-

Expenses soared in the rush to deploy emergency loans to small businesses, and now Bank of America may need to delay some investments if it hopes to meet cost targets, CEO Brian Moynihan said.

May 27 -

Bankers have become more uncertain about how to serve marijuana businesses owing to confusion about which states deem them essential.

May 27 FS Vector

FS Vector -

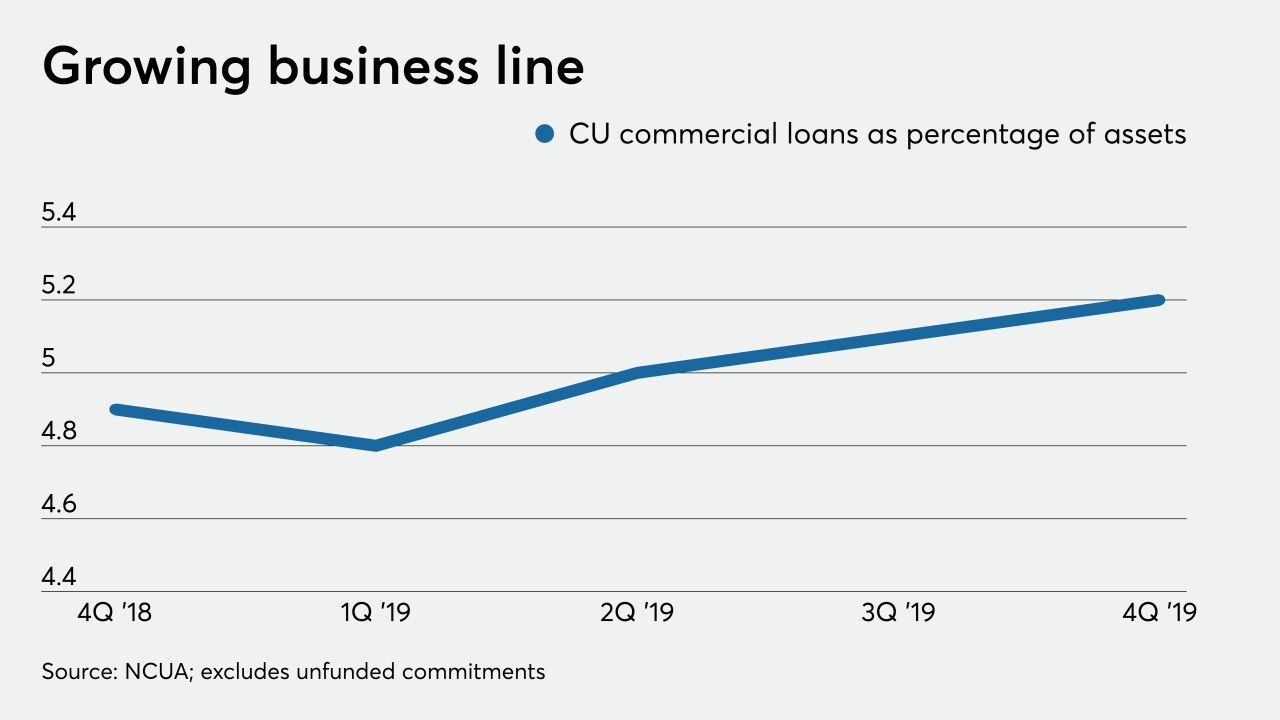

The industry is well positioned to gain market share, but institutions may not see the same levels of growth as after the last recession.

May 26 -

Federal Reserve Bank of Boston President Eric Rosengren said he expects companies to begin receiving money through the central bank's long-awaited Main Street Lending Program within two weeks.

May 24 -

The new Paycheck Protection Program rules, which created a review process and timeline for paying lenders, did not extend the time borrowers have to comply or increase how much money can be spent nonpayroll expenses.

May 24 -

Companies that received funding from the Paycheck Protection Program in early April can start to submit forgiveness applications at the end of May.

May 22 -

A Manhattan man was charged by federal prosecutors with fraudulently trying to obtain more than $20 million in government loans intended to aid small businesses affected by the coronavirus pandemic.

May 21 -

The Federal Reserve received a bipartisan critique Wednesday from members of a congressional oversight panel who said the central bank has been slow to launch a key emergency lending program for midsize companies.

May 21 -

Jennifer Roberts, the company's head of business banking, details a process to have units work one-on-one with customers to get Paycheck Protection Program funds deployed faster.

May 21 JPMorgan Chase & Co.

JPMorgan Chase & Co. -

The sellers will continue to service the loans and retain the fees they receive from the Small Business Administration.

May 20 -

Black and Latino business owners were less likely to get loans than overall borrowers, survey states; Atlanta Fed president tells lenders they won’t be second-guessed if they do right by borrowers.

May 19 -

The government's latest stimulus package cleared the House on Friday but a number of key credit union priorities didn't make the cut.

May 18 -

Triad Business Bank in North Carolina, which opened in March, has made $106 million in Paycheck Protection loans.

May 17 -

The agencies produced an application process that includes favorable interpretation of qualifying expenses.

May 15 -

The Independent Community Bankers of America would not rule out legal action if Congress doesn't address the National Credit Union Administration's recent decision expanding the low-income designation.

May 13 -

The move is the first time the bank has provided services to digital currency players; the Washington Post and four other heavy hitters want details on PPP and small business disaster loan programs.

May 13 -

SBA Express has existed for years, but its new $1 million cap could prove helpful to small businesses that need funds for more than just payroll expenses.

May 12 -

The agency is being methodical in its rollout of the Main Street Lending Program in hopes of avoiding missteps that followed the launch of other coronavirus relief efforts. But observers say delaying aid brings its own risks.

May 11 -

Lawmakers are pushing for better data on who's receiving loans in hopes that more funds will be directed to lenders that serve women- and minority-owned businesses.

May 11 -

Banks could end up holding many low-rate Paycheck Protection Program loans on their books for two years, and dealing with irate borrowers who failed to meet federal requirements for forgiveness.

May 11