Social Finance and CommonBond found a multibillion-dollar opportunity refinancing student loans to borrowers with advanced degrees and high-paying jobs. A few banks, including Wells Fargo, Darien Rowayton Bank and Citizens Financial, are in the business, too.

Now, a number of states, including Connecticut, Massachusetts, Minnesota, New Jersey, Rhode Island and Vermont, are getting in on the game.

There are 18 state-based student loan programs. The majority of them fund their lending via the capital markets, by issuing either taxable or tax-free revenue bonds. Until recently, these agencies could only use the proceeds of tax-exempt bonds to lower the interest rate on loans they originated to borrowers still in school. That changed in November 2015, when the Internal Revenue Service gave them the green light to use tax-exempt bonds to refinance student loans for anyone who lives or attended college in-state, regardless of the original lender.

-

The pricing of student loans, and higher-ed degrees themselves, should have more to do with the proven earning power of a university's graduates in the eyes of some innovators. Big data could play a huge role.

May 31 -

An online student loan refinancing business that was recently spun off from a Virginia bank has been rebranded as Purefy Inc.

April 20 -

A small Connecticut bank takes the plunge into mobile-friendly mortgages in a bid to turn an attractive pool of student-loan borrowers into lifetime customers.

March 17

While SoFi and CommonBond have focused, at least initially, on High Earners Not Rich Yet, or HENRYs, state agencies are targeting a different, and potentially much bigger, stratum of the population: the middle class.

"We try to set DTI [debt to income] and FICO requirements at a level that will get a vast majority of the loans repaid, but we we're not setting the bar so high that nobody would qualify," said Marilyn Kiser, manager of the refinance program at the Minnesota Office of Higher Education.

Like SoFi and CommonBond, the nonprofits want to help borrowers, and taxpayers, by lowering monthly payments. They are offering refi loans to qualified borrowers with rates below 5%. For a borrower paying 8% or 9% on some federally guaranteed or private student loans, that would be a big savings.

"There's an economic benefit for the state," said Chad Pistorius, manager of strategic planning at the Rhode Island Student Loan Authority. "All of our loan program borrowers save money, giving them more disposable income than they would have if they borrowed elsewhere."

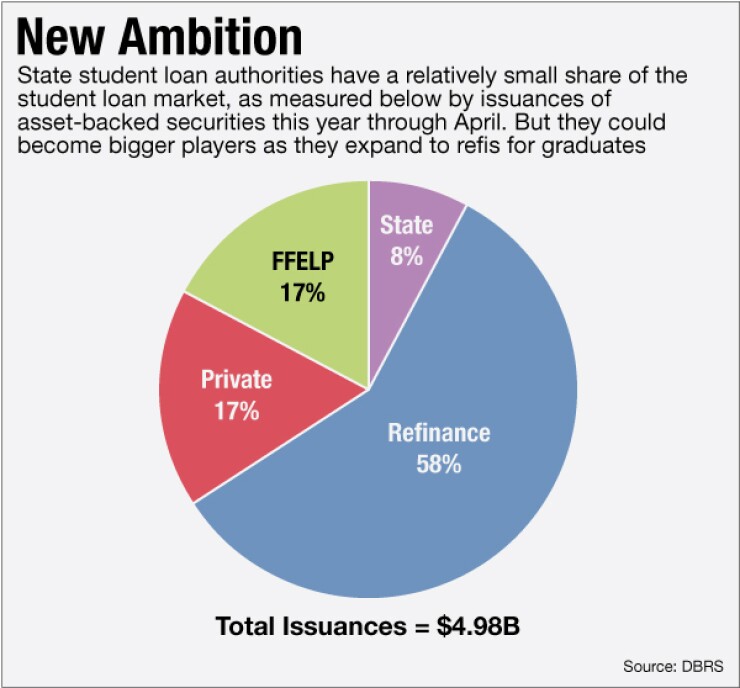

The agencies also sense a new business opportunity as the portfolios of federally guaranteed loans that they service run off. Most started out as lenders under the Federal Family Education Loan Program, but since 2010, the U.S. government has lent directly to students, cutting out state student loan authorities and other middle men. That prompted some states to shutter their student loan authorities; other agencies turned to making loans that are subsidized by issuance of tax-free bonds, but are not guaranteed by the federal government.

"Every year, hundreds of millions of dollars are borrowed to attend school in Rhode Island, and there are Rhode Island residents who go out of state, so it's a large market," Pistorius said.

Critics question how much taxpayers will really benefit, however.

"It will benefit people who would benefit relatively little," said Robert Kelchen, assistant professor of higher education at Seton Hall University. "People who have good, steady jobs typically have the ability to refinance at lower rates" with the likes of SoFi, CommonBond, Earnest or bank lenders.

"I can see why states are very interested," he said. "It's a benefit they can sell to keep talented students in-state. The question is whether the benefit is large enough to actually achieve that purpose … whether saving $500 a year is really going to keep you in state."

There is another drawback to refinance loans offered by both marketplace lenders and state student loan authorities: They cherry pick the most creditworthy borrowers from the U.S. government's student loan portfolio. That is because the borrowers that both kinds of lenders target subsidize the less fortunate, who are more likely to default. This puts federal taxpayers on the hook for more losses.

Kelchen said that, in theory, state programs using tax free bonds could undercut private lenders by offering lower interest rates, though it's unclear how much lending capacity states have. Any tax-free bonds that they issue to make refinance loans would count against federal caps on the volume of such borrowing in each state. That could potentially cannibalize subsidized lending to students still in school.

The first state agencies out of the gate with refinance loans did not wait for the IRS to give the OK. Minnesota is funding the initial $100 million of lending on balance sheet; the program was launched in January and origination is over $20 million. Participants must be Minnesota residents with a certificate or degree who are employed and have at least $10,000 in eligible loans. To participate, you need a credit score of 720, or 650 if you use a co-signer, and your total debt can be no more than 45% of your total income.

Interest rates for Student Educational Loan Fund, or SELF, refi loans range from 3% to 4.35% on variable-rate loans and 4.5% to 6.95% on fixed-rate loans.

Rhode Island and Massachusetts are funding their refinance programs with taxable bonds.

Rhode Island launched its program in 2014. Participants must have a credit score of 680 and a salary of $40,000 or more to qualify without a co-signer. Rates on five-year loans with a co-signer are 4.49% if borrowers sign up to make automatic payments and 5.74% for loans with no co-signer. Refinance loans with 10-year and 15-year terms are also available.

"We've made about $25 million in loans, we originate around $1.5 million to $2 million a month," Pistorius said. "We have a large federal loan legacy portfolio; some of those refinancing had higher-interest, PLUS [graduate] loans, and some of our own private borrowers," he said. However, "I'd say more than half of loans are coming from other lenders."

The Massachusetts Education Finance Authority also went the taxable route, issuing $75 million in bonds to fund its refinance loan program, which launched in January. The loans pay fixed rates of interest as low as 4.95% and variable interest rates as low as 3.25% and have terms of 15 years.

Refinance programs in other states, including New Jersey and Connecticut, are in earlier stages.

The Education Finance Council, a trade group for state student loan authorities, runs a monthly refinance working group. "I'd say if not all [members] that currently issue bonds, then a large percentage of those that do are in process or about to launch refinance programs," said Debra Chromy, the organization's president.

Even with the guidance that the IRS issued in November, there are still reasons to issue taxable bonds. That is because the agency specified that states refinancing private student loans with proceeds of tax-free bonds must get schools to certify that these loans did not exceed the cost of attendance, a cumbersome process.

The IRS guidance issued in November also allows states to use proceeds of tax-free bonds to refinance student loans that parents take out on behalf of their children.

"We heard from a lot of families that mom and dad are really the ones that plan to take on responsibility for the debt on co-signed loans, but all sudden the student has got this debt on his/her credit, creating a problem if he/she wants to rent an apartment," Chromy said.

But the bigger opportunity is refinancing.

With interest rates at current levels, even taxable funding via the bond market allows states to offer interest rates that are competitive. While SoFi advertises rates as low as 2.15%, most borrowers, even HENRYs, don't qualify. "Maybe you're not getting 3.5% from SoFi; maybe you're getting 5.5%," Kelchen said. "So there may be room for the states to come to market at 4.5%, instead."

Marketplace lenders, as well as banks, are awake to the possibility. SoFi, which originally targeted borrowers with advanced degrees from a few select universities, now offers loans to graduates from any accredited college or university that meet its other underwriting criteria.

"They're going to bump into each other at some point," Kelchen said.