-

Several dozen banks have been accused of operating websites that violate the Americans with Disabilities Act. Here’s why trial lawyers are targeting them and are expected to sue more.

May 21 -

The nearly $5 billion deal to acquire MB Financial would provide the Cincinnati company with immediate scale in the Windy City.

May 21 -

Equity warrants. Capital calls. Off-balance-sheet accounts. SVB's unusual business model thrives on financing rainmakers and cutting-edge firms, but old-school issues like overconcentration, unpredictable fee income and stock market swings lurk in the background.

May 15 -

Lenders are taking steps to reduce exposure to fluctuations in oil prices, including getting tougher in demanding that drillers use commodity hedges.

May 14 -

A planned stock offering by the French banking giant would lower its stake in First Hawaiian to 49.9%.

May 8 -

The Japanese bank, owner of Union Bank in San Francisco, has hired RBC alum Roger Blissett to raise its profile among lawmakers, oversee compliance and build deeper relationships with regulators as its recent charter switch continues to stir controversy.

May 8 -

The Bridgeport, Conn., company said Friday that CEO Jack Barnes has relinquished the president's title and that Jeff Tengel has moved into the role.

May 4 -

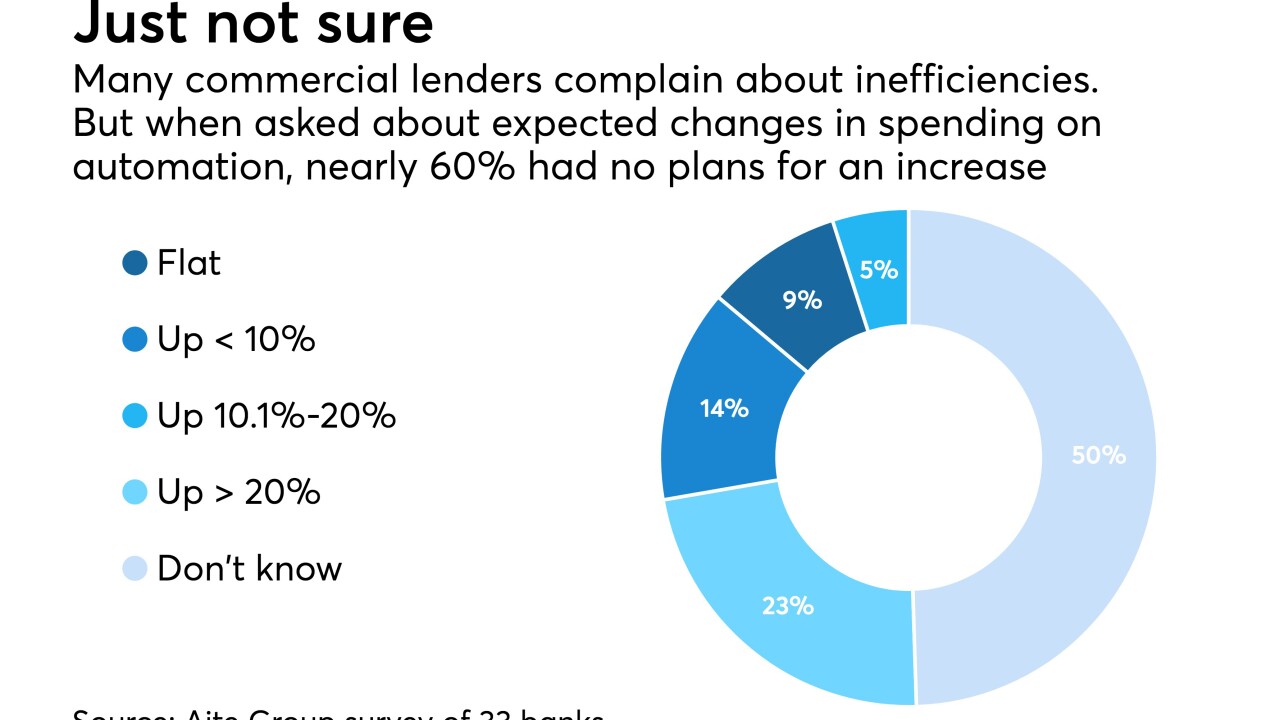

A bank that can deliver a loan decision a little faster, or ask a client to input information just once, could get a leg up on the competition. But some executives are skeptical of software sales pitches and fear overpaying.

May 3 -

Fifth Third is helping babies born in Chicago today (Get it? 5-3) save for college. It's the kind of nontraditional marketing that branding experts say more banks should experiment with.

May 3 -

Anderson Insurance & Investment Agency in Minneapolis also specializes in workers' compensation services.

May 1 -

Investments in analytics and a focus on courting midsize businesses have helped regional banks add non-interest-bearing deposits even as they struggle for other types of deposits. Can they keep it up as rates rise?

May 1 -

Vice chairman set to leave agency on Monday; big regionals are caught in the middle, losing share to both the biggest national banks and community institutions.

April 30 -

Grayson Hall has served as CEO since 2010. He will leave the post in July but remain executive chairman through the end of the year.

April 25 -

The company, which reported a slight decline in loans, lowered its expenses during the first quarter.

April 25 -

The Ohio bank's total deposits grew, unlike at some other regionals, and CEO Stephen Steinour said its 28-basis-point increase in overall funding costs will pay off.

April 24 -

The Utah company reduced the size of its loan-loss allowance, citing improvement in its energy book at minimal losses from Hurricane Harvey.

April 23 -

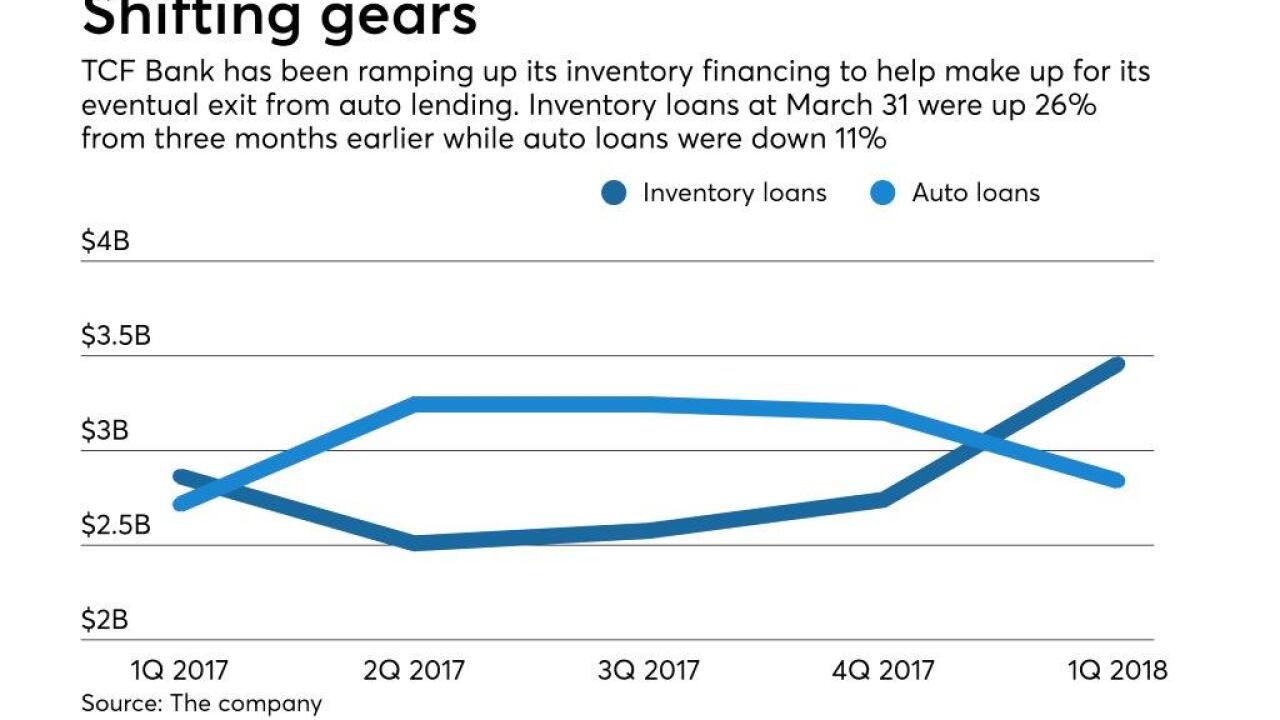

The move toward more asset-based finance shows how CEO Craig Dahl, in his second year at the helm, is reshaping the Minnesota company after its surprise exit from auto lending last year.

April 23 -

After nearly two years of sputtering commercial loan growth, regional bankers are counting heavily on expanding their portfolios of personal loans and other types of consumer credit.

April 20 -

SunTrust let about eight weeks pass before telling the public that data tied to 1.5 million customers had been stolen.

April 20 -

The Louisiana company has vowed to meaningfully improve investor returns and efficiency over the next two years.

April 20