For many banks, it's the most nettlesome part of the Dodd-Frank Act. And yet, even in this new era of regulatory skepticism in Washington, repealing caps on swipe fees may prove to be an impossible mission for industry lobbyists.

Bankers and others close to the industry are generally optimistic about the prospects for a major rollback of regulations in the upcoming Congress. But they are adopting a much more cautious posture regarding the Durbin amendment, which caps the interchange fees that many banks can charge when their customers use debit cards, and was named after Sen. Richard Durbin, D-Ill.

That's in large part because of the considerable clout of wielded by retailers, who waged an epic lobbying fight with banks to win enactment of the Durbin Amendment.

"I think the chance of that being repealed is unlikely," said Don Walker, regional executive at Arvest Bank in Bentonville, Ark. "I think it should be repealed personally, but I think it will be a battle."

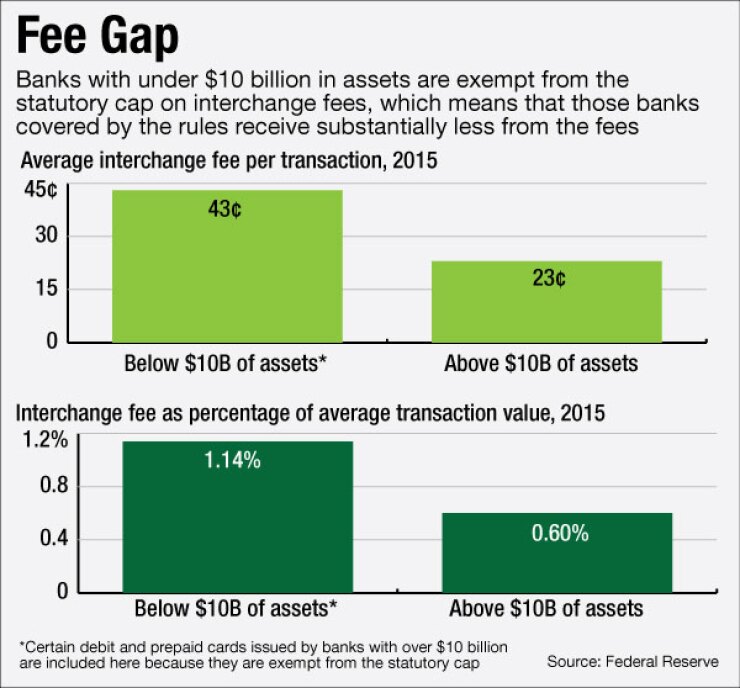

The cap on fees applies to banks with at least $10 billion of assets. The 6-year-old law has been particularly painful for banks that are just above the cutoff and compete closely with smaller banks that are exempt from swipe-fee caps. Arvest has $17 billion of assets.

FBR Capital Markets recently hosted a post-election conference for bankers, and the most frequently asked question from bank management teams was about the potential repeal of the Durbin Amendment, said Edward Mills, an analyst at the company.

Mills is highly skeptical of the industry's chances. "I think the outright repeal of Durbin remains extremely unlikely," he said.

Unlike many other areas of banking regulation, the swipe fee rules enjoy strong support from another powerful industry. The merchants' lobbying efforts defeated those of the banking industry in 2010, and retailers are now girding to defend their gains.

"We're going to fight over this," vowed Craig Shearman, spokesman for the National Retail Federation.

Bank lobbyists acknowledge the difficult challenge they face.

"We're under no illusion that this is a slam dunk to get done," said James Ballentine, executive vice president of congressional relations and political affairs at the American Bankers Association, which plans to lobby for repeal.

"We're going to work it very hard," added Aaron Stetter, executive vice president of policy and political operations at the Independent Community Bankers of America.

There are some reasons to think that the banking industry will be in a better position next year on Capitol Hill than it was in 2010.

First, the Durbin amendment would be repealed under legislation sponsored by Rep. Jeb Hensarling, R-Texas, which was approved by the House Financial Services Committee in September. Hensarling's bill is expected to be used as a starting point for financial services legislation in the next Congress.

In addition, the partisan makeup of Congress will be more favorable to the banking industry in 2017 than it was in 2010. Caps on swipe fees are not strictly a partisan issue, but Republicans have generally been more apt to support the banking industry's position than Democrats have.

Still, the Durbin Amendment passed the Senate in 2010 by a 64-33 vote. Even after Republicans gained more seats in the 2010 elections, a Senate vote to delay the fee cap’s implementation fell six votes short of the 60 needed.

During the upcoming legislative session, most members of Congress probably would prefer to avoid revisiting the issue, since a vote would force them to pick sides in a fight between two powerful industries.

Since the Nov. 8 election, there has been some chatter in financial policy circles regarding the chances for a partial repeal of the Durbin Amendment. One idea that has been floated would enable more banks to qualify for the exemption — for example, by raising the law's threshold from $10 billion in assets to $50 billion.

But even a compromise measure would likely provoke a big fight with the retail industry.

When asked to comment on the possibility of raising the threshold to $50 billion in assets, the ABA's Ballentine said: "I wouldn't necessarily want to negotiate items right now."

Swipe-fee rules figure to be a particularly important issue for the Mid-Size Bank Coalition of America, a trade group whose members have between $10 billion and $50 billion in assets.

Robert Jones, the group's chairman, said that it is too early to establish a list of legislative priorities for the next congressional session. "But clearly Durbin would be near the top," said Jones, the CEO at the $14.6 billion-asset Old National Bancorp in Evansville, Ind.

TCF Financial in Wayzata, Minn., is among the banks that have the most to gain from repeal. Abandoning the price cap would boost TCF's earnings per share by 13.1%, according to a recent Barclays analysis.

"This would be our No. 1 priority," said Craig Dahl, the CEO at the $21 billion-asset TCF. "I think that's a view that's shared by our board, and I think that's a view that's shared by our shareholders."

TCF was the lead plaintiff in a 2010 lawsuit against the Federal Reserve that sought to block the implementation of the Durbin amendment. The suit was dropped in 2011.