-

As the COVID-19 virus spreads globally, many U.S. financial institutions are said to be taking steps to protect employees and minimize disruption. But only a handful are sharing specifics, to avoid contributing to any public panic.

February 26 -

The game has changed and bank executives will have to do more homework before striking a deal.

February 19 CCG Catalyst

CCG Catalyst -

The tight labor market and public pressure to raise minimum wages are expected to nudge noninterest expenses upward in a year when the watchword is cost control.

February 13 -

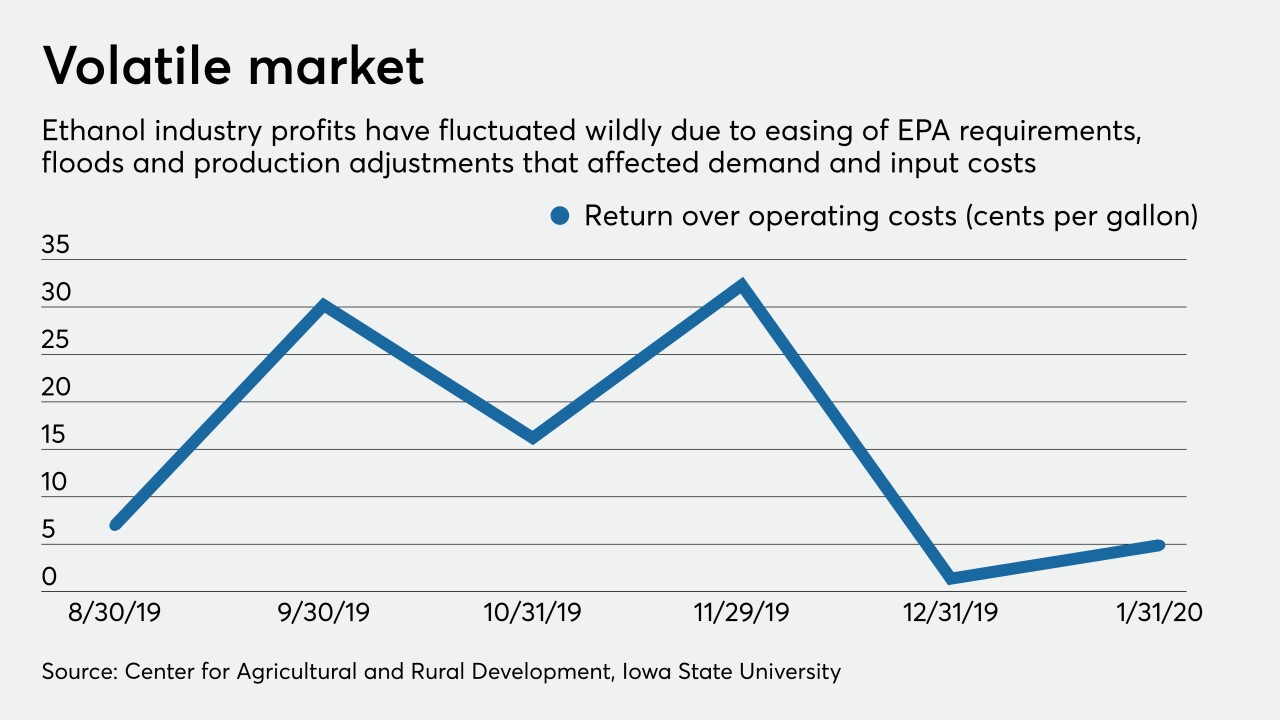

Ag lenders say the Trump administration’s waivers for oil refineries threaten another source of revenue for corn growers and ethanol makers.

February 12 -

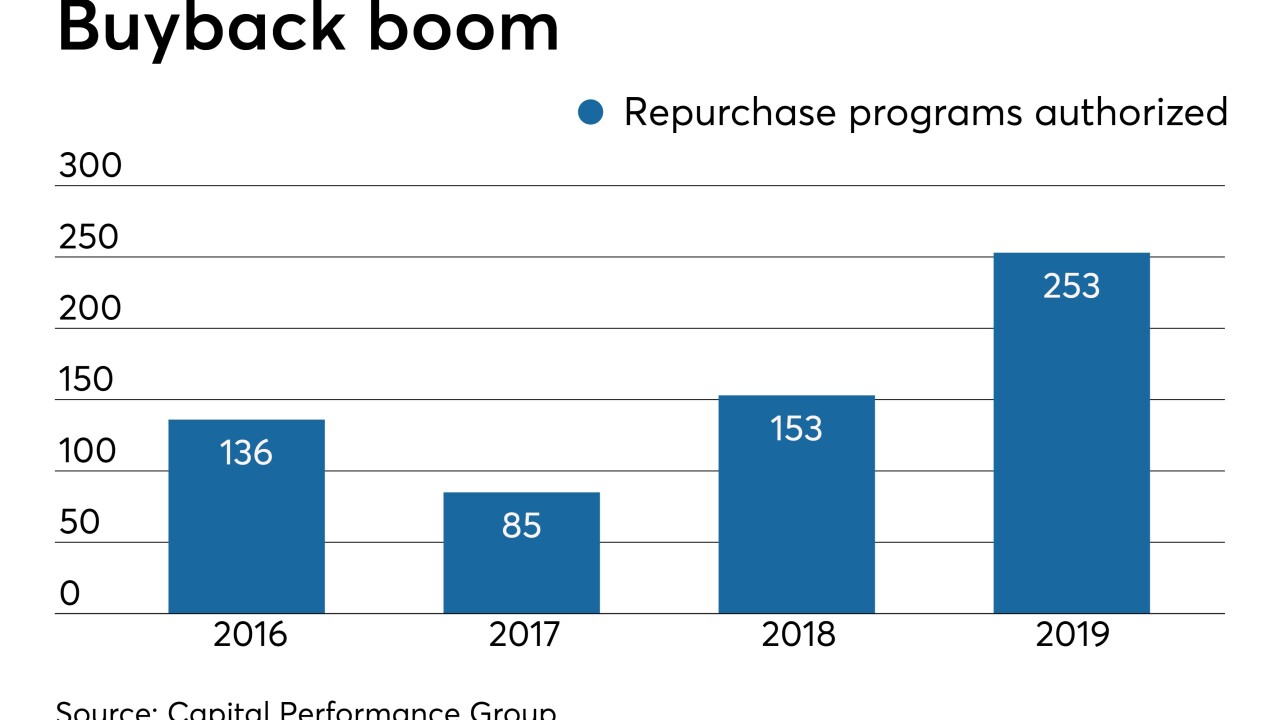

Anticipating a weaker economy and added pressure on stock prices, banks authorized more repurchases of outstanding shares last year.

February 5 -

TD’s brand will appear on 80 Cardtronics machines in the New York area, while Fifth Third’s will appear on 139 ATMs in the Carolinas.

February 3 -

Newcomers Nymbus, Neocova, Finxact and Technisys and older competitors like Temenos, Infosys and Oracle are winning over community and regional banks by offering what some bankers describe as more flexible technology at fairer prices.

February 3

-

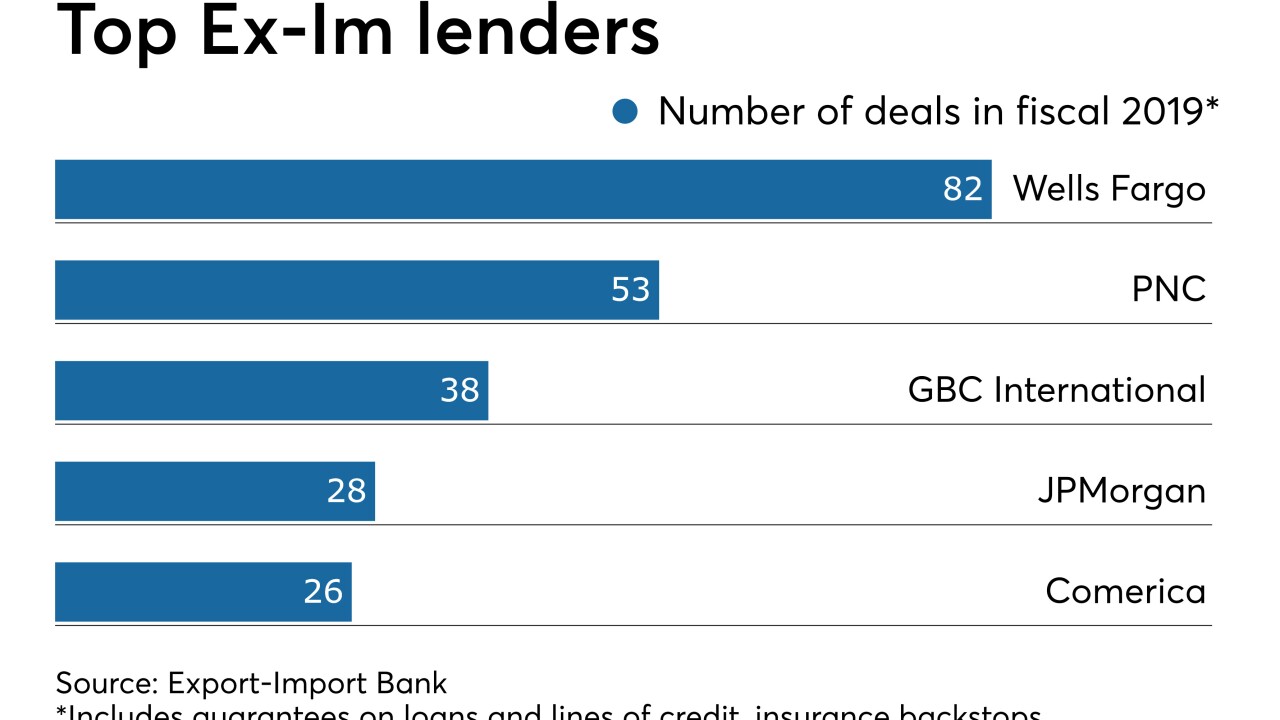

Lenders that depend on the Export-Import Bank to back loans to exporters are already seeing business borrowing pick up after Congress reauthorized the agency in December.

January 30 -

The U.S. arm of Toronto-Dominion Bank said Matt Boss will oversee credit cards, residential loans and deposit products, among other areas.

January 27 -

As more consumers order in using such services as Uber Eats and Grubhub, restaurants are selling fewer desserts, drinks and other high-margin items, said CEO Rajinder Singh.

January 24