-

One credit union economist says tit-for-tat on tariffs could slow economic growth but will not result in an economic downturn.

May 24 -

The Senate has confirmed a new president and two board members, giving the U.S. Export-Import Bank the ability to approve loan guarantees of more than $10 million for the first time since 2015.

May 8 -

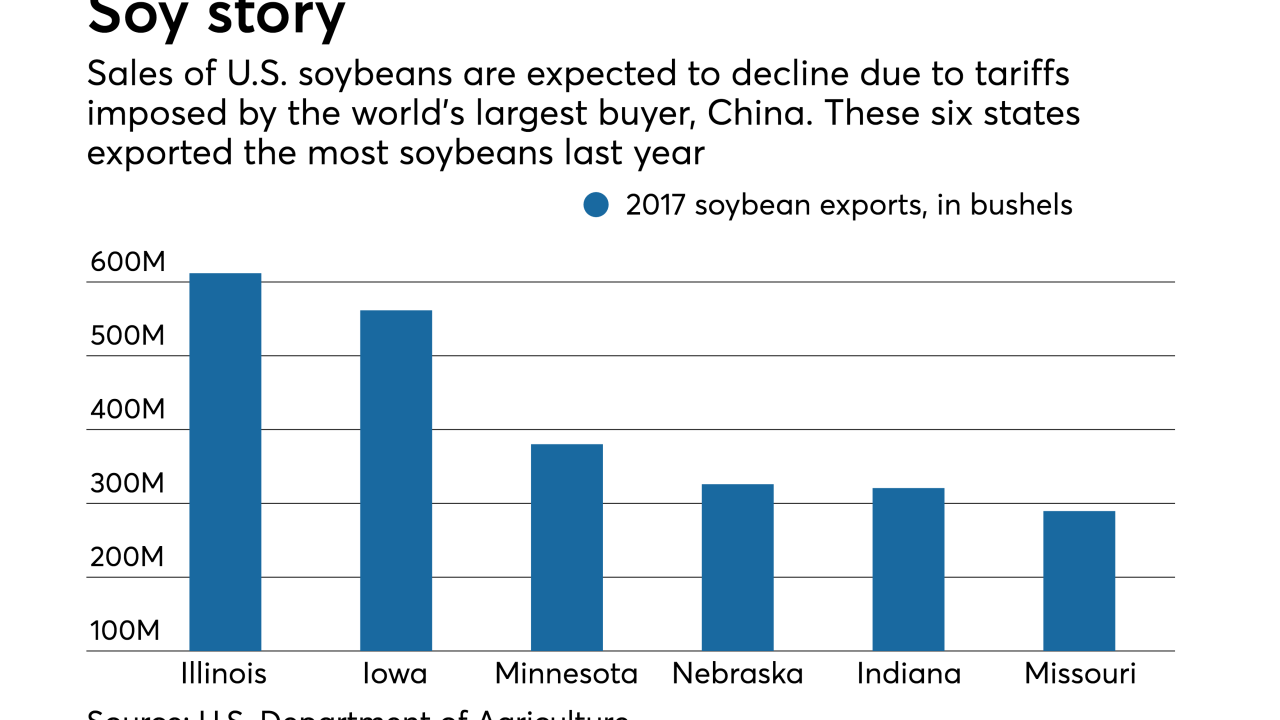

Can farmers — and the banks that lend to them — survive Trump's trade war?

November 5 -

What keeps execs up at night in the payments, retail and banking industries? Quite a lot, including disruption from tech giants and competition from foreign rivals.

October 29 -

From Democrats winning control of Congress to an escalating trade war and technology companies applying for a fintech charter, there are plenty of scary prospects facing the industry.

October 28 -

Rising tariffs are rapidly increasing the cost of building materials, putting banks at risk.

September 10 Contract Simply

Contract Simply -

Talk of a trade war has loomed large for months, but some credit unions may not be feeling the impact yet. Analysts say be patient – you will.

August 13 -

If President Trump’s tariffs on steel and other products stay in place long, big U.S. importers would be hurt and pass on the pain to their midsize and small-business suppliers — which are the bread and butter of commercial lending.

August 3 -

It's imperative that bank executives consider how the country’s trade war could hit their bottom lines.

July 25 MRV Associates

MRV Associates -

Price competition on deposits may finally force the largest banks to pay up, and consumers’ aggressive use of rewards and promotional rates is weighing on card income. And then there are those tariff fights that could hurt global clients.

July 13