-

The acting comptroller of the currency, appointed by the Biden administration, signaled that the regulation meant to provide legal clarity about the secondary market is safe for the time being.

June 2 -

The maker of software that helps banks offer "buy now, pay later" loans at the point of sale says its latest funding round has pushed it into unicorn status.

May 18 -

Some worry the Senate’s rejection of the OCC rule hampers efforts to clarify legal standards for banks selling loans to fintechs.

May 12 -

The Chicago fintech, which currently offers personal loans and credit cards, will add deposit accounts with the acquisition of Level.

April 8 -

Banks weren't involved in the trading frenzy, but some observers say the regulatory response should address risks to all financial institutions.

February 4 -

The online lender, which raised $240 million, wants to take its artificial intelligence technology for evaluating borrowers to the next level and expand its partnerships with banks, its CEO says.

December 20 -

Scammers may have had more success at duping fintechs than banks in obtaining Paycheck Protection Program loans. But there are reasons for this apparent disparity.

November 11 -

The San Francisco fintech, which is buying Radius Bancorp, will discontinue peer-to-peer lending and instead offer new products, like high-yield savings accounts, to its retail investors.

October 8 -

Kabbage co-founder Kathryn Petralia, whose company is being sold to American Express, discusses government and financial-sector lifelines she says could help businesses that have been hit hardest by the pandemic.

September 29 -

Fintech lenders that reported a surge in missed payments at the start of the pandemic have seen credit quality rebound substantially since. But credit performance could still deteriorate if high unemployment persists and Congress fails to enact more relief measures.

September 8 -

The agreement between Colorado authorities, marketplace lenders and banks offers a way to structure partnerships without triggering the wrath of state regulators.

September 3 Hunton Andrews Kurth LLP

Hunton Andrews Kurth LLP -

The agreement between Colorado authorities, marketplace lenders and banks offers a way to structure partnerships without triggering the wrath of state regulators.

August 31 Hunton Andrews Kurth LLP

Hunton Andrews Kurth LLP -

The former SoFi chief’s latest startup, Figure, has created what it says is a transparent marketplace for buying and selling assets. Some banks have embraced the technology, but other blockchain projects have stalled because lenders don't want rivals to see their data.

August 25 -

A group of eight Attorneys General filed suit against an FDIC final rule related to ‘rent-a-bank’ partnerships, mirroring a similar suit filed against the Office of the Comptroller of the Currency last month.

August 20 -

American Express isn't acquiring any loans in its deal for the online small-business lender. Here's what it is getting.

August 19 -

American Express isn't acquiring any loans in its deal for the online small-business lender. Here's what it is getting.

August 18 -

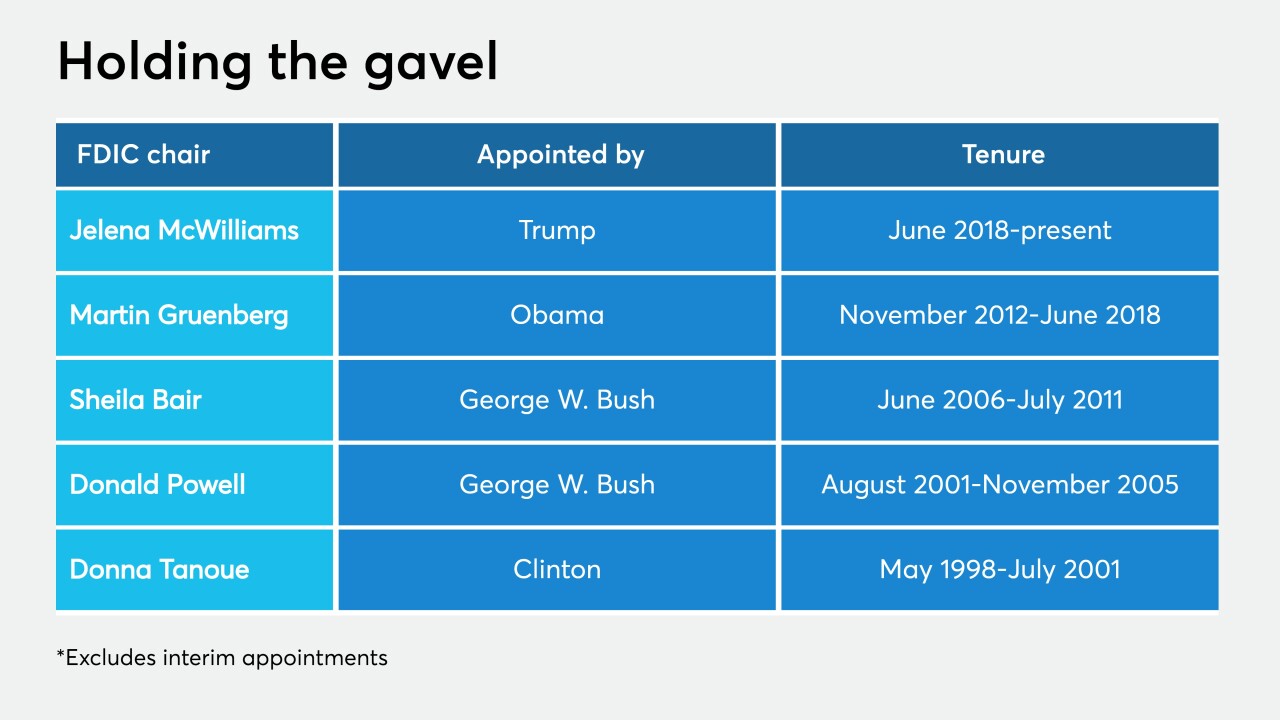

Jelena McWilliams's term as FDIC chair expires in 2023, and she cannot be removed by an incoming president. But if Joe Biden prevails, he may ask her to stay — and if she does, governing a Democratic-majority board would be a very different proposition.

August 18 -

Theorem is marketing its first-ever securitization of unsecured loans. It uses machine-learning technology to gauge the risk of default, a growing concern during the pandemic recession.

August 11 -

The e-commerce site and online lender have teamed up to let eBay sellers borrow up to $25,000.

August 5 -

The Conference of State Bank Supervisors, banking law scholars and consumer advocacy organizations filed amicus briefs siding with the New York State Department of Financial Services in its court battle with the federal regulator.

July 31