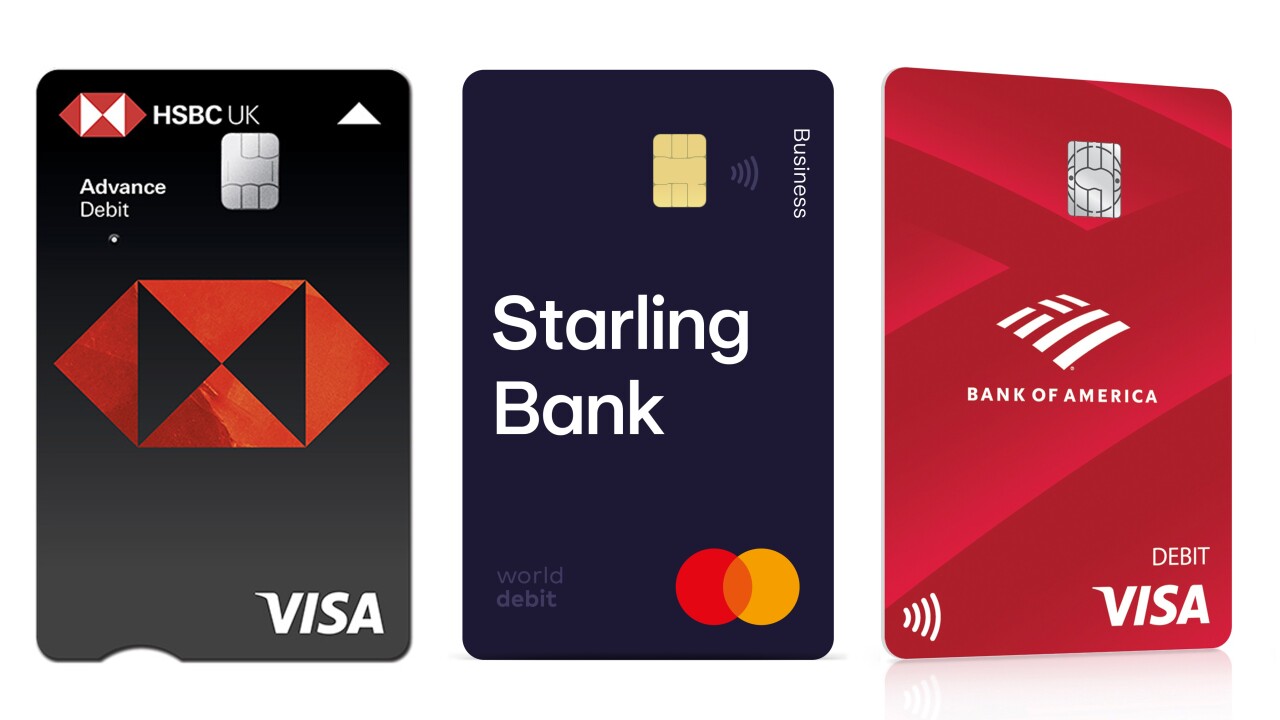

Switching from a horizontal layout — a relic of embossed account numbers — is an attempt by issuers like HSBC, Starling Bank and Bank of America to address accessibility challenges faced by customers with dementia, visual impairments and other conditions.

January 24 -

Bank of America revamped leadership across its wealth management business, placing more responsibilities on current heads Andy Sieg and Katy Knox.

January 21 -

The Tennessee bank reported an uptick in commercial lending during the fourth quarter. Executives pointed to the impact of a 2020 acquisition that allowed First Horizon to bulk up in in Florida, Georgia and Louisiana.

January 20 -

-

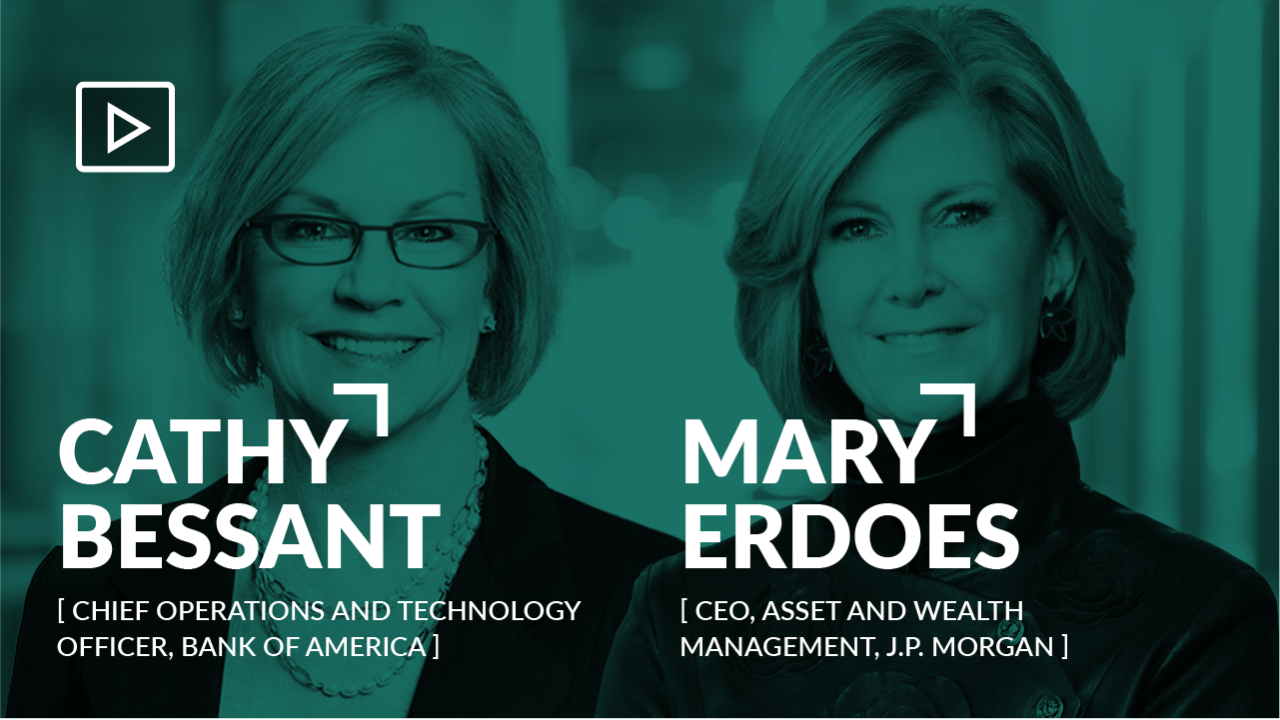

What else do banks need to do to achieve gender parity more quickly? What are the tech innovations that will be most impactful for the banking industry? What will the surviving banks look like a decade from now?

January 18 -

Citigroup CEO Jane Fraser is nearing the end of her organizational overhaul after deciding to cut loose retail-banking operations in Mexico. She will make the case at an upcoming investor day that the company is on the verge of producing stronger shareholder returns.

January 14