Citizens Financial Group in Providence, R.I., continues to build out its commercial banking offerings with an agreement to buy an M&A advisory firm in Atlanta.

The $160.5 billion-asset Citizens said Tuesday that it will buy certain assets of Bowstring Advisors, which specializes in five sectors: software, health care, industrial services, information technology services and human capital management. Citizens said Bowstring would beef up its deal advisory business and the options it can offer commercial clients in the Southeast and nationally.

“First and foremost, the sector focus was what piqued our interest, but it certainly will help to have more critical mass in other parts of the country,” Don McCree, Citizens’ head of commercial banking, said Tuesday. “We very much are agnostic about the business we do with our clients, but we want to be the bank they turn to in their time of need.”

Bowstring operates nationally, CEO Jim Childs said. Formerly known as CHILDS Advisory Partners, the firm primarily works on transactions involving companies valued at $50 million to $750 million. Its 40 employees will all work for Citizens when the deal closes, Childs said.

The all-cash transaction is expected to be completed this spring, Citizens said. It did not give the purchase price.

M&A advisory fee income

Citizens began expanding its M&A shop in 2017 when it

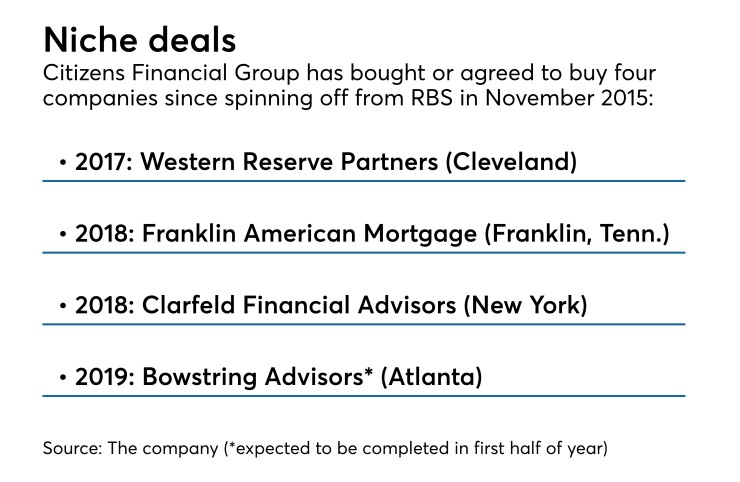

Bowstring would be Citizens’ fourth acquisition since it spun off from RBS in 2015. In addition to Western Reserve, it bought

McCree said that the head of Citizens’ Atlanta office introduced Bowstring to the bank.

Bowstring will operate as a division of Citizens’ capital markets business. The firm will retain its name and branding for about six months after the deal closes but will eventually take the Citizens name.

Debevoise & Plimpton advised Citizens. Morris Manning & Martin advised Bowstring.