-

Senate Republicans plan to modify the massive fiscal package to lower maximum deductions for state and local taxes and limit the impact of a "revenge" tax.

June 17 -

Veterans of the dot-com bubble of the late '90s, the early 2000s recession, the 2008 financial crisis and COVID-19 shutdown of 2020 say the more things change, the more things stay the same.

April 7 -

Republican leaders say they are closer to a plan to extend the 2017 tax cuts and increase the debt ceiling.

March 26 -

Donald Trump vowed to boost the U.S. auto industry by making interest on car loans fully tax-deductible and renegotiating a trade deal with Mexico and Canada as he courts Michigan.

October 15 -

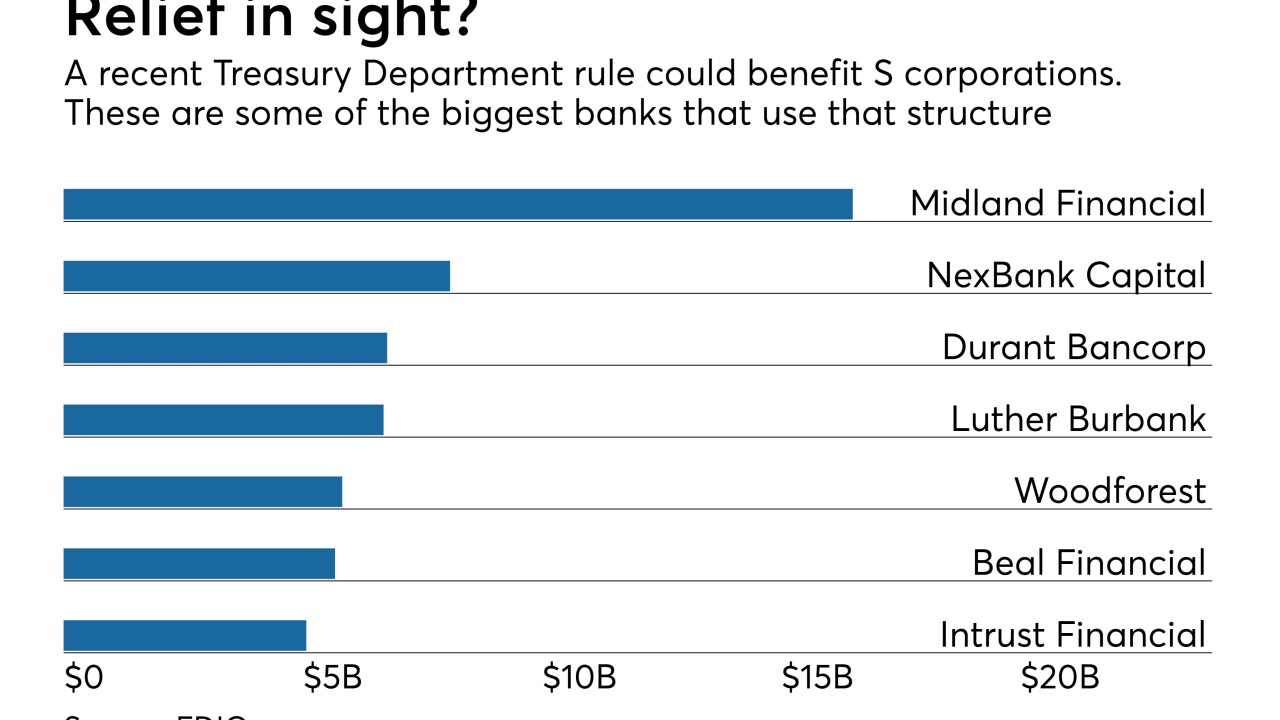

Shareholders in Subchapter S corporations will get some tax relief of their own under a new Treasury Department rule that will let them take a 20% deduction on qualified business income, which includes loan originations and sales.

February 5 -

In venturing into what's normally a province of large banks, nbkc in Kansas City, Mo., discovered innovative tax-management and other products that it could offer to its own customers or sell to other banks.

January 8 -

The itemized deduction for investment fees may have been eliminated, but clients still need guidance on paying IRA expenses. Here's what to tell them.

May 4 -

The company benefited from increases in residential and construction lending.

April 17 -

A mix of tax sweeteners and a lower cost of living has prompted banks such as MUFG Americas, Northern Trust and Bank of the West to locate corporate-level jobs in Phoenix and surrounding areas.

February 22 -

The company, which has been actively curbing growth to avoid becoming a systemically important financial institution, reported lower loan balances and reduced fee income after exiting the residential wholesale mortgage business.

January 31 -

The Arkansas company's earnings fell 52% from a year earlier, reflecting a higher provision, a revaluation of its deferred tax asset and higher costs following a series of bank acquisitions.

January 18 -

Highlights at the North Carolina bank included deposit service charges, CRE lending and wider margins, which all offset one-time costs related to tax reform.

January 18 -

The Senate approved the final tax reform plan 51-48 early Wednesday, the second-to-last obstacle before sending it to President Trump for his signature.

December 20 -

Jon Stein plans to make Betterment's robo-adviser as personalized and intelligent as the online retailer's recommendation engine.

December 18 -

The expected refund is tied to loans that investors bought when they acquired the failed BankUnited in 2009.

December 4 -

The trial of Stefan Buck was an unusual courtroom showdown in the decade-old fight by the U.S. against tax evasion aided by financial institutions in Switzerland.

November 21 -

Company’s first earnings report since the data breach also discloses lots of suits and investigations; Senate bill also calls for one-year delay in corporate tax rate cut to 20%.

November 10 -

The financial services industry has largely warmly greeted the GOP’s proposed overhaul of tax policy, yet some provisions have triggered concern and uncertainty. Here is a rundown of the key provisions and how they may impact the industry.

November 6 -

The proposed 20% corporate tax rate would benefit banks more than other industries; online lenders made nearly a third of new personal loans in the first half.

November 3 -

Banks have started reconsidering how much they are willing to pay for low-income housing tax credits.

January 12