Two top Citi consumer banking executives to depart

(Full story

JPMorgan Chase to offer online loans to credit card customers

(Full story

JPMorgan's Dimon: Square innovated where we should have

(Full story

House Financial Services Committee to examine Wells Fargo, CFPB

(Full story

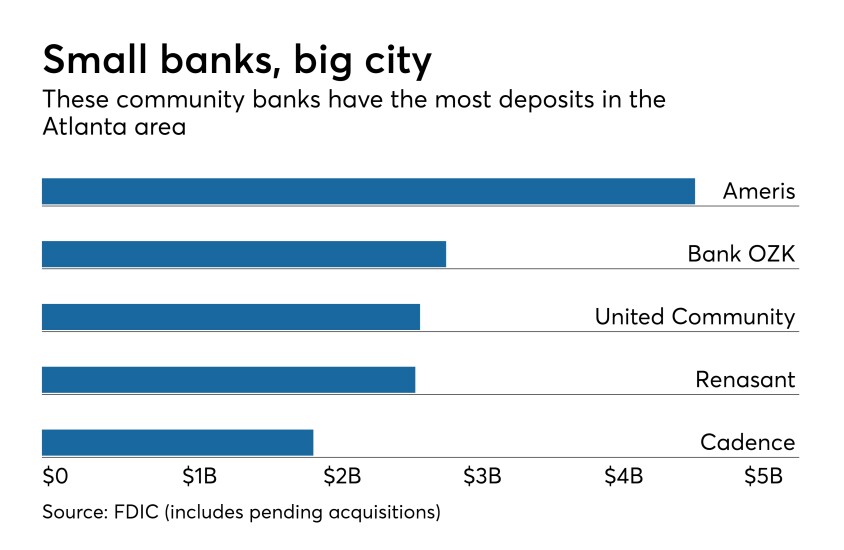

BB&T-SunTrust deal has Atlanta banks licking their chops

(Full story

Who will regulate BB&T-SunTrust?

(Full story

This company simplifies bank switching. And banks pay for it.

(Full story

Walmart teams with Affirm to offer point-of-sale loans

(Full story

Why this small bank created a separate, digital-first brand

(Full story

Citi bracing for hit to credit card sales from Sears' reorganization

(Full story