-

The Nusenda Credit Union Foundation, which is being honored with a Wegner Award, works with its partners to find creative solutions to unmet needs, including its mircolending program, Co-op Capital.

March 11 -

Adding new mobile payment methods and integrated platforms can take some of the sting out of processing issues for small to medium sized businesses, according to Tina Hsiao, vice president of risk and chargeback operations at WePay.

March 7 WePay

WePay -

Karen Mills, who led the Small Business Administration from 2009 to 2013, is joining the Eastern Bank spinoff Numerated as an adviser and investor as it tries to bring online-lending technology to community banks.

March 6 -

The Small Business Administration should consider partnering with fintechs, which have the capacity to approve loans quickly, to help avoid the kind of application backlog the agency faced after the last government shutdown.

February 26 Funding Circle

Funding Circle -

The Small Business Administration should consider partnering with fintechs, which have the capacity to approve loans quickly, to help avoid the kind of application backlog the agency faced after the last government shutdown.

February 15 Funding Circle

Funding Circle -

The Salt Lake City company, which connects small-business owners with lenders like JPMorgan and BofA, plans to use the funds to expand its partnerships and customer base.

February 12 -

Big data and artificial intelligence will allow banks to do more for small businesses, former SBA head Karen Mills argues.

January 30 Harvard Business School

Harvard Business School -

Small businesses short on cash can use advances from Fundbox to buy products from online suppliers.

January 25 -

With a permanent director confirmed, the agency should take steps to establish a small-business data collection rule mandated by the Dodd-Frank Act.

January 23 U.S. Chamber of Commerce

U.S. Chamber of Commerce -

The trade group hopes appropriations legislation for fiscal year 2019 will address confusion over websites being compliant with the ADA, among other concerns.

January 8 -

The objectives of a Financial Crimes Enforcement Network rule requiring financial institutions to collect “beneficial ownership” details are laudable, but the regulation can be subverted by unscrupulous customers.

December 18

-

With Brexit on the horizon, the volatility of the U.K. financial market has created an increased demand for more flexible financing among small and medium-sized enterprises. But a decade on from the 2008 financial crisis, the loans available for SMEs are still restricted by regulations on the total amount of capital that banks must hold.

December 12 -

The former head of Heritage Oaks Bancorp says she relishes a chance to reinvent Luther Burbank, a thrift that wants to make more commercial loans — a shift she has deftly orchestrated before.

December 10 -

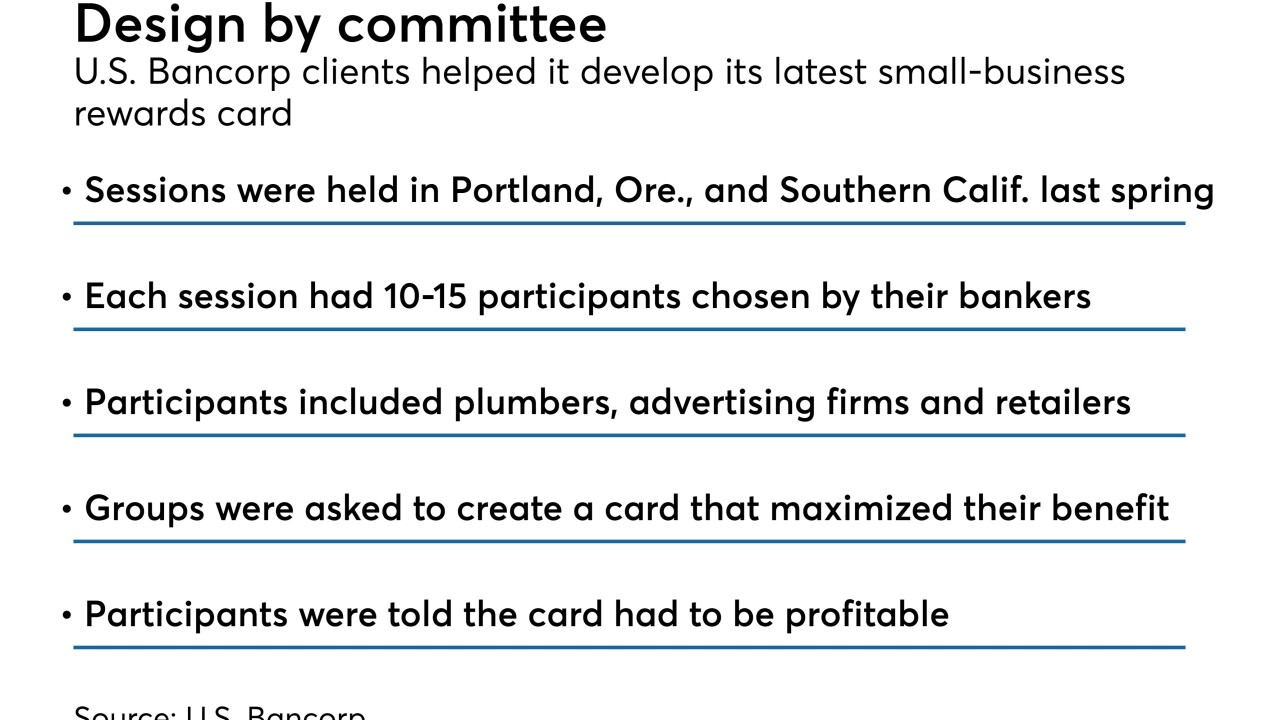

The regional bank is working with customers to help develop and launch new products, including a small-business credit card.

December 7 -

The legislation would ban legal clauses that force small-business borrowers to give up their right to court proceedings before obtaining a loan.

December 6 -

The House Financial Services Committee chairman said "so far, the United States Senate has done nothing" on a bill that passed the House with over 400 votes.

November 29 -

As the economy softens, traditional banks have an opportunity to win back market share from fintech competitors.

November 27 Oliver Wyman

Oliver Wyman -

An international move or a business expansion can bring on unexpected challenges that existing processing relationships can’t handle, according to Ralph Dangelmaier, CEO of BlueSnap.

November 26 BlueSnap

BlueSnap -

Lenders fear the agency's rule could make most poultry producers ineligible for 7(a) loans.

November 19 -

Credit unions are well positioned to serve small businesses, but they'll lose that opportunity if they're not adequately protecting those members' cash flow.

November 16 ACH Alert

ACH Alert