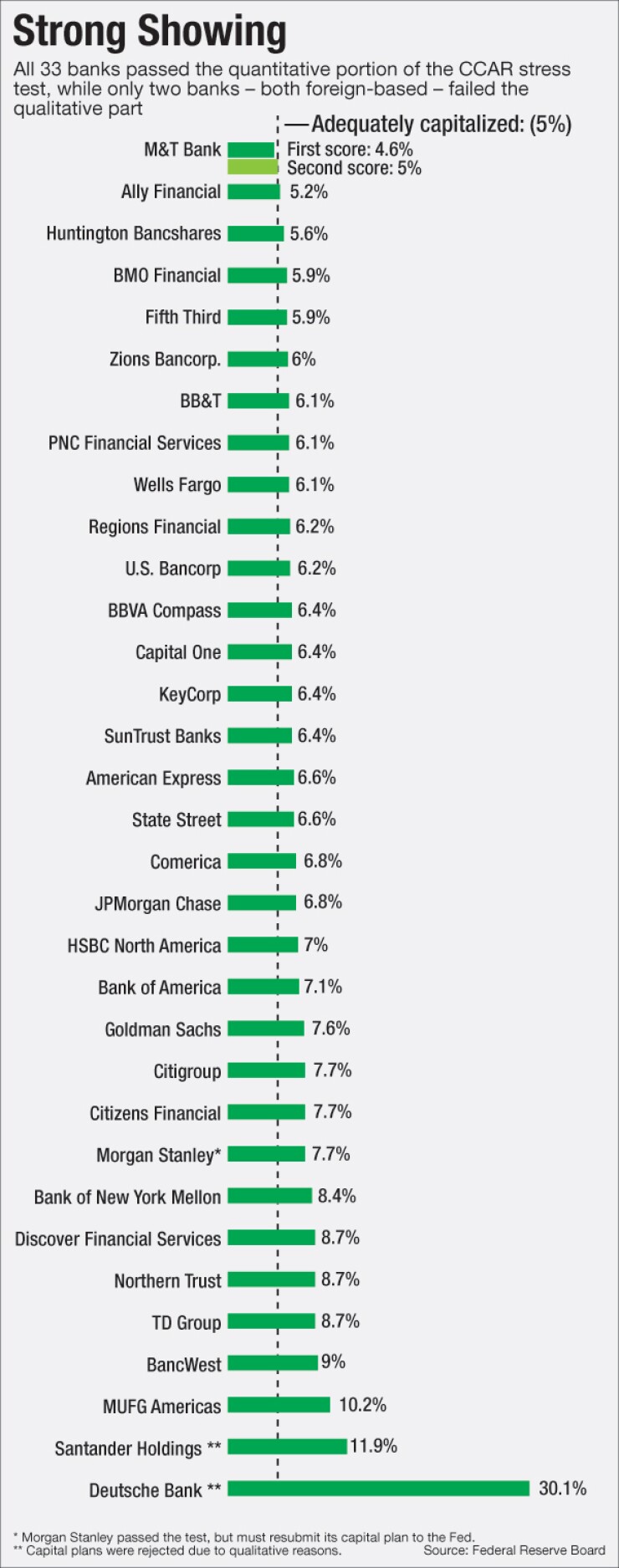

The vast majority of big banks seem to be getting a handle on the costly, labor-intensive and time-consuming stress-testing process. Twenty-nine institutions have cleared the bar in each of the last two years.

For a pair of large banking companies, however, Santander Holdings USA and Deutsche Bank Trust Corp., the stress tests have so far proven to be an unconquerable challenge.

The Federal Reserve Board announced Wednesday that the two were alone in failing this year's Comprehensive Capital Analysis and Review. The results marked the second consecutive failed stress test for the unit of Germany-based Deutsche Bank, and the third straight year that Santander's U.S. arm has flunked.

-

The U.K.'s surprise vote last week to leave the European Union has upped the ante for the banks taking part in the Federal Reserve Board's second round of stress tests on Wednesday.

June 27 -

The industry is better positioned than it was last year to weather a severe economic shock, according to the Fed, but the real test comes next week, when the central bank will release its latest evaluation of the sector's risk-management practices.

June 23 -

After the United Kingdom's surprising vote to exit the European Union, the financial markets are in turmoil and U.S. banks are left trying to assess their risks.

June 24 -

Bank executives and outside experts finger technology as the area most in need of improvement when it comes to vetting financial institutions' ability to withstand the next bit economic shock.

September 21

Both companies met the minimum regulatory capital ratios that are required by the Fed, but they fell short on qualitative grounds, just as they did in 2015. The Deutsche and Santander units were both called out for what the Fed identified as deficiencies in risk-management processes and stress-testing processes, though the Fed also said that both firms have made progress.

Both of the struggling banks are foreign-owned, but observers were split on whether that factor is contributing to their poor results.

Oliver Ireland, a partner at Morrison & Foerster, said that they may be the result of different priorities at the parent company level.

"The U.S. regulators may have the full attention of the U.S. management, but they may not have the same attention of the foreign management," he said.

But Will Newcomer, a vice president at Wolters Kluwer, expressed doubt that European ownership is a factor. "I can't imagine a foreign parent being less interested," he said.

Deutsche and Santander were quick to note that the Fed determined that they have adequate levels of capital. But they also acknowledged that they have work left to do.

"We appreciate the Federal Reserve's recognition of our progress," said Bill Woodley, deputy chief executive of Deutsche Bank Americas, in a press release, "and we will implement the lessons learned this year in order to strengthen our capital planning process for future CCAR submissions."

Scott Powell, CEO of Santander Holdings USA, said in a press release, "We have made progress, but our internal capital planning, stress testing, internal controls, governance and oversight require further improvement to meet our regulators' expectations."

The key question now is what will be the consequences for repeated failures. Santander Holdings USA, a unit of Banco Santander in Spain, is the first bank to fail CCAR three years in a row.

The Fed noted Wednesday that when banks fail the test, they may not make any capital distributions to their shareholders unless expressly authorized by the Fed.

In the past, the Fed has said that banks that demonstrate a chronic inability or unwillingness to correct deficient behavior can also be subject to enhanced regulatory actions, including but not limited to cease-and-desist orders.

But a senior Fed official told reporters Wednesday that the Santander and Deutsche units are committing more resources to the stress-testing process. At the same time, the official acknowledged the possibility that there could be additional consequences if the two banks continue to fail stress tests in future years.

In any event, the stress-testing struggles of Santander and Deutsche do not reflect the experiences of all foreign-owned banks.

BBVA Compass, BMO Financial, HSBC North America and MUFG Americas are among the foreign-owned banks that passed this year's stress test. So did first-time participants BankWest Corp. and TD Group US Holdings, both of which are also owned by foreign banks.

The results were also positive Wednesday for almost all of the large U.S.-based banks. The capital plans submitted by JPMorgan Chase, Wells Fargo, Bank of America, Citigroup and numerous regional banks did not receive an objection from the Fed.

That stamp of approval means that the companies can move forward with their plans for dividends and share repurchases.

The Fed's thumbs-up carried special significance for Ally Financial, which failed the stress tests in 2012 and 2013, and has yet to pay a dividend since going public in 2014. Detroit-based Ally recently emerged from a

Under Ally's capital plan, the firm plans to start paying a quarterly dividend in August, and to repurchase up to $700 million in stock over the next year.

"The inaugural dividend since becoming publicly traded is a critical step in returning capital to Ally shareholders," CEO Jeffrey Brown said in a press release.

Two U.S.-based banks did encounter problems, but both of them still passed the stress tests.

The Fed lodged what it calls a conditional non-objection with respect to Morgan Stanley's capital plan. The investment banking firm is being required to address certain weaknesses and resubmit its capital plan by Dec. 29.

M&T Bank initially fell short of the Fed's minimum required regulatory capital ratios, but the Buffalo, N.Y., company submitted an adjusted capital plan that enabled it to pass.

Overall, the results suggested that seven years after the stress tests were established, they are becoming a more routine exercise for most large banks.

"Over the six years in which CCAR has been in place, the participating firms have strengthened their capital positions and improved their risk-management capacities," Fed Gov. Daniel Tarullo said in a press release.

Starting next year, most regional banks with assets of $50 billion to $250 billion are expected to be exempted from the qualitative portion of the stress tests. The senior Fed official said Wednesday that those firms have made substantial progress in improving their capital planning.

In part one of the stress tests, which was released last week, the Fed concluded that the nation's 33 biggest bank holding companies have added more than $700 billion in common equity capital since 2009.

Part two took into account each bank's specific plan for returning capital to shareholders, rather than relying on a standard formula, as the first part did.

In between last week's results and those released on Wednesday, U.S. banks got a real-life stress test, when global financial markets were rattled by the decision of U.K. voters to leave the European Union. The Brexit outcome was not a specific part of the severely adverse scenario that the Fed established for this year's test, but the scenario did foresee serious recessions in the U.K., the eurozone and the United States.