-

Senate Republicans plan to modify the massive fiscal package to lower maximum deductions for state and local taxes and limit the impact of a "revenge" tax.

June 17 -

Veterans of the dot-com bubble of the late '90s, the early 2000s recession, the 2008 financial crisis and COVID-19 shutdown of 2020 say the more things change, the more things stay the same.

April 7 -

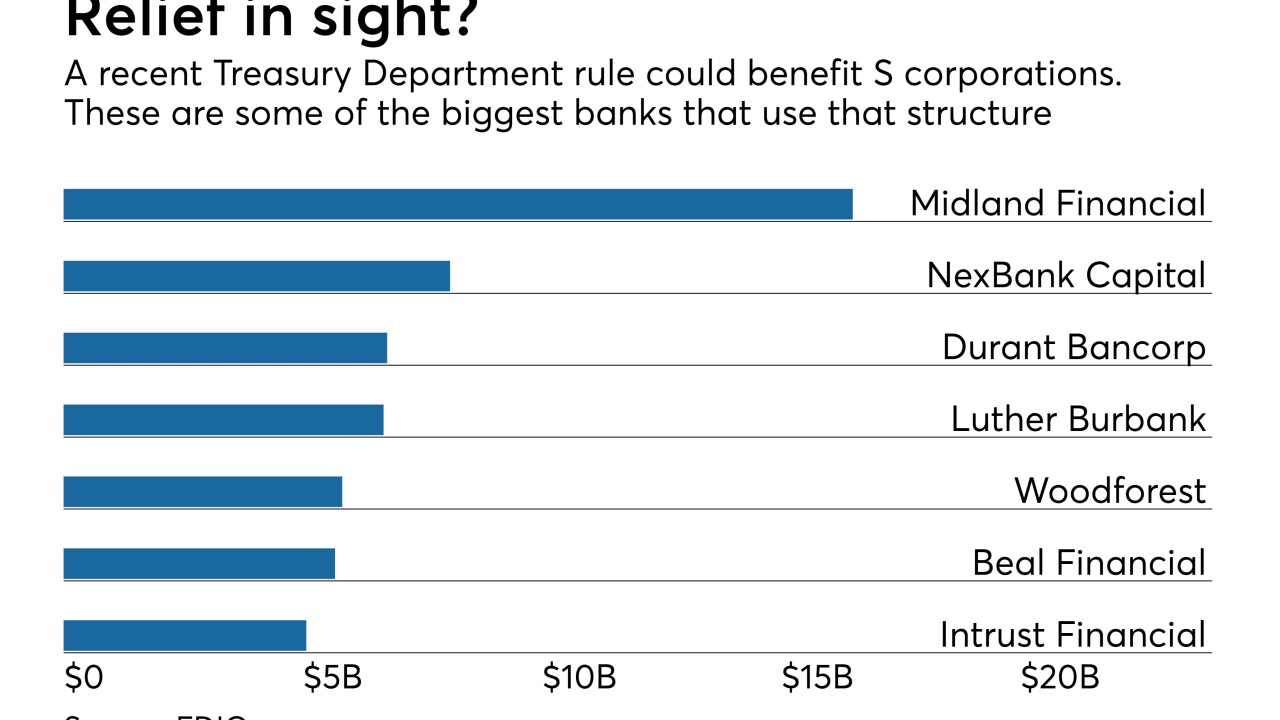

Shareholders in Subchapter S corporations will get some tax relief of their own under a new Treasury Department rule that will let them take a 20% deduction on qualified business income, which includes loan originations and sales.

February 5 -

In venturing into what's normally a province of large banks, nbkc in Kansas City, Mo., discovered innovative tax-management and other products that it could offer to its own customers or sell to other banks.

January 8 -

The itemized deduction for investment fees may have been eliminated, but clients still need guidance on paying IRA expenses. Here's what to tell them.

May 4 -

The Arkansas company's earnings fell 52% from a year earlier, reflecting a higher provision, a revaluation of its deferred tax asset and higher costs following a series of bank acquisitions.

January 18 -

Highlights at the North Carolina bank included deposit service charges, CRE lending and wider margins, which all offset one-time costs related to tax reform.

January 18 -

The Senate approved the final tax reform plan 51-48 early Wednesday, the second-to-last obstacle before sending it to President Trump for his signature.

December 20 -

Jon Stein plans to make Betterment's robo-adviser as personalized and intelligent as the online retailer's recommendation engine.

December 18 -

The expected refund is tied to loans that investors bought when they acquired the failed BankUnited in 2009.

December 4