Following months of behind-the-scenes work with OnDeck Capital, JPMorgan Chase has quietly started offering online loans to its existing small-business customers.

The New York megabank launched its digital lending platform on a limited basis last week, spokeswoman MaryJane Rogers confirmed Monday.

Existing Chase small-business customers are being prescreened, and some of them are being invited to apply for loans of up to $250,000, according to Brian Geary, director of platform solutions at OnDeck.

-

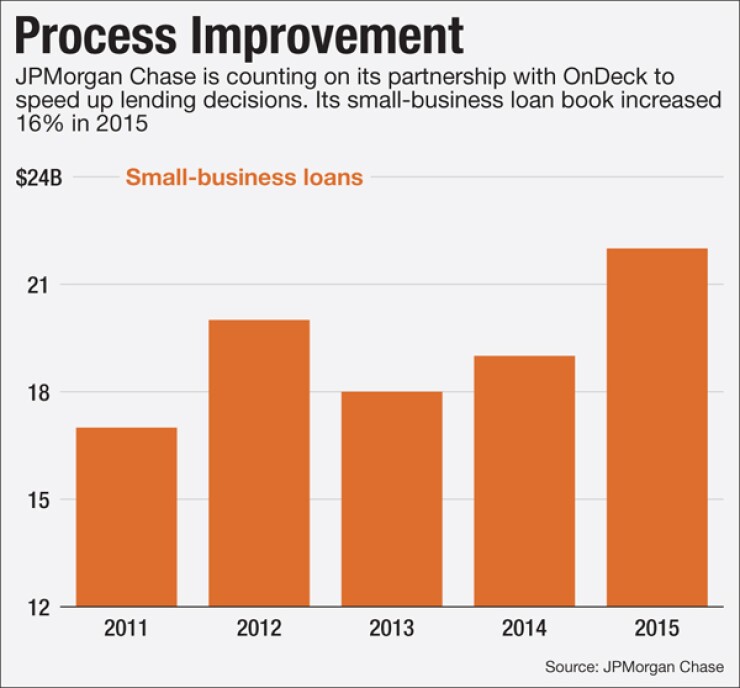

The bank says the partnership will improve the online experience for borrowers. It is just the latest example of banks and online lenders teaming up to speed up decision-making and win over new customers.

April 7 -

Despite their own vast resources, some large banks are partnering with fintech startups to help them meet the needs of one of their trickiest market segments: small businesses

December 10 -

Hours after Jamie Dimon alluded to the budding partnership, the banking giant and marketplace lender went public with their plans to launch an online lending platform in 2016.

December 1

JPMorgan has roughly 4 million small-business customers. The bank declined to say how many of those clients have received invitations to apply for a loan, or when its online lending platform will be opened to a broader group of prospective applicants.

Under the partnership, New York-based OnDeck, which also offers small-business loans through its own website, is providing its technology to JPMorgan. The loans are Chase-branded, and are being held on the bank's balance sheet. JPMorgan is also setting the underwriting criteria for the loans.

"The process will be entirely digital, with approval and funding generally received within one day," JPMorgan Chief Executive Jamie Dimon wrote in his

Previously, the bank's small-business loans could take up to one month or more to be approved and funded, according to Dimon.

The partnership, which was

"They want to remove friction points for customers, and make it efficient and easy for the customer to take out capital that's in the smaller range," Geary said.

In fact, applying for an online small-business loan from Chase is expected to take less time than applying for a similar loan directly from OnDeck.

Chase, like other banks, has a prior relationship with its small-business borrowers, which gives it a leg up over the new crop of online lenders, according to OnDeck Chief Executive Noah Breslow.

Because of those existing relationships, Chase does not have to collect as much information from prospective borrowers in order to fulfill regulatory requirements related to the prevention of money laundering.

"So we can make that process more efficient," Breslow said during an interview at the LendIt conference in San Francisco.

For its part, OnDeck is using the integration with Chase as a foundation for additional partnerships with banks. About 70% of the technology that OnDeck has built for Chase is reusable, according to Breslow.

He said that other large banks may be interested in partnerships that are similar to the deal between OnDeck and JPMorgan Chase.

Meanwhile, smaller banks may want to pursue referral partnerships, Breslow said. Under a

Explaining that similar partnerships might make sense for small banks, Breslow said: "It's lower risk, it's lower cost. You can be in the market faster."