-

A special committee in the state Senate has recommended not to move forward on a proposed bill to tax credit unions above a certain asset threshold.

October 30 -

Amid concern that an economic downturn is approaching, Greg Carmichael said that banks need to focus on credit quality and not worry about expanding their balance sheets.

October 22 -

A study commissioned by the Florida Bankers Association found that 70% of participants supported Congress requiring CUs with at least $500 million in assets to pay income taxes.

October 18 -

One bill would tax credit unions in the Sunflower State with at least $100 million in assets.

October 8 -

Readers react to a regulator's promise to reduce regulation that hinders innovation, Sen. Elizabeth Warren's plan to impose heavier taxes on lobbying groups, Freddie Mac's exploration into AI and more.

October 3 -

Sen. Thom Tillis of North Carolina called for the panel to hold a hearing on what he termed the danger that the Federal Reserve will meddle in the 2020 presidential election.

August 28 -

Competition for deposits is tight, the outlook for loan demand is uncertain, and regulatory relief is slow-moving. Yet community bankers are feeling better about the economy than they have in two years, a Promontory Interfinancial Network survey found.

August 19 -

China's decision to stop buying U.S. soybeans and let its currency depreciate raised the prospect of further interest rate cuts. That hurt banks slightly more than the rest of the market on what was a bad day for all equities.

August 5 -

The president said that European Central Bank President Mario Draghi would do a better job overseeing monetary policy in the U.S. than Fed Chairman Jerome Powell.

June 26 -

The bipartisan proposal aims to renew banks' interest in low-income housing tax credits and bring more lower-priced homes to markets that badly need them.

June 18 -

CEO Greg Carmichael said Wednesday that online-only banks "aren't relationship-based" and that Fifth Third would stick to its plan of attracting new depositors by selectively expanding into new markets.

June 12 -

Lenders are turning to the Farm Service Agency to backstop more loans as their Midwestern customers are beset by flooding in addition to the U.S. trade war with China and volatile crop prices. Can the FSA meet the increased demand?

June 10 -

Despite tension between the U.S. and trading partners, bank are doing booming business in financing cross-border commerce; some Republican lawmakers are getting antsy at the pace of rollbacks for bank regulations, and are pushing regulators for a sense of urgency.

June 10 -

As credit unions buy up community banks, policymakers should take another look at ending the industry’s tax exemption and regulatory breaks.

June 7

-

The merging banks, whose new headquarters would be Charlotte, N.C., will each double their charitable giving over the next three years in Atlanta and Winston-Salem, N.C.

June 5 - cuj bulletin lead

The Federal Communications Commission is expected to consider changes that would allow consumers to block calls from numbers not on their contacts list while the House should vote to extend the National Flood Insurance Program.

June 3 -

A former employee from a New York credit union pleaded guilty to theft and tax evasion while another was accused of falsifying records.

May 31 -

One credit union economist says tit-for-tat on tariffs could slow economic growth but will not result in an economic downturn.

May 24 -

Banks would be better able to comply with anti-money-laundering laws if all 50 states collected information on the owners of new corporations and published it in a national database, Comptroller Joseph Otting said Monday.

May 20 -

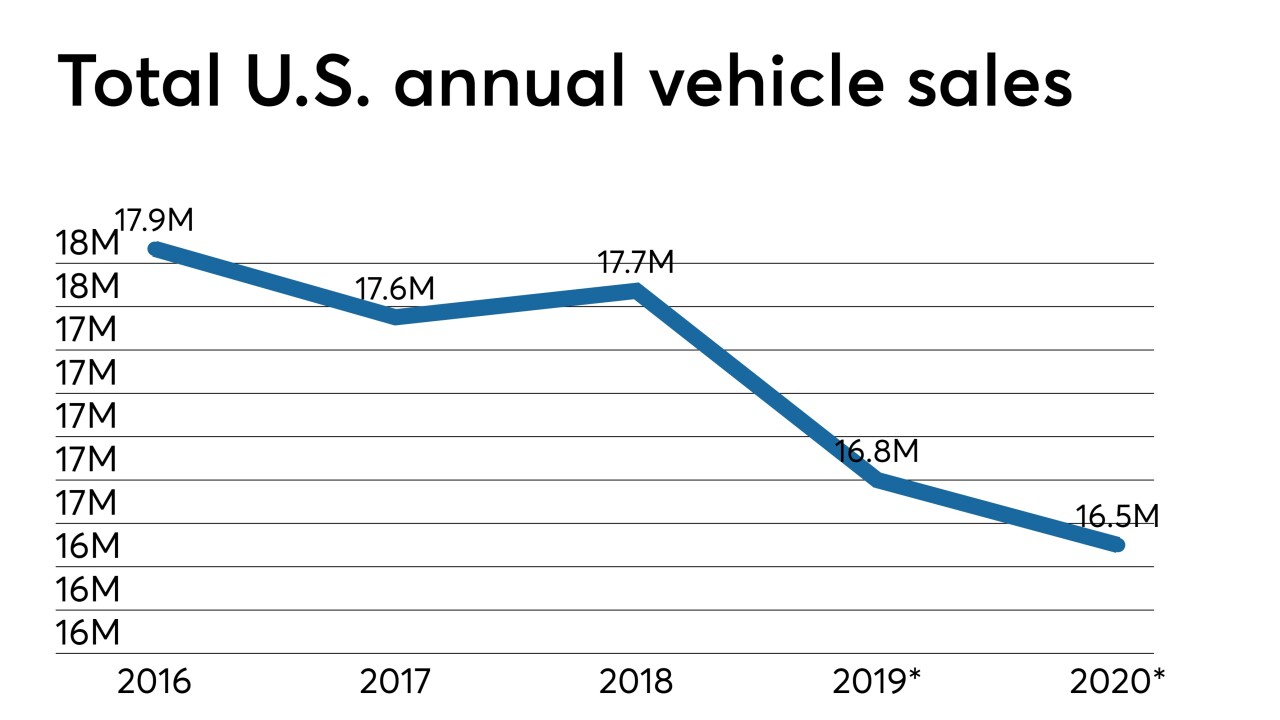

Two economists speaking during CU Direct's recent Drive conference in Las Vegas offered predictions on how a variety of economic factors could impact credit union auto lending portfolios in the not-too-distant future.

May 20