-

There were no sighs of relief from bankers, who realize their planning could still prove useful as the potential for another shutdown looms.

January 22 -

Citizens Financial, Regions and SunTrust reported strong gains in consumer banking, including loans made through partnerships with retailers and fintech lenders. They want to keep it up to compensate for slack in commercial lending.

January 19 -

The Providence, R.I., company’s results included a $317 million tax benefit as well as growth in mortgages, education and unsecured retail loans.

January 19 -

The Arkansas company has spent two years trying to reassure nervous investors and analysts that it can rapidly book real estate loans using conservative practices.

January 18 -

Highlights at the North Carolina bank included deposit service charges, CRE lending and wider margins, which all offset one-time costs related to tax reform.

January 18 -

Merger- and tax-related charges took a bite out of fourth-quarter profits at the Cleveland company, but its CEO emphasized that a recent deal and tax reform are promising for growth.

January 18 -

The Mississippi company reported strong loan growth, even as it reduced exposure to energy-related borrowers. Higher revenue also helped Hancock lower its efficiency ratio.

January 17 -

The elimination of a key deduction that had worked as a cap on CEO salaries, combined with investor pressure to maintain performance incentives, could lead to an upward drift in compensation for top executives of many banks.

January 9 -

Lower taxes mean more earnings, higher capital levels and perhaps a psychological boost for buyers.

January 9 -

Banks, especially smaller institutions, will be forced to find more ways to differentiate, Bryan Jordan said in an interview that also covered his company's recent purchase of Capital Bank and how tax reform will immediately stimulate the economy.

January 4 -

Changing political and economic forces are raising new questions about deployment of tax savings and the cost of deposits, while old concerns about cost-cutting, credit quality and risk-taking persist or return.

January 3 -

Commercial customers, including small businesses, seem ready to pay up to shift to faster, more sophisticated electronic invoicing and payments, and enterprising banks that provide them the technology to do so could find it lucrative.

January 2 -

Increases in charitable donations will be more important than ever for bank reputations, as tax breaks and a lighter touch from financial regulators rekindle public anger about the financial crisis.

December 29 -

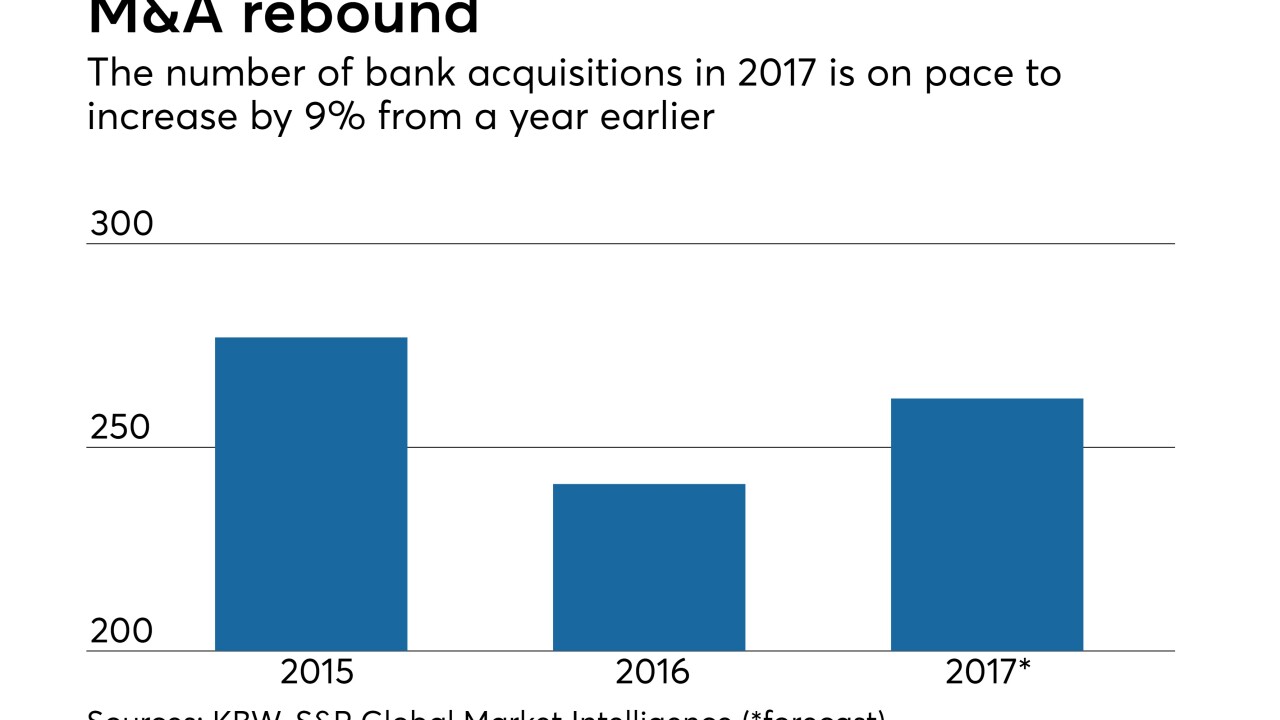

Bank M&A started off with a bang this year, with eight of the 10 biggest deals taking place in the first six months. North Carolina and Florida accounted for six deals on the list.

December 26 -

Davis, who stepped down as CEO a year ago, will retire as the company's chairman and as an employee at the end of 2017. Umpqua will then become one of the few publicly traded banking companies with a female chair.

December 22 -

The purchase will significantly increase Hancock's assets under management and administration.

December 18 -

The number of deals, overall dollar volume and premiums are on pace to top those from a year earlier, giving hope that even more consolidation will take place in 2018.

December 15 -

John Turner, the head of the Birmingham, Ala., company's corporate banking group, takes over the president's title from Chairman and CEO Grayson Hall.

December 13 -

The company has agreed to buy the operations of Veterans Mortgage in Salt Lake City.

December 12 -

The Los Angeles company will sell $1.6 billion in loans, largely tied to technology and health care, by the end of this year.

December 11