-

Just over 40% of respondents with private student loans said they had worked with their lenders to come up with a plan for reduced payments.

April 28 -

The Los Angeles regional bank recorded the $1.5 billion noncash charge after its stock price ended March below its tangible book value.

April 21 -

As universities move classes online, there are signs enrollment could be down in the coming academic year. That could have a major impact on credit unions’ private student loan portfolios.

April 15 -

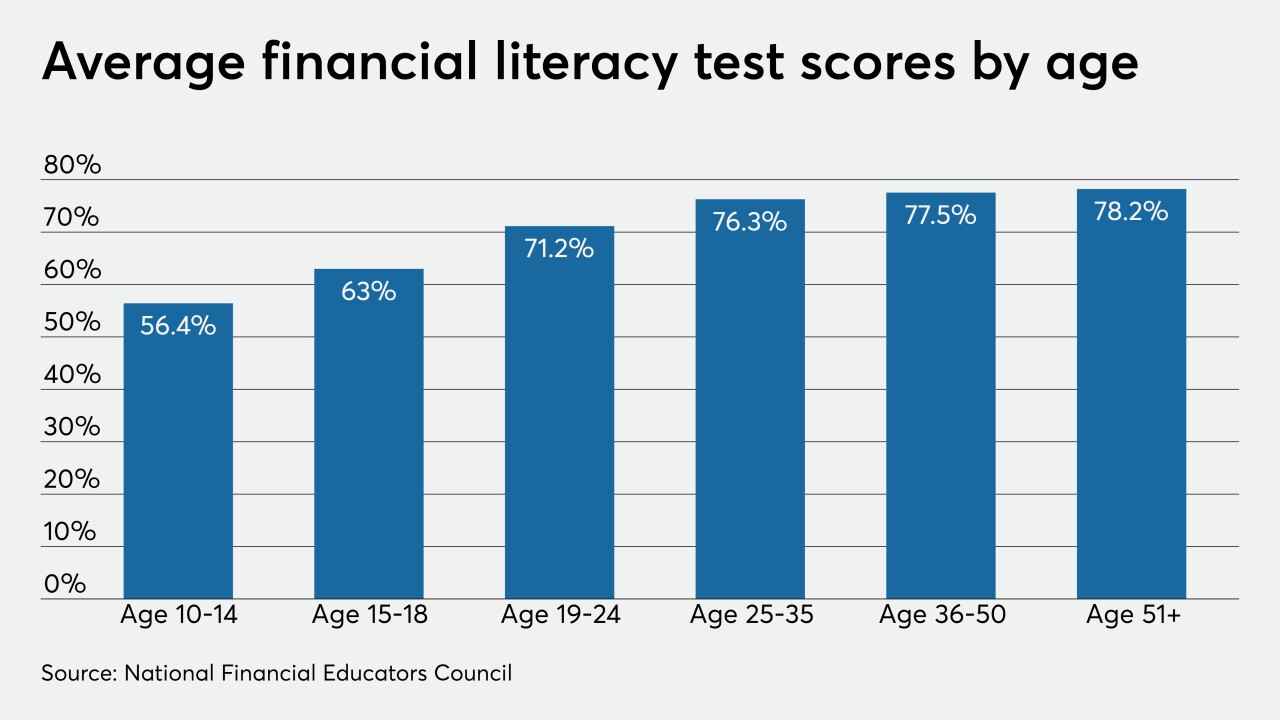

Older Americans also did fairly poorly by getting an average score equal to a C plus.

April 8 -

Requiring banks to test themselves is likely to be a waste of time in the current crisis, says a former Senate Banking counsel.

April 3 Corporations and society initiative at Stanford Graduate School of Business

Corporations and society initiative at Stanford Graduate School of Business -

The regulator will provide $4 million in loans and $800,000 in grants so institutions can assist their communities during the pandemic.

March 31 -

They are under less pressure from policymakers to halt repurchase plans, but some have already hit the brakes and others may unofficially do so if the pandemic worsens.

March 16 -

Sen. Sherrod Brown of Ohio, the top Democrat on the Banking Committee, said financial institutions "need to be investing in their communities right now, not investing in their CEOs’ stock portfolios.”

March 12 -

Investors worry the drop in crude prices could spark a rash of defaults; the bank denies it opened accounts without customer permission to meet sales quotas.

March 10 -

Concerns about the economic fallout of coronavirus have mostly focused on supply chain disruptions. But fears are growing that weakening consumer demand could spark a recession.

March 9