-

The Georgia bank's operating costs rose in the fourth quarter, but executives sought to assure shareholders that investments will produce revenue growth in the long run.

January 24 -

Commercial lending was sluggish in 2019, but leaders at Huntington, KeyCorp and M&T are encouraged that rates are stabilizing and business sentiment is improving.

January 23 -

While the New York bank has a handle on deposit pricing, Joseph DePaolo said a new accounting standard will play tricks with how it addresses credit quality.

January 21 -

The Southeast banks expect to complete their merger by midyear, hit their savings targets and still be able to invest in growth, according to Bryan Jordan.

January 17 -

Brian Moynihan said banks must be mindful of pricing and risk as they contend with lower yields on loans and securities.

January 15 -

The Charlie Scharf era began with the company's lowest quarterly net income in more than nine years. Culprits included falling revenue, rising salaries and yet more financial fallout from the bank's sales scandal.

January 14 -

With loan demand weak due to factors beyond their control, small-bank execs can expect to field lots of questions about capital and expense management.

January 8 -

Paul Murphy took full responsibility for a recent spike in charge-offs at the Houston company. His challenge in 2020 is keeping credit issues in check.

December 24 -

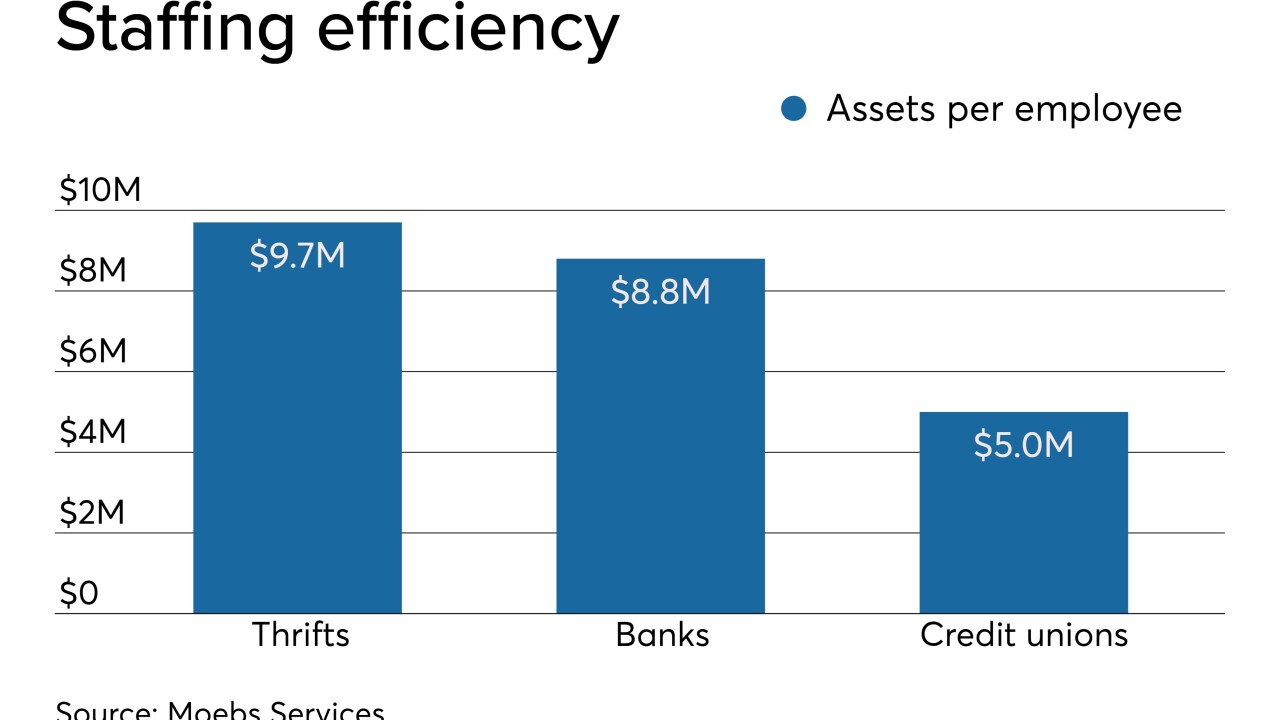

Savings institutions are aggressively cutting staff and shortening hours to be more competitive. As a result they have become more efficient than commercial banks.

December 16 -

The rapid pace of technological change will force financial services companies to invest in more efficient digital offerings for clients, eliminate jobs and retrain staff to focus on higher-value work, according to an Accenture report.

December 12 -

The Independent Bank-Texas Capital merger could prompt other banks in the state to consider selling or buying.

December 9 -

Several banks have reported spikes in substandard loans, special mention credits and watch-list relationships. What does it all mean?

November 25 -

A 10% cut next year, which will be identical to the fee reduction this year, is projected to save the industry about $85 million.

November 25 -

The Louisiana company's willingness to combine with First Horizon without a big initial payday is fueling talk that other banks could be keen on selling at relatively inexpensive prices.

November 12 -

While layoffs at big banks get the headlines, small and midsize lenders are also trimming payrolls in response to lower rates and fears that a recession is getting closer.

November 6 -

The credit they received in the third quarter is helping to soften the blow from falling net interest margins and weakening loan demand.

October 30 -

The institution also remained well capitalized and its membership rose in the first half of the year.

September 30 -

A new study suggests banks have the ability to operate leaner than ever before. That could fuel investor demands for more cost cutting and drive more banks to pursue M&A.

September 23 -

Loans and net income continued to rise while delinquency rates improved. Other major trends continue, including ongoing consolidation amid sustained membership growth.

September 4 -

Pockets of job growth — in technology and compliance as well as from branch openings in new cities — are offsetting some of the dramatic cuts elsewhere at the world’s largest lenders.

September 3