-

Proposed legislation that encourages utility companies to report positive payment data is just one way to improve underserved consumers' access to high-quality credit products they can truly afford.

November 7 -

Experian is feeling the heat in the wake of a hacking at Abilene Telco Federal Credit Union that wound up exposing data at the credit reporting agency, leading Experian to defend its security protocols.

November 1 -

We need a system in which credit bureaus are required to sell consumer data at a uniform price to any company with permission to access it, instead of pricing out perceived competitive threats or withholding the information.

June 15

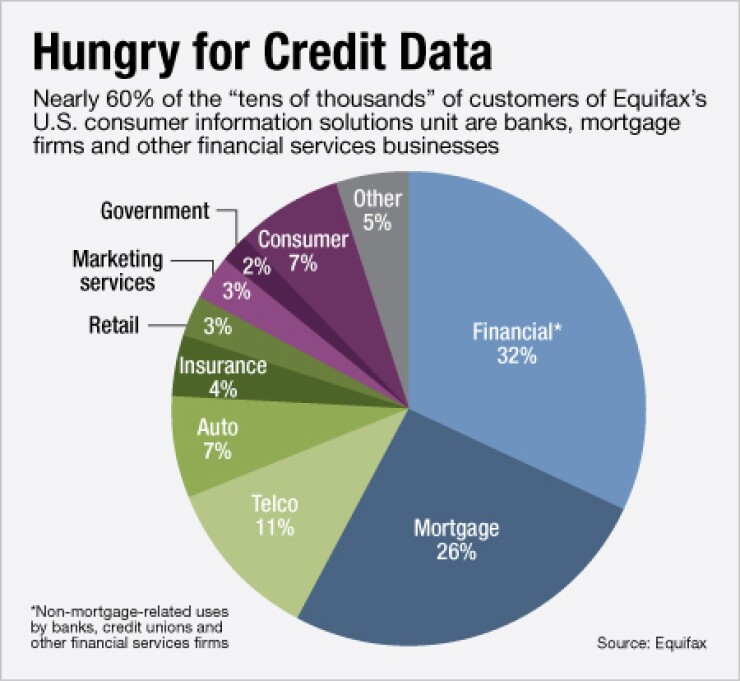

Bankers in the central U.S. may soon try to renegotiate the price they pay Equifax (EFX) to learn the creditworthiness of borrowers.

The opportunity came when the Atlanta credit bureau announced Monday that it would pay $1 billion in cash to

Computer Sciences owns credit files in 15 states, including Illinois and Texas, covering a fifth of the U.S. population. It has partnered with Equifax since 1988 to provide that data to banks, mortgage companies and others interested in how people manage their debts.

Computer Sciences' credit division was one of the last independent credit reporting agencies. Its acquisition by Equifax, which is expected to close this month, eliminates a middleman, and savvy banks and other financials may see this as a chance to ratchet down the price of reports.

"When someone buys a consumer credit report in one these 15 states, they are paying essentially two companies right now, Equifax and CSC," said John Ulzheimer, president of consumer education for SmartCredit.com and a former Equifax executive. "The local banks and credit unions may not know what has transpired, but the big boys, who buy tens of millions of products a year, may see this as an opportunity to beat them up on price a bit."

Equifax says its customers should expect things to stay the same - both in the data and the price - for now.

"All of the processes are basically going to be the same as they were before," said John Hartman, senior vice president of corporate development for Equifax. "Most of the banks have contracts in place and those will continue to be honored."

Equifax already maintains a database of Computer Sciences' credit files and incurs all of the storage, transaction and technology expenses, while Computer Sciences had a sales force for the services, Carter Malloy, an analyst with Stephens, said in a research note Monday.

Malloy estimated that Equifax receives 25% of the business' net annual revenue, while Computer Sciences received the remaining 75%. Equifax is expecting additional revenues of $115 million to $125 million annually after the acquisition.

The deal was years in the making, and is a remnant of a bygone era. Equifax, along with TransUnion and Experian, has consolidated the credit bureau industry through acquisitions of small shops across the country.

"This was our last one to roll up and it happens to be a big one," Hartman says. "But some were bureaus that tracked half a city. … We gradually bought up the smaller affiliate bureaus."

The two firms have long had an option in their contract that would allow either to initiate a sale. If the option had been exercised at Sept. 30, the price range would have been $750 million to $1 billion, based on its internal analysis and current market conditions, Equifax had said in its third-quarter report with the Securities and Exchange Commission.

Despite the option, both companies said the acquisition was negotiated.

One bank said it is comfortable with the deal.

"We expect a continuation of the same good service we have had with CSC for the past 25 years when we begin working directly with Equifax. We don't expect any changes," said Genny Rakowitz, executive vice president of central credit approval for Frost Bank, in an email.

The deal's biggest impact on banks could be an eventual sale of Equifax, observers say. Any potential buyers who may have been tentative over the looming Computer Sciences options now have more certainty.

"It may check a box for possible buyers. Having said that, Equifax has been around since the late 1800s, so there has been ample opportunity to sell if they wanted to," Ulzheimer says. "Now that they have full ownership of all the credit reports, they might be more attractive."

Malloy also sees Equifax as a potential target, but says the Computer Sciences deal was never an impediment.

"They've always been attractive," Malloy says. "The put was never anything scary because of the potential accretion."

Ulzheimer adds the potential buyers are hard to predict, and could include international players.

Hartman said that wasn't the motivation for the deal, but said the deal makes the company leaner.

"We had this partnership for 25 years, and it worked very, very well. However, we owned the data in all of the other 35 states, with this carve out in 15 states. There are operational efficiencies in having all 50 states treated the same way," Hartman says. "I don't want to draw any conclusions for any hypothetical purchase, but this brings much greater operational efficiency."