-

While equity prices drop an average 5% at big banks, bosses express confidence in the U.S. economy; the bank appoints new managers in payments, consumer banking and marketing.

December 5 -

Few firms have been able to blend predictive virtual assistants, geolocation, data analytics and other cutting-edge technology into apps like TD Bank, which has more mobile users in Canada than anyone in finance.

December 3 -

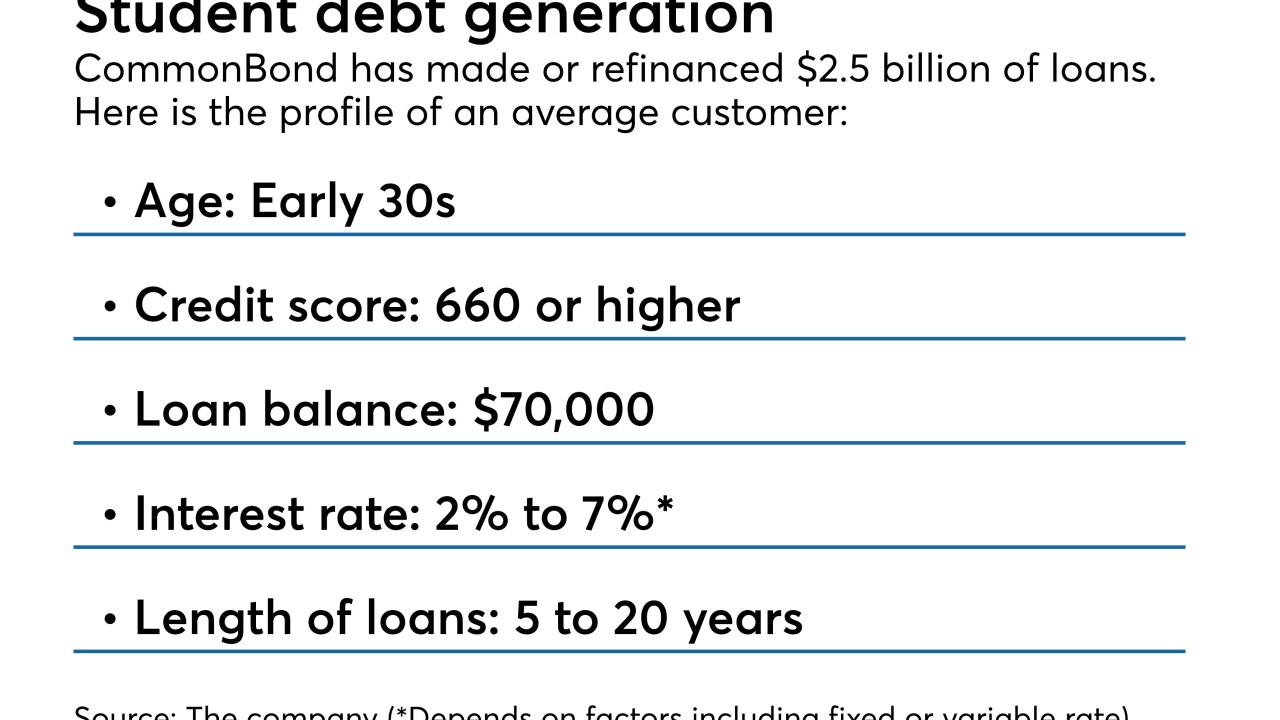

The Midwest regional recently announced a referral partnership with the fintech lender CommonBond. By offering customers an option to refinance student loans at more favorable terms, the bank is hoping to cultivate their loyalty.

November 30 -

Quicken and U.S. Bank are launching a co-branded contactless credit card that will integrate with Quicken's personal finance software and mobile app.

November 29 -

U.S. earnings climbed 44% from a year earlier, aided by lower taxes, a widening net interest margin, record contributions from its stake in TD Ameritrade.

November 29 -

The latest personal financial management tools provide a more passive approach for customers that analyzes patterns and suggest ways to fix issues.

November 28 -

As the industry relies more on digital products, credit unions are looking for ways to update their financial literacy programs to become more interactive and reach a broader audience.

November 28 -

Through timely investments, opportunistic dealmaking and a laser focus on employee engagement, Turner has Wilmington, Del.-based WSFS on the cusp of becoming a regional power.

November 27 -

Nearly all banks need more fee income, and many have extra cash for investing in growth. Some have started buying up wealth management firms, while others have decided to pare back and specialize.

November 26 -

It started with financial literacy classes, but now Chelsea Groton Bank in Connecticut is offering crafts and other so-called lifestyle courses, all in an effort to connect with the public and drive traffic to its branches.

November 20