-

Investments in analytics and a focus on courting midsize businesses have helped regional banks add non-interest-bearing deposits even as they struggle for other types of deposits. Can they keep it up as rates rise?

May 1 -

Vice chairman set to leave agency on Monday; big regionals are caught in the middle, losing share to both the biggest national banks and community institutions.

April 30 -

Grayson Hall has served as CEO since 2010. He will leave the post in July but remain executive chairman through the end of the year.

April 25 -

The company, which reported a slight decline in loans, lowered its expenses during the first quarter.

April 25 -

The Ohio bank's total deposits grew, unlike at some other regionals, and CEO Stephen Steinour said its 28-basis-point increase in overall funding costs will pay off.

April 24 -

The Utah company reduced the size of its loan-loss allowance, citing improvement in its energy book at minimal losses from Hurricane Harvey.

April 23 -

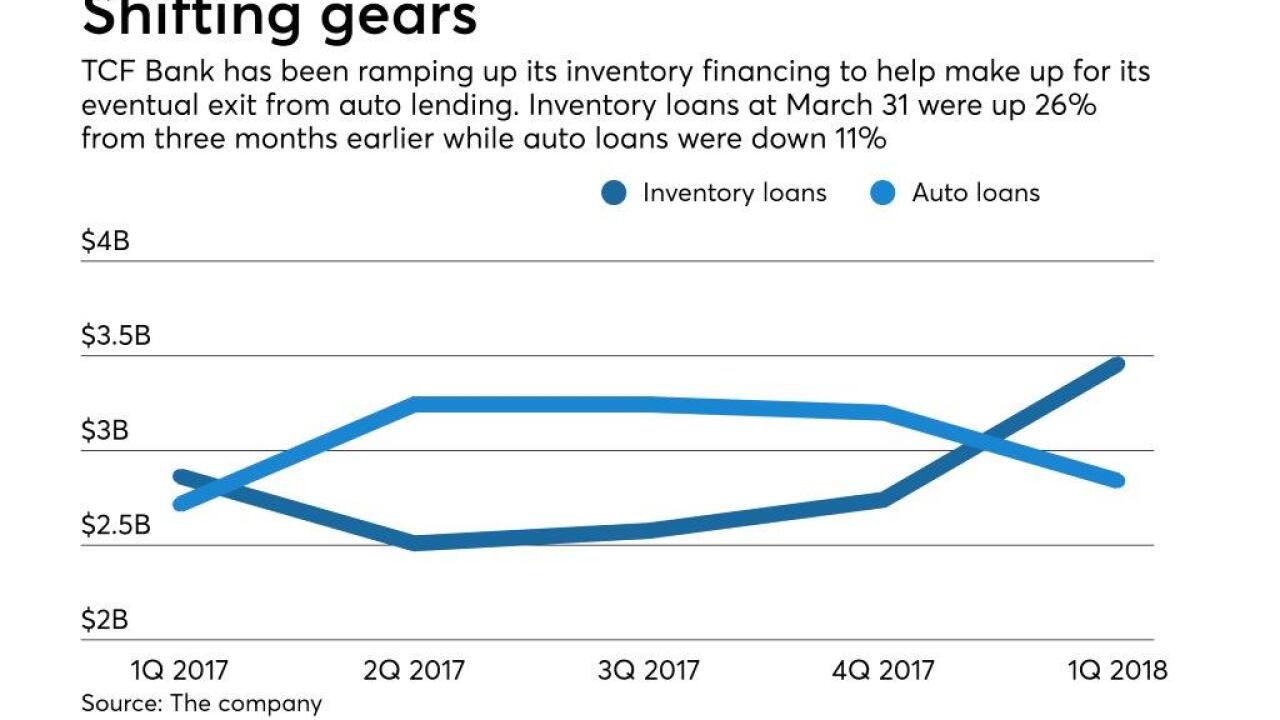

The move toward more asset-based finance shows how CEO Craig Dahl, in his second year at the helm, is reshaping the Minnesota company after its surprise exit from auto lending last year.

April 23 -

After nearly two years of sputtering commercial loan growth, regional bankers are counting heavily on expanding their portfolios of personal loans and other types of consumer credit.

April 20 -

SunTrust let about eight weeks pass before telling the public that data tied to 1.5 million customers had been stolen.

April 20 -

The Louisiana company has vowed to meaningfully improve investor returns and efficiency over the next two years.

April 20 -

The regional bank's net income rose 37% thanks to those factors and others.

April 20 -

The Waterbury, Conn., company also posted a double-digit gain in net interest income thanks to a 7% increase in commercial loan balances and a widening net interest margin.

April 19 -

The North Carolina company's efforts to contain expenses made up for a marginal increase in revenue.

April 19 -

Results were also aided by strong growth in residential construction, commercial and equipment financing.

April 18 -

A $135 million increase in litigation expenses related to its 2011 acquisition of Wilmington Trust overshadowed a wider net interest margin and improved credit quality for the Buffalo, N.Y., company in the first quarter.

April 16 -

Bankers hoped the tax overhaul would stimulate a boom in business borrowing, but several said this week that hasn’t happened yet. PNC’s Bill Demchak warned that the tax cuts could be encouraging lenders to underprice loans.

April 13 -

The Pittsburgh company reported a 39% gain in retail banking profits amid a lot of strong first-quarter numbers, yet it still fell short of analysts' earnings expectations by a penny and wants to push for stronger loan growth.

April 13 -

James Smith said his late enrollment in the state’s Republican Party meant he would be ineligible to be a candidate in its August primary and that he did not want to disrupt the nomination process.

April 11 -

James Smith said he would decide soon whether he’ll seek the Republican nomination for governor. He said he was inspired partly by his recent work on a commission tasked with recommending fixes to the state’s fiscal and economic problems.

April 6 -

BB&T is the nation's fifth-largest insurance broker. The deal, expected to close in the third quarter, would further expand its reach in the Southeast and Texas.

April 6