-

For First Foundation, the government-backed program should help address a recent CRA exam's criticism that it has "poor penetration among businesses of different revenue sizes."

September 14 -

Fundation Group, a New York-based online small-business lender, announced Tuesday that it has secured a $100 million credit facility from Goldman Sachs.

August 23 -

The Ohio company is eager to rev up SBA lending in the Windy City now that it has closed on its purchase of FirstMerit. CEO Steve Steinour also credits his company's willingness to make big upfront community commitments for a seamless approval process.

August 16 -

United Community and Wells Fargo are among the banks building platforms to lend to senior-care facilities. Demographics suggest the business should grow significantly in coming years.

August 12 -

Online alternative financing can be an efficient source of capital for small businesses, but it can also be predatory, especially to unaware and inexperienced borrowers.

August 12 Invest in Women Entrepreneurs Initiative

Invest in Women Entrepreneurs Initiative -

Small-business owners are struggling to understand the cost of loans sold by marketplace lenders. To remedy this, the industry must embrace a disclosure box that includes these five principles.

August 11 Fundera

Fundera -

The marketplace lender OnDeck Capital is sticking with its lend-and-hold strategy even though the practice contributed to a second consecutive quarterly loss.

August 8 -

Banks need to improve their use of technology designed for small-business customers soon, or risk losing them.

July 28 -

Virgin Money Holdings, the bank backed by billionaire Richard Branson, postponed plans to start lending to small businesses as Britain faces a potential economic slowdown after voting to leave the European Union.

July 26 -

In an acknowledgement that many U.S. small businesses cannot qualify for a bank loan, a federal agency that assists minority-owned firms is now partnering with a pair of online lenders.

July 20 -

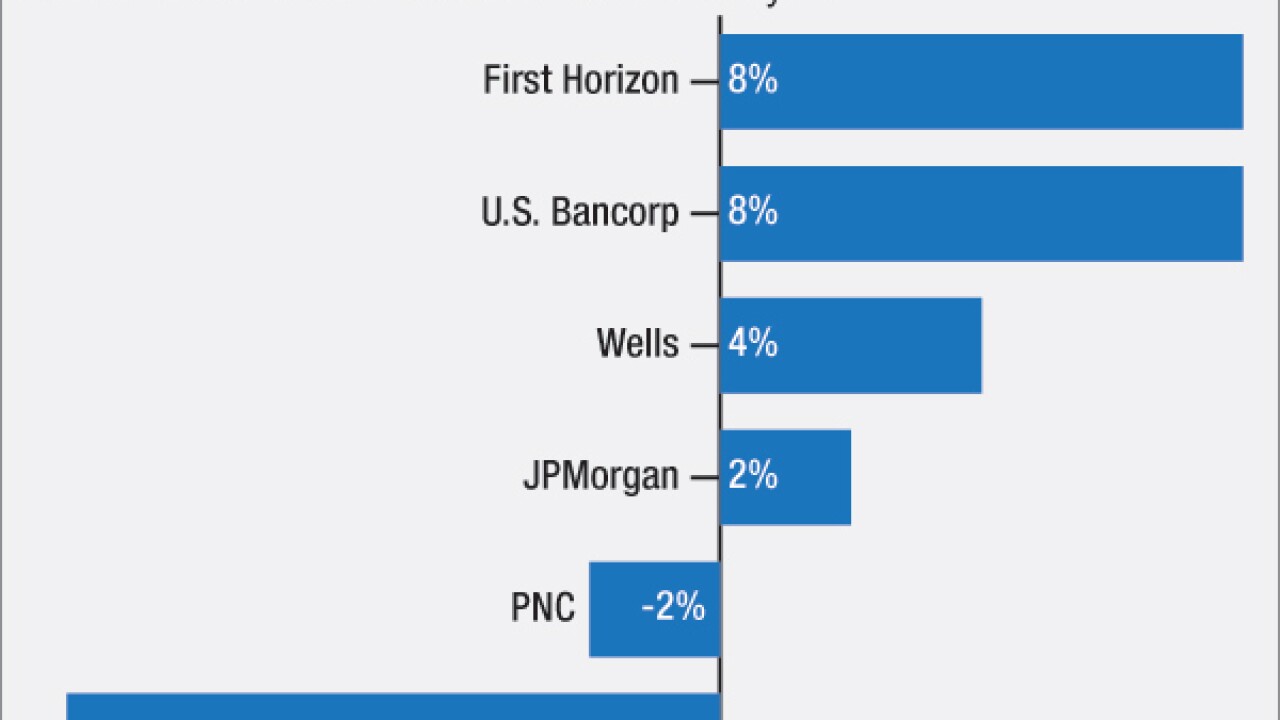

It's liable to be an uphill climb as banks try to boost revenue and hold profit steady over the rest of the year. Here's why.

July 15 -

Loans tied to franchises were often an area of concern for banks before the financial crisis. Industry growth, improved credit metrics and a need to diversify commercial loan portfolios are prompting several banks to take a second look at the business.

July 14 -

Online marketplace lenders found themselves in the congressional crosshairs Tuesday just as some lawmakers are attempting to provide the industry with sought-after reforms.

July 12 -

The $25 billion-asset company said in a press release Tuesday that BankUnited Small Business Finance is now making loans in Ohio, Washington and Wisconsin.

July 12 -

Charles Schwab Bank, BBVA Compass and Mechanics Bank are among the latest investors in a California microfinance firm that specializes in small-business lending.

July 12 -

American Express plans to debut an online loan platform for small-business clients this year, targeting territory occupied by startups like Square and On Deck Capital.

July 5 -

Berkshire Hills Bancorp is buying a bank with a national mortgage platform. The company hopes the business will provide a much-needed lift in fee income.

July 1 -

Kabbage is licensing its digital lending technology to one of Canada's largest banks, which plans to offer an online application process to small businesses.

June 22 -

A growing number of marketplace lenders and other fintech companies say they no longer use FICO scores or are using them in a limited way. The open question is whether their alternative methods will be more effective.

June 14 -

A megabank on the surface might not seem like the right fit for the financing needs of upstart craft breweries, but Bank of America's Brian Mulvaney has cooked up quite a niche business.

June 14