Verdict coming on OCC's supervision of Wells Fargo

(Full story

TD Bank names new consumer products chief

(Full story

Western Union alum starts digital bank for low-income Americans

(Full story

CenterState, South State plan $3.2B merger

(Full story

CFPB at long last defines enigmatic 'abusive' standard

(Full story

Banks find a cheat code to catch up on digital: Merging

(Full story

CFPB sues Citizens over card fraud claims, but bank pledges to fight

(Full story

Banks that can't ride the M&A wave

(Full story

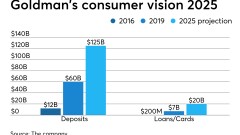

Inside Goldman Sachs' big plans in digital consumer banking

(Full story

Amex names ex-Comerica executive to its board

(Full story