-

Even with another annual surge of over 20%, the pace of home-price growth eased in May and experts anticipate even further moderation over the next year.

July 5 -

Risky loan applications had been on the rise for more than a year, according to the analytics firm CoreLogic. Now that activity is slowing down, lenders face a higher risk of fraud, and many could be ill-equipped to handle it.

June 3 -

Former FHFA director Mark Calabria said the mortgage market was a “ticking time bomb” on track for a 2008-like crisis. Other experts foresee a tamer end to the bull housing market.

May 23 -

Democrats cited the increasing share of home purchases by Wall Street firms while Republicans pointed to rising conforming loan limits and other measures by Fannie Mae and Freddie Mac during the Senate Banking, Housing and Urban Affairs committee hearing.

February 10 -

The standards, if finalized, could shed light on how Fannie Mae and Freddie Mac are complying with the Federal Housing Finance Agency's new capital framework.

October 27 -

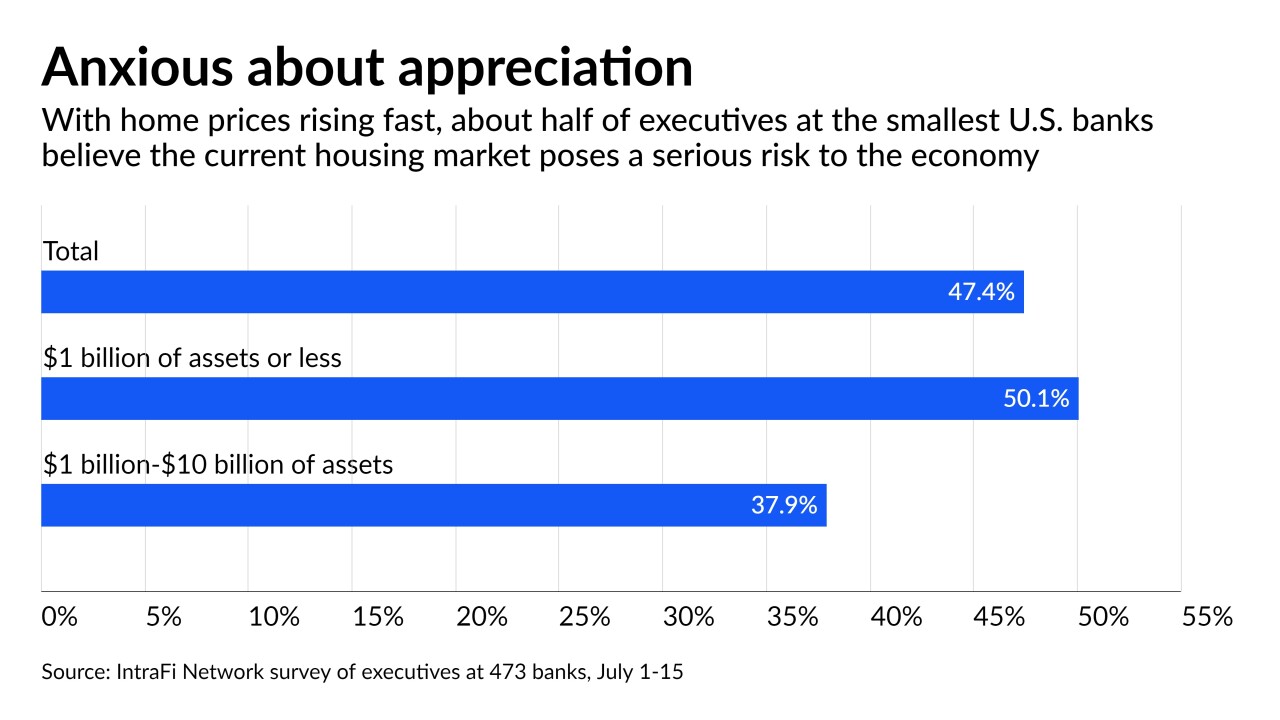

The very smallest banks, whose numbers shrank during the financial crisis, were most likely to express concern that the housing market will imperil the broader economy.

July 27 -

Federal Reserve Chair Jerome Powell is dismissing claims that loose monetary policy has led to rising home values and shrinking inventory and insists that the market is buoyed by creditworthy borrowers and investors.

April 28 -

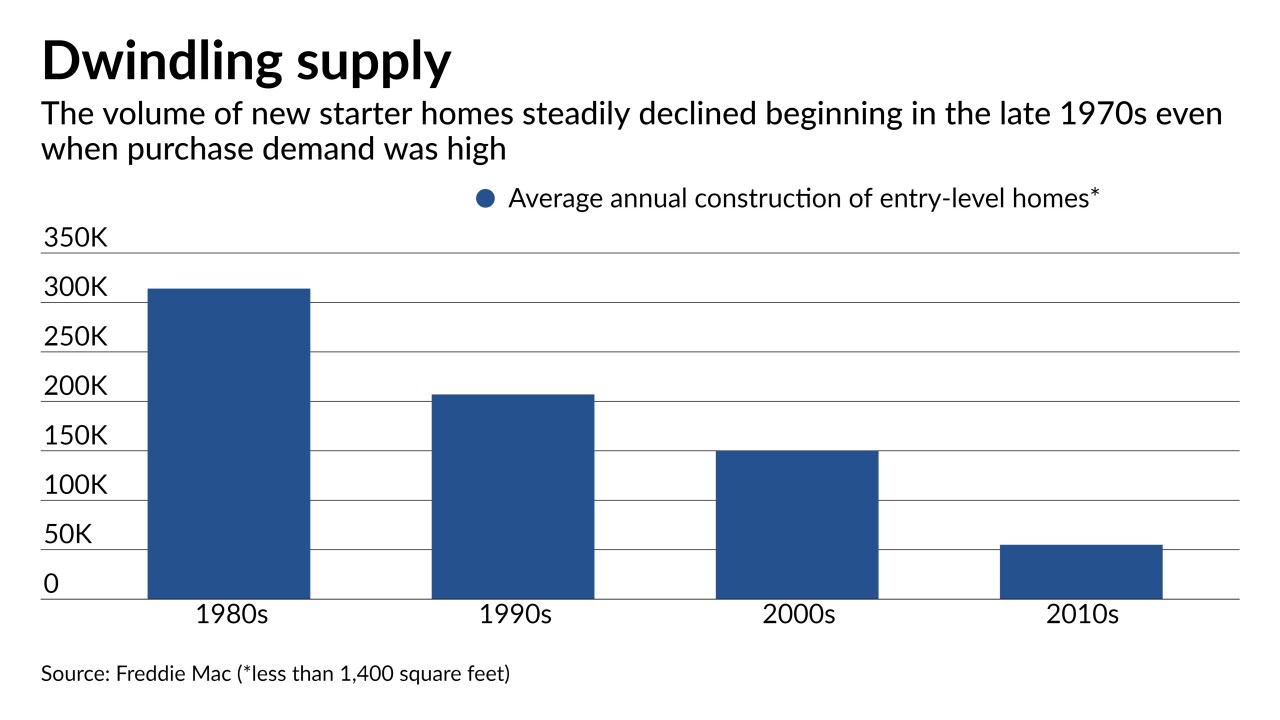

The end of the refinancing boom and impending rise in rates are not the only challenges lenders face. As one observer put it, they "can't make loans on homes that don't exist."

April 27 -

The reduction currently under consideration by the Biden Administration would lead to even faster home price appreciation, especially in areas with moderate FHA presence, says Tobias Peter, the American Enterprise Institute’s director of housing research.

February 12 American Enterprise Institute’s Housing Center

American Enterprise Institute’s Housing Center -

Default risks soar in minority neighborhoods during challenging economic times because, data shows, homes there are overpriced relative to incomes. Zoning and other changes could make loans more affordable by boosting housing stock and driving down prices.

November 25 American Enterprise Institute’s Housing Center

American Enterprise Institute’s Housing Center