-

If President Trump’s tariffs on steel and other products stay in place long, big U.S. importers would be hurt and pass on the pain to their midsize and small-business suppliers — which are the bread and butter of commercial lending.

August 3 -

It's imperative that bank executives consider how the country’s trade war could hit their bottom lines.

July 25 MRV Associates

MRV Associates -

Price competition on deposits may finally force the largest banks to pay up, and consumers’ aggressive use of rewards and promotional rates is weighing on card income. And then there are those tariff fights that could hurt global clients.

July 13 -

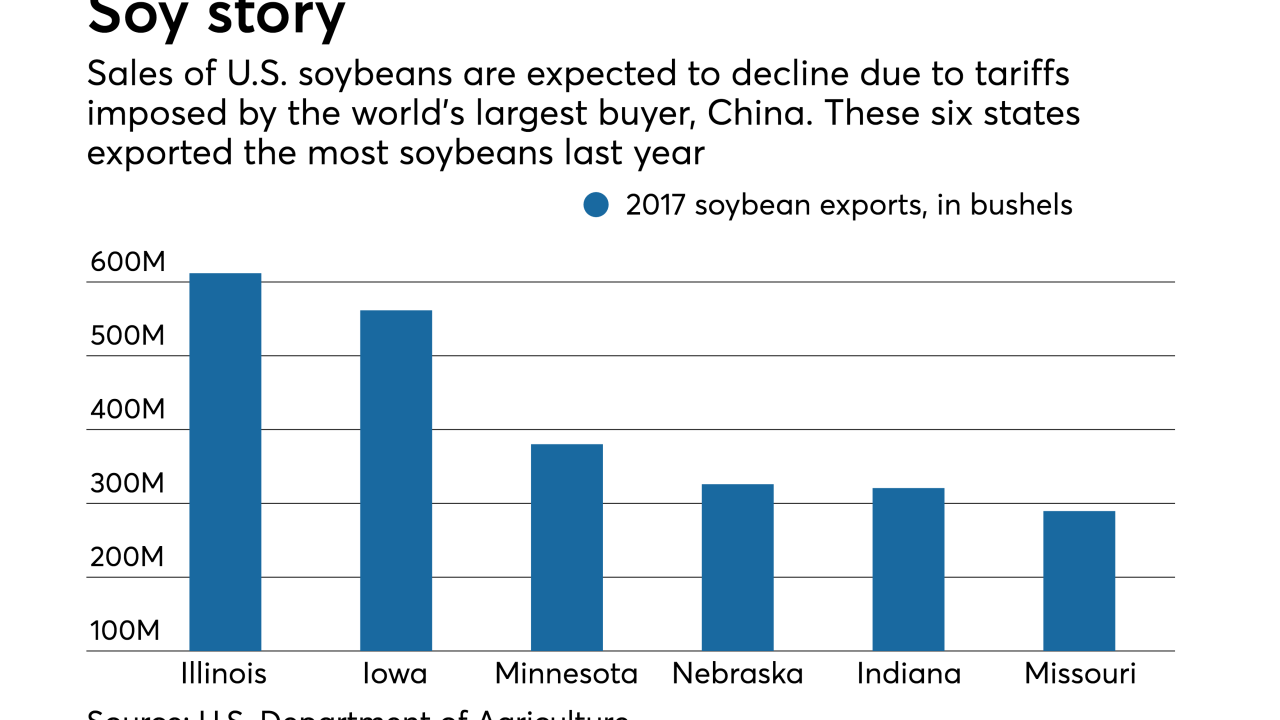

Banks are adjusting loan terms, making use of federal loan guarantees and working with farmers to find new markets, all in an effort to mitigate the damage from a likely drop in soybean exports.

July 11 -

President Trump is expected to announce as early as Thursday morning that he has selected Larry Kudlow, the host of CNBC's "The Kudlow Report," to replace Gary Cohn as head of the National Economic Council, according to multiple media reports.

March 14 -

As head of the National Economic Council, Gary Cohn played a key role in helping guide the Trump administration on its financial services policy, including regulatory relief and housing finance reform. Institutions are anxiously watching to see who President Trump picks as Cohn's replacement.

March 11 -

Deposit prices are starting to rise, deposit growth is slowing, commercial loan growth remains tepid (with some exceptions) and concerns are mounting about the economic toll of U.S. trade policy, bank executives said just a few weeks ahead of the end of the quarter.

March 6 -

Turmoil at the Export-Import Bank, a possible trade war with China and a potential retreat from the North American Free Trade Agreement all add up to high anxiety for bankers in the business of financing U.S. exports.

February 13 -

For remaking East West Bank from a small savings institution into a $36.3 billion-asset player with a seat on the front lines of U.S.-China relations — all while churning out record earnings year after year — American Banker is recognizing Ng for being a "Consistent Performer" as part of our 2017 Banker of the Year awards.

November 28 -

It's been a decent year for banks, especially given the industry's return on assets hit a 10-year high. But there are signs it might not last. With Halloween near, here is a look at some potentially frightening developments that could keep bankers up at night.

October 29 -

The California lender, which specializes in trade finance, reported strong growth in commercial and other lending categories last quarter, and it urged the Trump administration to seek fair trade deals with China.

July 20 -

A new tariff on Canadian lumber threatens to further disrupt homebuilding at a time when lenders are increasingly concerned about a purchase mortgage resurgence that has failed to materialize.

June 1 -

Community banks, which could be the hardest hit if economic tensions between the U.S. and Mexico escalate into a tariff battle, are urging policymakers to refrain from rash action, and big banks are already trimming exposures.

March 22 -

The president’s vow to impose a 20% tax on Mexican imports could make life harder for the Citigroup-owned unit, which is Mexico’s second-largest bank.

February 3 -

Bank CEOs have recently raised red flags about the president's protectionist rhetoric, including his proposals to tax imports from China and Mexico. The concerns have arisen as import-export financing is already facing headwinds.

February 1