Some Citigroup customers in New York can open ATM vestibules with their phones. Bank of America and JPMorgan Chase customers can retrieve cash more quickly from ATMs using codes generated on their phones. Apple users will soon be able to use their Apple Pay on their iPhones to complete purchases made on their computers.

Welcome to the future of mobile banking, where smartphones begin to make the transition from being a way for people to bank on the go to being the nucleus of banking.

"Mobile is not just a channel anymore — it is becoming the heart of the relationship," Steve Ellis, head of the innovation group at Wells Fargo, said in an interview this week. Similarly, Cathy Bessant, chief operations and technology officer at Bank of America, said last month that "

-

Bluetooth beacons small night-light-sized devices that can communicate with a mobile app as shoppers move throughout a store may have the same potential for bank branches as they do for megaretailers like Target.

March 14 -

Citigroup is testing Bluetooth beacon technology in a pilot that gives customers cardless access to branch ATMs after business hours, among other services.

May 12 -

Despite the rise of digital banking, most people still look to physical channels when opening accounts. That's partly due to consumer preference, but banks have a long way to go to make the digital sales experience smooth.

February 17

For much of the industry, this type of development is likely a far-off future. After all, many banks are still trying to master basic mobile banking. And for some, it is perhaps too much of a theoretical play right now given the still relatively low adoption rate of mobile banking.

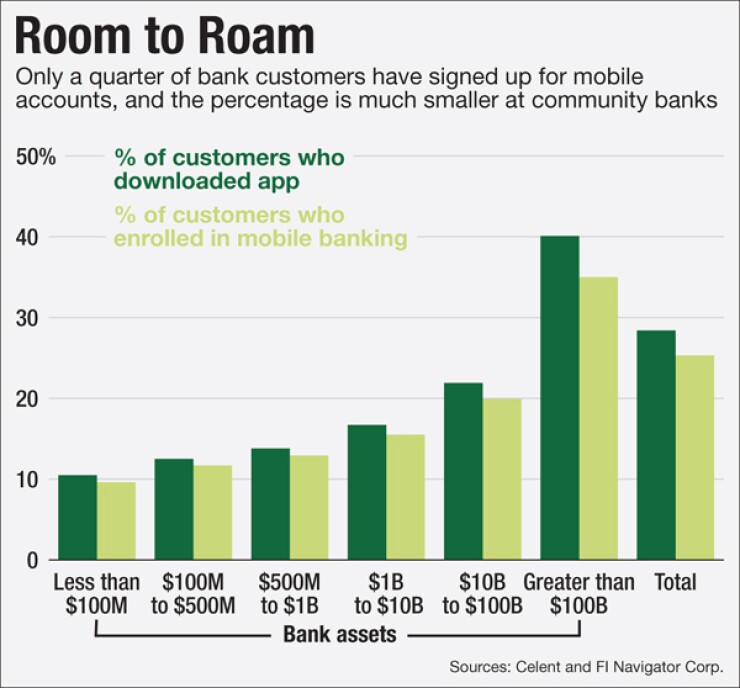

"If you look at customer utilization of mobile banking and express it in terms of what percentage of retail banking customers are active mobile banking users, it's barely 20%," said Bob Meara, a senior analyst at Celent.

That figure drops to about 10% for banks with less than $1 billion in assets, but rises to about 35% for the largest banks.

"We haven't yet seen the critical moment where mobile banking takes off dramatically," said Rob Berini, global service line lead for omnichannel customer acquisition and servicing at the consulting firm Genpact.

Still, there's a clear digital-physical convergence happening across industries and banks ought to "treat the smartphone as experience glue because it is the device that is always with your customer," Berini said.

"It's connected, it's powerful – more powerful than the huge supercomputers. It's identifiable, it's ubiquitous."

Beacon Power

To achieve an omnichannel experience, banks need to do two things, Berini said. The first is allowing customers to start tasks in one channel and finish them in another, and the second is finding ways to bring various channels together, such as Citi's use of beacons, Bluetooth-enabled devices that connect with customers when they are nearby.

Citi has been testing beacon technology in 10 New York branches. The program has been available to iPhone and iWatch customers of Citi since mid-March and requires that customers have the app downloaded to their phones and Bluetooth turned on. About 450,000 customers are currently eligible to try it, but there's no data on how many have actually opted into it.

The pilot gives customers cardless access to branch ATMs after business hours by turning mobile phones into "keys" that unlock the door when they sense a customer is near, removing the need to fumble for bank cards to gain entry to the ATM vestibule.

Echoing Berini's comments, Citi said its experiment with beacon technology was inspired by other industries.

"Beacon technology enables an enhanced customer experience, whether that's in an airport, at a concert or in a bank branch," Will Howle, president of U.S. retail banking at Citi, said in a statement. "There are special considerations in each venue, and companies need to consider if and how they're adding value to the customer experience through the use of beacons. We see companies in other industries testing and learning from beacons much like we're doing at Citi."

It's easy to see why Citi chose New York for the test. Many of its mobile banking customers live there, and it was looking to solve common problems facing city dwellers.

"Particularly in cold weather areas, [Citi] had customers who had complained about the hassle of reaching into their belongings to find their Citi card that would give them access to an ATM or were concerned about safety issues of pulling out wallet on city streets to access the ATM," said Brian Dunphy, senior vice president of business development and strategic partnership at Gimbal, the maker of the beacons Citi is using. "This in turn gave rise to the mobile and beacon-enabled door popper we are seeing today."

Customers who opt in to the pilot can also receive "contextually relevant" location-based notifications.

They're more commonly used as marketing tools in retail settings to alert shoppers to discounts as they navigate a store – similar to the way online retailers give shoppers suggestions based on their browsing history.

The program demonstrates "there are ways to take advantage of beacon technology to treat the smartphone as an extension of the human," Berini said, as well as the "more important aspect of geolocation."

Incidentally, financial institutions surveyed by Celent last year indicated geolocation technology would be the least likely out of 12 technologies to be used in future branch designs at 27%. By comparison, 92% of respondents said they'd likely spend money on tablet-based applications for front-line staff; cash recycling technology came in at 89%.

"Many banks are not fully there yet in terms of being able to capitalize on the omnichannel opportunity," Berini said. "Once the adoption of mobile banking takes off there will be more of a focus on what's next for geolocation."

Beyond ATM access, Citi "smart branches" are also placing beacons underneath workbench desks where employees and customers do business together on computers or mobile devices. When the beacons sense a customer has been waiting too long for a teller, they can send a notification directing the customer to a workbench.

Dunphy said the company has many more ideas for how Citi can use its beacons.

"With these phones constantly being at a consumer's hip – or in their hand – there is an enormous opportunity to use location-based technologies like beacons to proactively engage with them," he said. They "allow a bank to understand who is interacting with their retail banks, how they use those locations, how often they come, and so forth, so that they can further improve that channel and make it more personalized for their customers."

Dunphy cited other potential opportunities, like providing more personalized messages to consumers, telling bank staff which customers are in the branch so they can personalize services and reporting average line times in bank branches so customers can better plan their visits. Right now, however, the beacons Citi is testing don't send or receive data, they just read that a customer is nearby.

Beacons can also alert bank customers to affiliate partner benefits when they are at these locations (notifying them about discounts for being a bank customer, for example), remind bank customers to use their retail private-label card when shopping to maximize benefits and offer them spontaneous seat upgrades at sports or entertainment venues that the bank sponsors, Dunphy added.

Challenges

Although beacons present many "no-nonsense applications" that can help banks enable customer engagement, there's "a long list of scary topics" around geolocation and customers' acceptance of it, Meara said. Some of those same concerns make overall digital banking difficult. Besides tackling the ways the technology works and can be applied, there are also regulatory issues, data privacy, security and anti-money-laundering rules that need the organization's attention. That effort "becomes part art and part science," he said.

These are some of the reasons banks haven't yet nailed omnichannel. Many of them have yet to even implement a successful digital banking strategy. Until recently, digital banking was all about the number of transactions and the number of active users, Meara said. Now, banks are thinking about it like the rest of the retail universe – in terms of customer engagement.

"If we have a path to get to omnichannel as we now know it, what's the next step? Maximize customer engagement, add value, reduce the hassle factor," Meara said. That, he added, is what Citi is trying with beacons.