-

The California bank is directing $30 million to Stride Funding, a provider of flexible student-payment options, to finance deferred tuition for participants in a technology upskilling program.

October 21 -

The bank is giving virtual reality headsets to branch employees, which they'll use to practice conversations in private before they happen in real life.

October 7 -

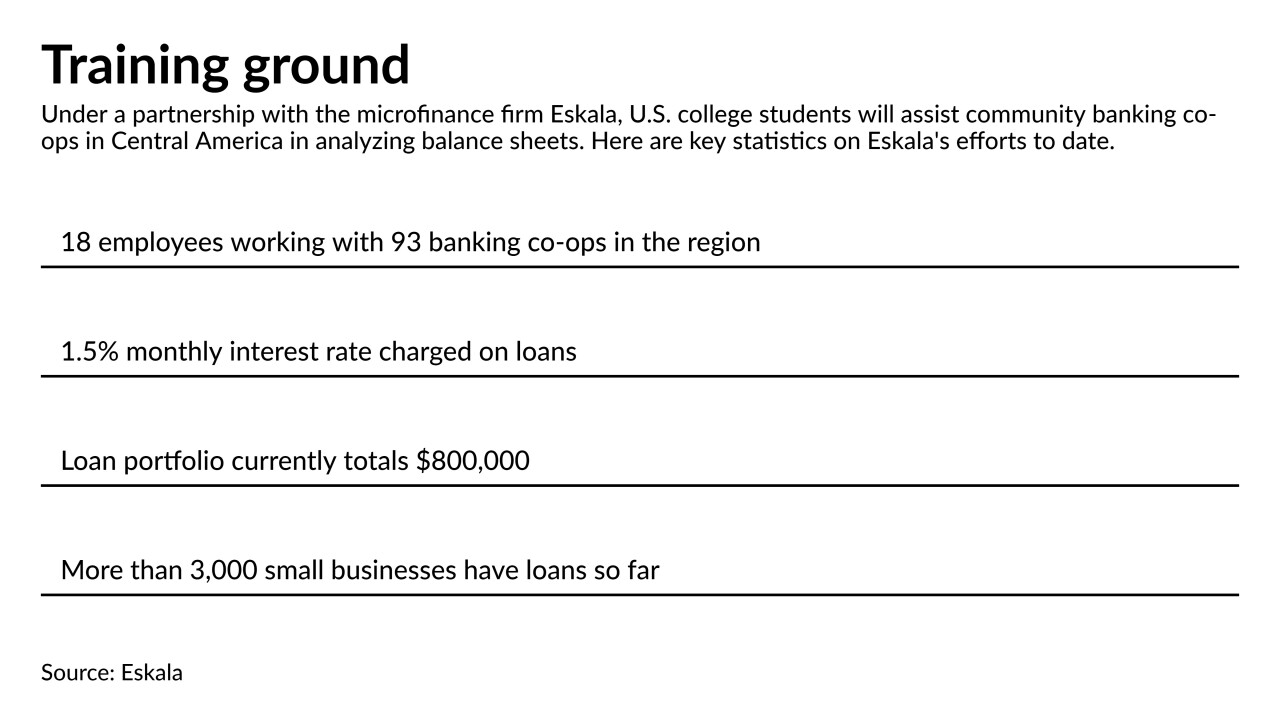

Marquette University has formed a partnership that will give undergraduate business students experience working with grassroots lenders in Panama, Honduras and Nicaragua. The goal is not only to teach the basics of commercial lending, but also to instill some idealism in the next generation of bankers.

September 8 -

The Federal Deposit Insurance Corp. is soliciting feedback on banks' experiences with remote exams during the pandemic. Some welcome the review as a step toward a more modern examination system, while others contend the last year and a half exposed the drawbacks of long-distance oversight.

August 31 -

The agency asked bankers to reflect on their experience with virtual monitoring over the past year amid speculation that the pandemic could speed a full conversion to off-site supervision.

August 13 -

The company, which is phasing out positions in areas including mainframe computing and lockbox operations, is offering employees 10 hours of instruction per quarter to learn how to manage bots and develop other new skills, Chief Information Officer Amy Brady says.

July 27 -

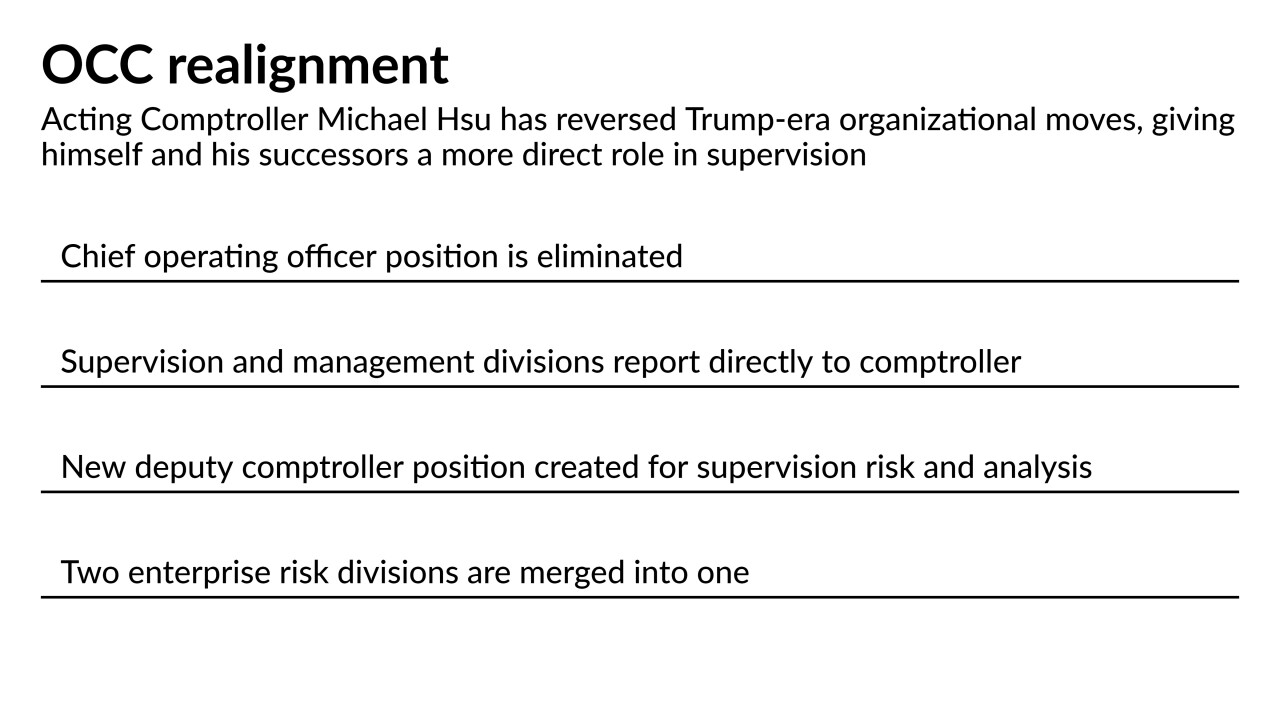

Michael Hsu is reorganizing the Office of the Comptroller of the Currency so that he directly oversees staffers who develop examination strategy. Some analysts suggest the move could result in more aggressive oversight by an agency long accused of being too cozy with national banks.

July 21 -

Bank of America, JPMorgan Chase and United Wholesale Mortgage are among the financial companies teaching employees and recruits technology skills to take on new roles and get better in their current ones.

June 25 -

Companies from Bank of America to PlainsCapital have ditched dull webinars and found more engaging ways to train workers to show empathy to clients and explain bank programs.

May 14 -

Citigroup has started an early intake program in Asia to boost the hiring of women in its investment banking and markets businesses.

May 13 -

Queensborough National Bank and Trust in Georgia is one of several banks aiming to recruit tech-savvy interns through a network of universities and fintech companies.

April 20 -

Virtual training and orientation, including any licensing needed, will begin in July for the bank’s campus hires, with the aim of having new employees at offices in October, Bank of America said.

March 30 -

David Murphy, the credit union's vice president of risk and finance, will succeed Carol Adler, who is retiring.

March 24 -

The new group is made up of leaders from institutions with assets of $300 million or less and aims to help foster collaboration, mentorship opportunities and more.

March 15 -

Mark Kelly will step down next month as president and CEO of the Oklahoma City-based institution. He will be succeeded by the credit union's executive vice president.

March 12 -

Juan Fernandez Ceballos will take the helm at the state league following Paul Stull’s retirement this summer.

March 11 -

Konstantina Baker has been appointed to lead the Fort Wayne, Ind.-based institution following the retirement of longtime CEO Gregory Troutner.

March 9 -

The new leaders include some who succeed retiring chief executives retiring and others stepping in after unexpected departures.

March 5 -

The St. Louis-based institution is the latest in the industry to create an executive-level position focused on diversity, equity and inclusion.

March 5 -

Rodney Hood, a board member and former chairman for the credit union regulator, was selected to fill a seat previously held by Todd Harper, who was recently appointed NCUA chairman.

March 3